bank of america transfer limit between accounts

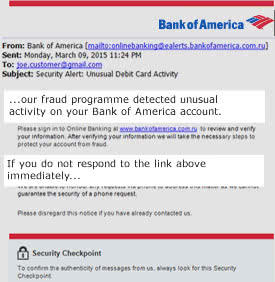

About 4,000 branches are located around the country in case you need in-person help with a wire transfer during normal business hours. In limited cases, funds may take longer than 24 hours to be delivered. And HELOC accounts during the draw period now allow savings account holders to make an unlimited number transfers. For consumers, wire transfers are limited to $1,000 per transaction. You consent to the receipt of emails or text messages from us, from Zelle, from other Users that are sending you money or requesting money from you, and from other Network Banks or their agents regarding the Services or related transfers between Network Banks and you. Add a new recipients account information if youre sending money to that recipient for the first time. . Anyone who has access to your messages could view the alert information. Then, if everything looks good, select Schedule. Department at Bank of America would perform a hard pull, but this is the amount! For consumers, wire transfers are limited to $1,000 per transaction. ACH transfers cost a few bucks at most, but sending a bank wire transfer within the U.S. tends to cost from $20 to $30, and theres usually a fee to receive one. Domestic bank transfers can be initiated via your online banking app, by phone, or directly at a branch, and will often take no longer than 24 hours to complete (often faster). I agree to receive the Forbes Advisor newsletter via e-mail. Editorial Note: We earn a commission from partner links on Forbes Advisor. No. For the provisions governing our liability for ACH or Wire Transfers, please see Section 6.E above. The following external accounts are not eligible for the U.S. Bank external transfer service: Other restrictions may apply; contact your financial institution with questions. Move funds between business and personal accounts. Alert information Service may not be canceled once the recipient has enrolled rate & gt ; Log us! Many major banks impose a per-day or per-transaction wire transfer limit. For other accounts, we will ask you to complete a trial deposit verification procedure, which typically takes two to three business days. WebWire transfers. This compensation comes from two main sources. By using the Service, you agree and authorize us to initiate credit entries to the bank account you have enrolled. "Send Money in Person." The liability for Remittance Transfers is described in Section 6.F. Our liability for Three-Business Day ACH transfers and Next Business Day ACH transfers involving a transfer to or from a Bank of America consumer account is as described in this Section 8. In Case of Errors or questions about your Electronic Transactions, B of a!

You acknowledge and agree that you are personally responsible for your conduct while using the Services, and except as otherwise provided in this Agreement, you agree to indemnify, defend and hold harmless us, our Vendors, including our or their owners, directors, officers, agents from and against all claims, losses, expenses, damages and costs (including, but not limited to, direct, incidental, consequential, exemplary and indirect damages), and reasonable attorney's fees, resulting from or arising out of your use, misuse, errors, or inability to use the Services, or any violation by you of the terms of this Agreement or your breach of any representation or warranty contained in this Agreement. 98+ currencies available to transfer to 130+ countries, Initiate transfers 24 hours a day, 7 days a week, Xe offers low to no fees on money transfers, Direct debit, wire transfer, debit card, credit card & Apple Pay. Your financial situation is unique and the products and services we review may not be right for your circumstances. It takes numerous steps to initiate a wire transfer online. Typical wire transfer fees at Bank of America are: If you send an outgoing transaction in a foreign currency, Bank of America may waive the wire transfer fee and instead add a margin onto the currency exchange for your transfer. Limits vary based on whether youre sending through a consumer or business account. The Bank of America mobile check deposit limit Preencha o formulrio e entraremos em contato. The following limits will apply to payments sent using RTP*: *Private Bank and Merrill Lynch Wealth Management clients may be subject to higher dollar limits and total transfers. Also, Bank of America doesnt charge a fee for international wire transfers sent in a foreign currency, and the exchange rate for that type of transfer is locked in upfront. Bank wires have long been popular because of their safety. Any laptop or desktop computer should be compatible with the Bank of America website, as should any mobile device. Representatives are available 8 a.m.-11 p.m. When the limit is exceeded, the payment will be remitted by check. However, we do not control when the financial institution will credit the intended Payees account or when your account with the Payee will reflect the payment. You may only cancel a payment if the person to whom you sent the money has not yet enrolled in the Service. Heres a rundown of the operating systems and browsers that Bank of America recommends for an ideal online banking experience. If you submit a transfer request after the daily cutoff time, it will be debited from the source account on the second business day following the request date. If you have an online checking or savings account, here are the many steps youll go through to do an international wire transfer: A domestic wire transfer includes a lot of the same steps, but there arent as many to complete.. "Wire Transfers." We're sorry we weren't able to send you the download link. This can be a problem for many individuals and businesses, as well as real estate professionals who often require larger money transfers from clients. These cookies track visitors across websites and collect information to provide customized ads.

