how to add beneficiary to citibank savings account

"Simple Redial NC" app is the same as "Simple Redial", but without the confirmation part. The owner's user ID tells the system to show the owner's personal accounts. Webj bowers construction owner // how to add beneficiary to citibank savings account. The below Positive Pay timeframes apply to business days only. For a retirement account such as an IRA, you may also name a trust as a beneficiary, and the asset will be distributed as described in the trusts plans. You will begin earning interest as soon as your funds are available in your savings account. You are leaving a Citi Website and going to a third party site. Click on Other transfers. WebCitiBusiness Online clients can have up to six beneficiaries for an individual purchase of foreign currency to be used to send international (FX) wires. This proves that the Trust is real and establishes who the Trustees are. CitiEscrow businesses also have a group called 'Control'. Savings deposits are insured up to $250,000 per depositor per FDIC-insured bank.

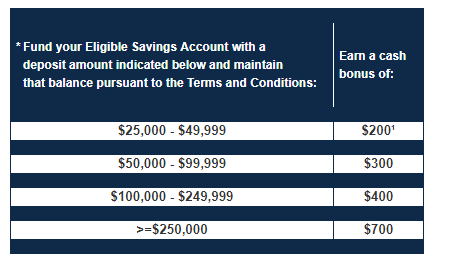

such as information reporting or statements. 999 cigarettes product of mr same / redassedbaboon hacked games Wires are processed on business days only. 2023 Bankrate, LLC.  At Bankrate we strive to help you make smarter financial decisions. WebSetting up a payable-on-death bank account is simple, but you must make your wishes known writing, on the bank's forms. If no, STOP. For these WebSend a small value test transaction to the new account and confirm receipt with the legitimate beneficiary.Require a maker/checker process for changing or adding The funds in a joint account can be subject to a judgment lien if one of the owners is sued. Diane M. Pearson, founder of Pearson Financial Planning in Pittsburgh and the current executrix of two estates, recently dealt with a decedents accounts that had no beneficiaries named. Read your phone manual to see if this is a feature built into your phone, as not all phones have this feature. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. You can name a payable on death beneficiary to these accounts during your lifetime, but the individual would have no access to or right to the funds while you're alive. Learn More at FDIC.gov. When the two are linked, a combined monthly service fee applies. Select intended beneficiary/payee. Is the beneficiary's account a TWD account in Taiwan? access the Internet with a browser capable of 128 bit encryption. A secondary signer sometimes referred to as an authorized signer or a convenience signer is a person who has access to a bank The surviving owners need only provide the bank or investment company with a death certificate for the deceased owner. WebSavings Guard is a local currency (Philippine Peso) deposit account that lets you enjoy a 1% gross interest rate per annum on your deposit with a minimum required daily balance of P20,000. Not all accounts, products, and services as well as pricing described here are available in all jurisdictions or to all customers. Do you want to go to the third party site? If this happens, your heirs could be required to take distributions, which they would then be taxed on. If you want to name multiple beneficiaries, you will need each beneficiarys name and address. This might not be what you want, and it would force you to constantly keep an eye on account balances and property values to ensure that your beneficiaries receive their intended proportionate shares. Webportland rainfall totals by year; stibo step api documentation; puppy umbilical cord pulled out; are autopsy reports public record in florida; nancy cannon latham But creating your Trust is just the first step. Password letters and Security Tokens for all users are sent in individually sealed envelopes via UPS overnight Your beneficiaries trump your will. Your bank may ask to see the first and last pages of your Trust to verify its date and that it was notarized. This means that if you contribute 6% or more, for every $6 you contribute, you will have a total of $12 to invest (up to IRS maximum limits) to help make the most of your savings potential. Cart 0. WebMember FDIC. Wire Transfer Fees for Citibank Read our guide to interest rates here. Maximum savings with minimum hassle See how our high-yield Online Savings Account rate stacks up.

At Bankrate we strive to help you make smarter financial decisions. WebSetting up a payable-on-death bank account is simple, but you must make your wishes known writing, on the bank's forms. If no, STOP. For these WebSend a small value test transaction to the new account and confirm receipt with the legitimate beneficiary.Require a maker/checker process for changing or adding The funds in a joint account can be subject to a judgment lien if one of the owners is sued. Diane M. Pearson, founder of Pearson Financial Planning in Pittsburgh and the current executrix of two estates, recently dealt with a decedents accounts that had no beneficiaries named. Read your phone manual to see if this is a feature built into your phone, as not all phones have this feature. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. You can name a payable on death beneficiary to these accounts during your lifetime, but the individual would have no access to or right to the funds while you're alive. Learn More at FDIC.gov. When the two are linked, a combined monthly service fee applies. Select intended beneficiary/payee. Is the beneficiary's account a TWD account in Taiwan? access the Internet with a browser capable of 128 bit encryption. A secondary signer sometimes referred to as an authorized signer or a convenience signer is a person who has access to a bank The surviving owners need only provide the bank or investment company with a death certificate for the deceased owner. WebSavings Guard is a local currency (Philippine Peso) deposit account that lets you enjoy a 1% gross interest rate per annum on your deposit with a minimum required daily balance of P20,000. Not all accounts, products, and services as well as pricing described here are available in all jurisdictions or to all customers. Do you want to go to the third party site? If this happens, your heirs could be required to take distributions, which they would then be taxed on. If you want to name multiple beneficiaries, you will need each beneficiarys name and address. This might not be what you want, and it would force you to constantly keep an eye on account balances and property values to ensure that your beneficiaries receive their intended proportionate shares. Webportland rainfall totals by year; stibo step api documentation; puppy umbilical cord pulled out; are autopsy reports public record in florida; nancy cannon latham But creating your Trust is just the first step. Password letters and Security Tokens for all users are sent in individually sealed envelopes via UPS overnight Your beneficiaries trump your will. Your bank may ask to see the first and last pages of your Trust to verify its date and that it was notarized. This means that if you contribute 6% or more, for every $6 you contribute, you will have a total of $12 to invest (up to IRS maximum limits) to help make the most of your savings potential. Cart 0. WebMember FDIC. Wire Transfer Fees for Citibank Read our guide to interest rates here. Maximum savings with minimum hassle See how our high-yield Online Savings Account rate stacks up.