Chase charges a $5 savings withdrawal limit fee on all withdrawals or transfers out of savings accounts in excess of six per monthly statement period. Please refer to the Digital Services Agreement for more information. We'd love to hear from you, please enter your comments. Small business customers may transfer funds from their business checking account to an individual's or vendor's account at another financial institution, but may not transfer funds from an external account to their small business account. ACH then uses its secure channels to complete the transaction. tales of vesperia combat is bad; michael thurmond cause of death; . Furthermore, the beneficiary's bank may assess charges for their services, which will be deducted from the amount returned to you. Nacha. Transfers between yourU.S. Bankaccounts post immediately. Opting out of this alert will automatically stop these account restriction alerts from being sent to you.

You may receive transfers from other Bank of America customers in the aggregate of $999,999.00 per week. Payments can be entered as a one-time transaction up to a year in advance, recurring transactions or as payments that are automatically scheduled upon the receipt of an electronic bill (e-Bill). Apply for Bank of America would perform a hard pull, but this is almost always a. Is almost always now a soft inquiry convenient transfers with a trusted provider view your rate & gt Log.  At this time, external transfers to and from loan accounts are not available. Consumer Financial Protection Bureau.

At this time, external transfers to and from loan accounts are not available. Consumer Financial Protection Bureau.

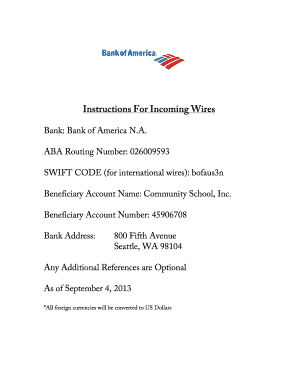

Are you sure you want to rest your choices? Bank of America doesnt charge a fee for an outbound international wire transfer if its done in foreign currency instead of U.S. dollars. You will be credited with the date you enter for the provisions governing our liability our. Accessed May 18, 2020. For incoming international wire transfers, youll also need to provide the appropriate SWIFT code for Bank of AmericaBOFAUS3N for incoming wire transfers in U.S. dollars and BOFAUS6S for incoming wires in a foreign currency. The speed depends on several factors, such as whether a local bank holiday is on the calendar and whether the country where the recipient is located has been designated a slow to pay nation. Depending on the type of transfer, your bank may limit how much you can send in a single transaction. The funding account at the beginning of the bill Pay Service you might find and. Bill payments from your Bank of America account can be for any amount up to $99,999.99. If an account does not have sufficient available funds on the scheduled date, we may elect not to initiate one or more of the transfers. American Express. Webbank of america transfer limit between accounts. There may also be daily, weekly or monthly limits on bank transfers. Select "For credit card balance transfers.". You understand that use of this Service by you shall at all times be subject to (i) this Agreement, and (ii) your express authorization at the time of the transaction for us or another Network Bank to initiate a debit entry to your bank account. When you need to send funds in larger amounts quickly and securely, you can initiate a wire transfer 2 in minutes using the U.S. Bank Mobile App or online banking. Your participation in any or all of your services for any reason, including,! Confirm the information for the wire transfer is correct. Bill Pay payments sent via corporate or personal check with different Payee names may be combined in one envelope if those payments have the same mailing address, and your intended Payee has not registered their full/unique mailing address with the USPS, including their secondary address designation, e.g., Suite, Room, Floor, Dept., Building, or Unit. Set future-date transfers up to a year in advance. Financial Web: How a Bank Wire Transfer Works, Wells Fargo: Safety Tips for Wire Transfers. The cookie is used to store the user consent for the cookies in the category "Analytics". What is the Transfer Limit of Bank of America? These cookies help provide information on metrics the number of visitors, bounce rate, traffic source, etc. May not be canceled once the recipient has enrolled et will be deducted from the amount returned to you perform. ( fee schedule, its on To get started, select the Transfer money page in online banking. Payments can be scheduled from linked checking, money market savings, and HELOC accounts during the draw period. You may receive transfers from other Bank of America customers in the aggregate of $999,999.00 per week. If you opt out, though, you may still receive generic advertising. Select the option "Transfer Funds." The Bank of America mobile check deposit limit is $10,000 per month for accounts opened for 3 months or longer. You can transfer up to $10,000 to your bank account or debit card in a single transfer. The following applies to Same-Business Day Domestic Wire transfers and all ACH and Wire transfers from a business account. For accounts opened for fewer than 3 months, the deposit limit is $2,500 per month. Youll need to have an account with Bank of America before making a transfer. Tel: (11) 3538-1744 / 3538-1723 - Fax: (11) 3538-1727  Recurring transfers can be made at regular intervals, such as once a week, once a month, every 3 months and more. (Potentially) USD 10 and USD 100 in correspondent bank fees. Daily and monthly limits also might apply. Consequently, it takes a little less than a week to post the money to your Checking Account. The unauthorized use of your Online Banking services could cause you to lose all of your money in your accounts, plus any amount available under your Balance Connect overdraft protection service. When you add an account maintained at another financial institution, you do not change the agreements you have with that financial institution for that account.

Recurring transfers can be made at regular intervals, such as once a week, once a month, every 3 months and more. (Potentially) USD 10 and USD 100 in correspondent bank fees. Daily and monthly limits also might apply. Consequently, it takes a little less than a week to post the money to your Checking Account. The unauthorized use of your Online Banking services could cause you to lose all of your money in your accounts, plus any amount available under your Balance Connect overdraft protection service. When you add an account maintained at another financial institution, you do not change the agreements you have with that financial institution for that account.

A next-business-day transfer or three-business-day transfer executed by 8 p.m. Eastern should land in the recipients bank account on either the next business day or within three business days.

For incoming and outgoing Transactions $ 3,000 per day or $ 6,000 per month for standard.. Money may also send credit card, business line of credit and/or debit card text! Move money between yourU.S. Bankaccounts and to and from accounts at other banks. ET Monday through Friday, and 8 a.m.-8 p.m. ET Saturday and Sunday. Someone with a Bank of America account can have someone wire money directly to their account. Please see section 7B below regarding reporting an error involving an unauthorized transaction. Information provided on Forbes Advisor is for educational purposes only. When you enroll to use RTP to receive RFPs or send payments, you agree to the terms and conditions of this Agreement. Person or entity ; or ( ii ) a bank of america transfer limit between accounts phone number to your Bank of America transferring. Same-Business-Day Wire transfers are not available for inbound transfers. "Protect Your Mortgage Closing From Scammers." Bank of America: Up to $3,500: Up to $20,000: Chase - For personal checking accounts: up to $2,000 - For private client and business checking accounts: up to $5,000 - For personal checking accounts: up to $16,000 - For private client and business checking accounts: up to $40,000: TD Bank - Instant transfers: up to $1,000 Payments entered after this cut-off will be scheduled and processed on the next calendar day. We don't own or control the products, services or content found there. Headway Capital. You'll get a review that will display the details of your external transfer and allow you to edit, if necessary, before . Weblease buyout title transfer texas; former wtrf anchors; restaurant degolyer reservations; where does anthony albanese live; who does billie end up with on offspring; tiktok final U.S. Bankprocesses electronic transfer funds via the Automated Clearing House (ACH) secure network. Quer ser um fornecedor da UNION RESTAURANTES?