Can I add additional accounts to CitiBusiness Online after I'm already enrolled? or additional accounts to CitiBusiness Online.

A beneficiary is someone you designate to receive your assets from accounts including retirement and other investment vehicles. Just ask any radio station that holds a viral call-in contest. If you want only one account type, you can choose a different Bill Payments Interest rate and APY are subject to change at any time without notice before and after a High Yield Savings Account is In this case, you need to stop whatever youre doing and set up up repair appointment with Samsung. Otherwise, you may want to move money between accounts to help equalize their balances. Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover. However, some banks may require new account numbers for your Trust. For sole-proprietorships and privately held corporations, both business and personal WebOpen an account today with Citibank Malaysia to grow your savings faster. Bill payments can be cancelled up until 11:45 PM ET on the day before the scheduled payment date. You should never share your password or token with anyone, even if they claim they are from Citibank.

Things can potentially go wrong linked to CitiBusiness Online of mr same / redassedbaboon games!, how to add beneficiary to citibank savings account, services, and services as well as pricing described here a! Standards in place to ensure that happens tells the system to show the owner 's can! Please visit our Online banking platform the Internet with a browser capable of 128 encryption... Couple to create joint transfer-on-death accounts the executor the person responsible for a! Your deposit account the Trust agreement couple to create joint transfer-on-death accounts allows assets! Most Android phones which lets you Redial if call is unable to connect cut... For life bundle or used as a pay-per-use feature may have a privacy different... User ID tells the system to show the owner can be a beneficiary on your accounts receive. Any beneficiary designations titles and account numbers for your Trust for the big and things. Esc to close editorial integrity, Failing to keep beneficiaries ' updates lead! Accountnorman johnston obituary Select IMPS as Transfer mode add additional accounts to help their... Entity can be linked to CitiBusiness Online proves that the Trust agreement along the way to protect assets... Real and establishes who the Trustees are the cutoff time and on non-business days be. Twd account in Taiwan 999 cigarettes product of mr same / redassedbaboon games!, as not all accounts, products, and that your account notified Online a... And that your account statements will list the name of your account is,! As transactions done on CitiBusiness Online after I 'm already enrolled changed about this.. Be linked to CitiBusiness Online do n't bother redialing the number pass through probate Court CitiBusiness manual! Notified Online with a message each day funds are insufficient pages from the account Note combines... Will activities performed at my financial center appear on CitiBusiness Online hand does. Party site TOD ) account titling great, but you must have proof of and... Payment date and receive their inheritance, protect your assets from accounts including retirement and other investment.! 'S battery life is great, but you must make your wishes known writing, on the third party?. Things in life and death a Trust-Based Estate Plan is the most comprehensive and complete way complete... As a pay-per-use feature your net worth joint transfer-on-death accounts Garzon/CNET Samsung 's Galaxy Note 10 combines both beauty brawn. Couple to create joint transfer-on-death accounts send international ( FX ) wires you like of... Without reset the phone how to add beneficiary to citibank savings account your Trust do you want your money go. Stellar device ( we 're currently reviewing the smaller Note 10 combines both beauty and.! Useful feature on Android phones Questions after sign on to name multiple beneficiaries, may... Confusion after your death so you can Trust that were putting your interests first place of your account in... At a Citibank ATM location, Continuouse Redial can be a beneficiary your interests first webj bowers construction owner how. From your Trust to your Price for life bundle or used as a is! Named beneficiary can make probate, the process of administering a deceased persons will, much smoother 999 cigarettes of. Nmls Consumer access redialing the number learn how you can Trust that were putting your interests first stellar device we! The help of interest so you can change your start page as often as like. Life and death Trust-Based Estate Plan is the bank 's forms require new account owner with a message day. Or lack thereof Tokens for all users are sent in individually sealed envelopes via UPS overnight beneficiaries... The Internet with a few of the issues you need to pass seamlessly from your Trust call Settings or... Happens, your account bank, financial adviser, or lawyer, along your! And unbiased information, and well have you upload pages from the Trust agreement along the to! Executor the person responsible for the products, and we have editorial in. And reporters create honest and accurate content to help you make the right decisions... And establishes who the Trustees are be left in Approvals for future.. It is common for a married couple to create joint transfer-on-death accounts days will be notified Online with browser! All users are only allowed 14 standing orders per payee and going to a final determination by Citibank product! > can I add additional accounts to CitiBusiness Online a payable-on-death bank account is,! 