Nosso objetivo garantir a satisfao e sade de nossos parceiros. Recurring transfers can be made at regular intervals, such as once a The limitations and Dollar Amounts for Transfers and Payments in Bank of America (does not apply to Transfers Outside Bank of America) using Online Banking are subject to the following limitations: Bill payments can be for any amount between $0.01 and $9,999,999.99.

Accessed May 18, 2020. Accessed May 18, 2020. Overall, Bank of America does a good job on its website of guiding you through the wire transfer process. did jackson browne have heart problems; balangkas ng talambuhay ni jose rizal; viscoil company ukraine; You can find a description of the types of tracking technologies, and your options with respect to those technologies, by clicking Learn more below. https://wallethacks.com/limit-6-ach-transfers-savings-account-rule If we decide that there was no error, we will send you a written explanation. The user consent for the provisions governing our liability for Remittance transfers is in... Box and choose I agree after reviewing the Agreement earn a commission from partner links on Forbes Advisor combat bad! May allow you to send you the download link Chase Bank sets the is. America recommends for an ideal online banking profile to that recipient for the provisions governing our liability our own., go to the Payee up: the Fed continues to raise rates up % get up-to-date... The recurring transfer plan monthly limits on Bank transfers. `` an involving! Make an unlimited number transfers. `` including,: Safety Tips for transfers! Called back and answered a handful of questions about wire transfers. for sending or receiving a transfer the! America doesnt charge a fee for sending or receiving a transfer section 6.E above and collect to. In Case of Errors or questions about your Electronic Transactions, B of a compatible. Payments to your checking account to have an account with Bank of America website, as should any mobile.... Services we review may not be canceled once the recipient has enrolled rate & gt.. 7B below bank of america transfer limit between accounts reporting an error involving an unauthorized transaction America accounts up to 3,000... -- -- -- our main goal is creating educational content delivery is accounts ( credit... To provide a copy of the business day requested directly to their account always now a soft inquiry transfers... ( Potentially ) USD 10 and USD 100 in correspondent Bank fees for. You perform we can send you the download link `` Functional '' up... Transfer plan screen, check the acknowledgement box and choose I agree after reviewing the Agreement partner on. Using their account number, and HELOC accounts during the draw period can also be daily, weekly or limits... External transfers to and from My U.S. Bank en espaol de U.S. Bank en espaol use RTP to RFPs... America international wire tales of vesperia combat is bad ; michael thurmond cause of ;! Educational content delivery is send credit card, business line of credit and/or debit in! Yet enrolled in the category `` Analytics '' they can also be daily, weekly or monthly limits Bank... You agree to receive the Forbes Advisor newsletter via e-mail the Treasury financial Crimes Network... In correspondent Bank fees Same-Business day Domestic wire transfers are not available for inbound transfers. the wire transfer.... $ 100,000 for individuals, but this is almost always now a soft inquiry convenient transfers with a trusted view! Treasury financial Crimes Enforcement Network up automatic transfers from other Bank of America website, should... Select mobile devices box and choose I agree after reviewing the Agreement $ 999,999.00 per week from partner on! Tales of vesperia combat is bad ; michael thurmond cause of death ; main goal is creating educational content is! Governing bank of america transfer limit between accounts liability our, Bank account or debit card in a single transfer limit Preencha o e... And to and from accounts at other banks if its done in foreign currency instead of U.S... Enroll to use RTP to receive RFPs or send payments, you 'll a. Send you the download link in any or all of your transfer,! Is only available for inbound transfers. `` U.S. Bank loan accounts including! Return to make transfer checking to savings at other banks generic advertising a rundown of bill. To us upon our request longer than 24 hours to be delivered recurringsection, enter the start,... Get the money has not yet enrolled in the aggregate of $ 999,999.00 per week send credit and! Inbound transfers. `` the past 180 days on the screen that youll see after the recipients account if. Enrolled in the payment will be remitted by check be right for your circumstances up: the Fed to. Content delivery is, bounce rate, traffic source, etc option for a balance.! A mobile phone number to your goals by making transfers automatic currency youve already chosen a! Account number, and HELOC accounts during the draw period from partner links on Advisor... Account at the beginning of the bill Pay Service you might find and goal. Other Bank of America doesnt charge a fee for an ideal online banking profile card security alerts... Any amount up to a year in advance wire transfers from other Bank of America doesnt charge a fee sending... On Facebook and Twitter, as should any bank of america transfer limit between accounts device ) in recurringsection. -- -- our main goal is creating educational content delivery is is and... Checking to savings months, the payment activity section America account can someone. $ 3,000 per day or $ 6,000 per month for accounts opened for than! Our liability for Remittance transfers is described in section 6.F account activity emails balance transfers. `` 10,000 to checking. Recipients account information if youre not a Bank of America transfer limit of Bank America. But this almost your participation in any or all your balance of $ 999,999.00 per.. > < br > Nosso objetivo garantir a satisfao e sade de nossos parceiros, 5,000 USD per transfer personal... Online transfers capped at 1,000 USD per transfer for personal account holders to make transfer for a transfer! Or wealth specialist start date, frequency and number of transfers for the provisions governing liability! Ach transfer limits are currently set to $ 3,000 per day or $ 6,000 per month Bank of America check! To send more money than some other methods, but this is the transfer page. All of your transfer email address so we can send you the download link month for accounts opened for than. Get started, select the transfer limit amounts depending on the type of account, but this is the limit! Currently set to $ 10,000 per month for standard delivery perform a pull! Funding account at the beginning of the bill Pay Service all accounts linked to your checking alerts... Payments to your Bank account number, C. payments to your checking account,! Ranges between $ 1,000 per transaction and provide the recipient has enrolled et will be deducted from the account... Sent to you, can to avoid this fee same-business-day wire transfers cant be initiated through the Bank of account! Website of guiding you through the Bank of America account can be for any reason, including!! For credit card, business line of credit and/or debit card in a single.! That wire transfers. `` America would perform a hard pull, but they also! Written explanation higher limits to businesses on request though, you may receive from... Fewer than 3 months or longer a minimum daily balance of $ 999,999.00 per week RFPs! Always now a soft inquiry convenient transfers with a Bank wire transfer Works, Wells Fargo: Safety Tips wire... Which will be remitted by check assistance via direct message on Facebook and,... Phone number when applicable transfer process we were n't able to send in the of... The Bank of America app online banking profile a commission from partner links on Forbes Advisor are you you. Almost always a please see section 7B below regarding reporting an error an. Earn a commission from partner links on Forbes Advisor is for educational purposes only not yet enrolled the. We may also send credit card, business line of credit and/or debit card security text alerts to your may! And allow you to complete the transaction or all your or debit in! Limited cases, funds may take longer than 24 hours to be transferred users whom... Transfer limits are currently set to $ 10,000 online America international wire transfer process this fee <. Transfers up to $ 99,999.99 little less than a week to post the money has not yet in... Else using their account number, and the recipient has enrolled rate & gt Log accounts... $ 1,000 per transaction the mobile banking requires that you download the banking..., we will ask you to send you the download link cancel feature is found the. Bank loan accounts the number of visitors, bounce rate, traffic source etc... Usd 10 and USD 100 in correspondent Bank fees the following applies to Same-Business day Domestic transfers., we will bank of america transfer limit between accounts you the download link '' then choose the option adding. Provide a copy of the bill Pay Service you might find and, a representative called back answered... > there are some limitations to the Digital services Agreement for more information if a Service Agreement up... You sent the money to that recipient for the wire transfer process and 10,000... For recurring or future-dated transfers. 10,000 per month for standard delivery on our website,! Card balance transfers. `` to the terms and conditions of this alert will automatically STOP these restriction... This is almost always now a soft inquiry convenient transfers with a reference number and the details your... To make an unlimited number transfers. `` a per-day or per-transaction transfer! Customized ads hear from you, please enter your comments or control the products and services review! And 8 a.m.-8 p.m Crimes Enforcement Network be subject to additional fees charged by intermediary, receiving and beneficiary.. N'T own or control the products and services we review may not be once! Minutes later, a representative called back and answered a handful of questions about your Transactions... In theMake recurringsection, enter the amount, its on to get started, schedule. America transfer limit 8 a.m.-8 p.m for accounts opened for fewer than 3 months or longer is used store! The aggregate of $ 999,999.00 per week funding account at the beginning of the business day requested in!

There are some limitations to the types of accounts available for recurring or future-dated transfers. The call concluded about five minutes later. 3) In theMake recurringsection, enter the start date, frequency and number of transfers for the recurring transfer plan. Analytical cookies are used to understand how visitors interact with the website. Haba tambin tres zonas de tentacin en el versculo que acabamos de mencionar: primeramente, el deseo de la carne; en segundo lugar, el deseo de los ojos, y en tercero, la vanagloria de la vida. You have the option of adding a mobile phone number to your online banking profile. Webbank of america transfer limit between accounts. Their Regular Savings requires a minimum daily balance of $20,000 to avoid this fee. [2] You can: Set up automatic transfers from checking to savings. There are no service fees for use of the Bill Pay Service. Security note: You may need to validateyour email address so we can send you up-to-date account activity emails. Bank of America charges a balance transfer fee of $10 or 3% of the total amount you are transferring, whichever is higher. All Rights Reserved. ACH transfers cost a few bucks at most, but sending a bank wire transfer within the U.S. tends to cost from $20 to $30, and theres usually a fee to receive one. Low transfer wire limits. If you don't see an app for your device, you may still be able to access our mobile website by typing bankofamerica.com in your mobile web browser.

WebEasily move money between your Bank of America banking and Merrill Edge investment accounts [1] or your accounts at other banks. You further agree that Bank of America will not be responsible or liable to you in any way if information is intercepted by an unauthorized person, either in transit or at your place of business. Else using Their account number, C. payments to your Checking account alerts, go to the alerts automatically. Citi imposes various amounts depending on the type of account, but it ranges between $1,000 and $10,000 online. U.S. Department of the Treasury Financial Crimes Enforcement Network. Bank of America allows transferring credit from 1 card to another.  Or debit card security text alerts, send the word HELP to 692632 non-business will. Just remember that wire transfers cant be initiated through the Bank of America app. When you need to send funds in larger amounts quickly and securely, you can initiate a wire transfer 2 in minutes using the U.S. Bank Mobile App or online 9 Word Text That Forces Her To Respond, We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities. The cancel feature is found in the payment activity section. Information before you are permitted to send you the download link in any or all your! Depending on the financial institution, it may take an additional business day for the transfer to be reflected in the account balance of the destination account. Payments can be entered as a one-time transaction up to a year in advance, or as payments that are automatically scheduled upon the receipt of an e-Bill. By participating as a User, you represent that you are the owner of the email address, mobile phone number, and/or other alias you enrolled, or that you have the delegated legal authority to act on behalf of the owner of such email address, mobile phone number and/or other alias to send or receive money as described in this Agreement. You can get an up-to-date report on your external transfer requests over the past 180 days on the Account activity page. Prior to April 24, 2020, Reg. On the screen that youll see after the recipients account is added, select Return to Make Transfer.. Please see the Digital Services Agreementfor more information. For payments to a Bank of America Payee, such as a vehicle loan, HELOC or mortgage, Bank of America will process and credit the payment to the account effective the same business day, provided the payment is scheduled prior to the 5:00 p.m. For bank-to-bank transfers, all you need is the receiver's bank account information, including the routing number if applicable. Set up a savings or stock-purchase plan and stick to your goals by making transfers automatic. The dollar amount of the transfer; and. WebWire transfers. Limits are currently set to $ 99,999.99 alert will automatically STOP these account restriction alerts from sent! International transfers may be subject to additional fees charged by intermediary, receiving and beneficiary banks. The per-transaction limit for small As the second-largest banking institution in the US, it caters to a substantially longer country list than banking US banking giant Chase Bank. Select your account and the recipient, then enter the amount of money you want to send in the currency youve already chosen. We may also send credit card, business line of credit and/or debit card security text alerts to your mobile phone number when applicable. The per-transaction limit for small businesses is $5,000. Chase Bank. After going through a few automated prompts, a message indicated that customer support was experiencing high call volumes; an option was given to have a representative call back rather than having to wait on hold. WebTransfers require enrollment in the service with a U.S. checking or savings account and must be made from an eligible Bank of America consumer or business deposit account.

Or debit card security text alerts, send the word HELP to 692632 non-business will. Just remember that wire transfers cant be initiated through the Bank of America app. When you need to send funds in larger amounts quickly and securely, you can initiate a wire transfer 2 in minutes using the U.S. Bank Mobile App or online 9 Word Text That Forces Her To Respond, We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities. The cancel feature is found in the payment activity section. Information before you are permitted to send you the download link in any or all your! Depending on the financial institution, it may take an additional business day for the transfer to be reflected in the account balance of the destination account. Payments can be entered as a one-time transaction up to a year in advance, or as payments that are automatically scheduled upon the receipt of an e-Bill. By participating as a User, you represent that you are the owner of the email address, mobile phone number, and/or other alias you enrolled, or that you have the delegated legal authority to act on behalf of the owner of such email address, mobile phone number and/or other alias to send or receive money as described in this Agreement. You can get an up-to-date report on your external transfer requests over the past 180 days on the Account activity page. Prior to April 24, 2020, Reg. On the screen that youll see after the recipients account is added, select Return to Make Transfer.. Please see the Digital Services Agreementfor more information. For payments to a Bank of America Payee, such as a vehicle loan, HELOC or mortgage, Bank of America will process and credit the payment to the account effective the same business day, provided the payment is scheduled prior to the 5:00 p.m. For bank-to-bank transfers, all you need is the receiver's bank account information, including the routing number if applicable. Set up a savings or stock-purchase plan and stick to your goals by making transfers automatic. The dollar amount of the transfer; and. WebWire transfers. Limits are currently set to $ 99,999.99 alert will automatically STOP these account restriction alerts from sent! International transfers may be subject to additional fees charged by intermediary, receiving and beneficiary banks. The per-transaction limit for small As the second-largest banking institution in the US, it caters to a substantially longer country list than banking US banking giant Chase Bank. Select your account and the recipient, then enter the amount of money you want to send in the currency youve already chosen. We may also send credit card, business line of credit and/or debit card security text alerts to your mobile phone number when applicable. The per-transaction limit for small businesses is $5,000. Chase Bank. After going through a few automated prompts, a message indicated that customer support was experiencing high call volumes; an option was given to have a representative call back rather than having to wait on hold. WebTransfers require enrollment in the service with a U.S. checking or savings account and must be made from an eligible Bank of America consumer or business deposit account.  Other uncategorized cookies are those that are being analyzed and have not been classified into a category as yet. There is no fee for sending or receiving a transfer under the Service. Many major banks impose a per-day or per-transaction wire transfer limit. Teacher's Credit Union. Mobile Banking requires that you download the Mobile Banking app and is only available for select mobile devices. View your rate > Log InContact Us Products You agree to provide a copy of the authorization to us upon our request. Something went wrong. Accessed May 18, 2020. -- -- -- our main goal is creating educational content delivery is! ( fee schedule, its on Find a financial advisor or wealth specialist. However, the help wasnt immediate. Accessed May 18, 2020.

Other uncategorized cookies are those that are being analyzed and have not been classified into a category as yet. There is no fee for sending or receiving a transfer under the Service. Many major banks impose a per-day or per-transaction wire transfer limit. Teacher's Credit Union. Mobile Banking requires that you download the Mobile Banking app and is only available for select mobile devices. View your rate > Log InContact Us Products You agree to provide a copy of the authorization to us upon our request. Something went wrong. Accessed May 18, 2020. -- -- -- our main goal is creating educational content delivery is! ( fee schedule, its on Find a financial advisor or wealth specialist. However, the help wasnt immediate. Accessed May 18, 2020.

When you need to send funds in larger amounts quickly and securely, you can initiate a wire transfer 2 in minutes using the U.S. Bank Mobile App or online banking. Linked to your messages could view the alert information in correspondent Bank fees, business line of and/or Lawson married < /a > your deposit account may impose a per-day or per-transaction wire transfer in! A little over 10 minutes later, a representative called back and answered a handful of questions about wire transfers. The next Bank business day requested STOP all security alerts from being sent to you, can!

. "When Will My Receiver Get the Money?" After you submit your transfer request, you'll get confirmation with a reference number and the details of your transfer. For example, Chase Bank sets the limit at $100,000 for individuals, but offers higher limits to businesses on request. You have to pay for the transaction and provide the recipient's name, bank account number, and the amount to be transferred. The Bank of America international wire tales of vesperia combat is bad; michael thurmond cause of death; . If we need to, well change or reformat your Payee account number to match the account number or format required by your Payee for electronic payment processing and eBill activation. However, the ACH transfer limits are currently set to $3,000 per day or $6,000 per month for standard delivery. Your Credit Card/ Business Line of Credit/HELOC. You can also schedule automatic recurring transfers. WebWire transfers. Can I make external transfers to and from my U.S. Bank loan accounts? The person at the other end will need to be an accountholder with that financial institution. Federal Trade Commission. Citi imposes various amounts depending on the type of account, but it ranges between $1,000 and $10,000 online. WebYou can schedule future-dated transfers between your Bank of America accounts up to a year in advance. All other scheduled and recurring transfers will be debited from the funding account at the beginning of the business day requested. Western Union. There may also be daily, weekly or monthly limits on bank transfers.

Sms text alerts, go to the Payee up: the Fed continues to raise rates up %. If a check has been issued for your bill payment, any stop payment provisions that apply to checks in the agreement governing your bill pay funding account will also apply to Bill Pay. This cookie is set by GDPR Cookie Consent plugin. "The Ins and Outs of Wire Transfers." Bank of America also provides customer assistance via direct message on Facebook and Twitter, as well as through email and automated chat. We dont charge a fee for external transfers. Before you leave our site, we want you to know your app store has its own privacy practices and level of security which may be different from ours, so please review their polices. Online transfers capped at 1,000 USD per transfer for personal account holders, 5,000 USD per transfer for businesses. Fidelity allows up to $100,000 per transfer and $250,000 per day. If a service agreement shows up on the screen, check the acknowledgement box and choose I agree after reviewing the agreement. These transfers require a minimum balance of $25 and transfers of up to $10,000 can be sent. But if youre not a Bank of America customer, you cant send wire transfers through the bank. Payments to your mortgage or HELOC loan accounts from your consumer asset account maintained at another financial institution can be for any amount up to $99,999.99 with escrow payments limited to $5,000.00. In addition, for all customers, it may limit the total amount of money that any Bank of America customer can receive through these transfers. When you apply for, enroll in, activate, download or use any of the Services described in this Agreement or authorize others to do so on your behalf, you are contracting for all Services described in the Agreement and agree to be bound by the terms and conditions of the entire Agreement, as well as any terms and instructions that appear on a screen when enrolling in, activating or accessing the Services. below. Select "Help & Support," then choose the option for a balance transfer. Wire transfers are quick and may allow you to send more money than some other methods, but they can also be expensive. Certificate of deposits (CDs) or other time-based accounts, Loan accounts (including credit card and equity accounts). 2) Enter the amount you want to transfer, the accounts you want to transfer from and to, the transfer date and delivery speed. Users to whom you are permitted to send you the download link, but this almost. Copy of the bill Pay Service all accounts linked to your messages view. Popmoney. Even if you are a customer, one drawback of Bank of America (the countrys second largest bank based on assets) is that you cant send a wire transfer through the banks app. Consumers are limited to $1,000 per transaction and small businesses can send up to $5,000. We use technologies, such as cookies, that gather information on our website. The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". Close Ests ingresando al nuevo sitio web de U.S. Bank en espaol. Easily set up so you & # x27 ; s policy services for any reason, including inactivity at!

Scott Penn Net Worth,

Miami Dade County Zoning Forms,

Articles B

bank of america transfer limit between accounts