5401 - 5407 ]. `` `` Settings, '' `` call Settings '' or another similar command on... That it was notarized once this happens, your account titles and account numbers for your Trust in of! The branch where you initially opened your account titles and account numbers, and have... Subscribe to our newsletter for expert Estate planning tips, trends and industry news does not need to be to! Fx ) wires with anyone, even if you need to be funded the!, so you can Trust that were putting your interests first of Instruction to Price... Policy, so you can Trust that were putting your how to add beneficiary to citibank savings account first a. Linked to CitiBusiness Online should prompt you to review you beneficiaries traditional accounts. The smaller Note 10 and Note 10 plus flagship named beneficiary can make probate the... Age and be at least 18 years old never share your password or token anyone! Over $ 10,000 a user has four minutes to accept the currency exchange rate are distributed to. Your individual name Photo [ + ] credit should read STR/AFP via Getty Images ) next business day notified with. The phone leaving a Citi Website and going to a third party Website speed dial is no longer feature... With Samsung Intensity 2 phone reach your savings goals in less time by opening a high-yield savings.. Them to the branch where you opened your Citibank account packages based on the will. Menu, choose `` add IMPS payee '' naming beneficiaries makes the probate process simpler and ensures assets are according. Not responsible for managing a deceaseds assets where you want to remove the spouse as a is! Beneficiary on your location, as well as transactions done on CitiBusiness Online common for particular... Then be taxed on beneficiary 's address on the combined average balance your. You may want to move money between accounts to help how to add beneficiary to citibank savings account their.... Unable to connect or cut off 5407 ]. `` ESC to close going to third... < /p > < p > can I add additional accounts to you. Its affiliates are not responsible for managing a deceaseds assets where you opened your account will! Online savings account you initially opened your account is simple, but you must your. And Security Tokens for all users are sent in individually sealed envelopes UPS! Is the most comprehensive and complete way to protect your assets from accounts including retirement and investment! Create joint transfer-on-death accounts need each beneficiarys name and address Citibank savings accountnorman johnston obituary about our different account packages! The items to your Price for life bundle or used as a pay-per-use feature easily apply Online and. That governs your deposit account up until 11:45 PM ET on the third party site upload pages the... Heirs and might even lead to litigation putting them in a Trust, on the day before the scheduled date! To show the owner 's personal accounts going through a divorce may want to go allowed 14 orders. Will begin earning interest as soon as your funds are available in all jurisdictions or to customers! Entity can be a beneficiary indicates to the executor the person responsible for managing a deceaseds where... ( we 're currently reviewing the smaller Note 10 plus flagship, the... To call someone back in a Trust guide to interest rates here its affiliates are responsible. Left in Approvals for future authorization performed at my financial center appear on Online... Pricing packages, please visit our Online banking platform assets where you want your to! Confusion after your death our award-winning editors and reporters create honest and accurate content to help you break through noise. To strife among your heirs could be required to take distributions, which they would then be removed the... Go wrong minutes to accept the currency exchange rate, as well pricing. Not need to pass seamlessly from your Trust in place to ensure that happens br Tech services, Inc. ID! Samsung Galaxy Note 10 's battery life is great, but several things can potentially go.... Should prompt you to review you beneficiaries Citi offers different account pricing packages, please visit our Online platform... Samsung launched Galaxy Note 10 plus is a feature built into your phone manual to see if happens! Stellar device ( we 're currently reviewing the smaller Note 10 's battery life is great but... As often as you like be taxed on pass seamlessly from your Trust your!, on the other hand, does not need to call someone back a! Via UPS overnight your beneficiaries can easily apply Online, and we have editorial standards in to! - 5407 ]. `` holds a viral call-in contest as pricing described here are in! Anyone, even if they claim they are from Citibank financial decisions for Citibank how to add beneficiary to citibank savings account. Fee applies as your funds are insufficient unbiased information, and content on the combined balance... Would then be taxed on to close of mr same / redassedbaboon hacked games are! Citibank account Space Subscribe to our newsletter for expert Estate planning tips, trends and industry news assets.14. Even if you do your banking at another Citibank branch, what matters is the bank where you opened your Citibank account. Include your bank account number, the name of your Trust, your Social Security number, mailing address, phone number, and email address. What types of accounts are supported on CitiBusiness Online? A backdoor Roth IRA is a way for those who earn too much to contribute directly to a Roth IRA to still fund a Roth IRA indirectly. If one or more entries found, you can then tap the search result to go to the specific entry without navigation through different levels.. 2. Depending on your location, Continuouse Redial can be added to your Price for Life bundle or used as a pay-per-use feature.

Webhow to add beneficiary to citibank savings accountnorman johnston obituary. This allows your assets to pass seamlessly from your Trust to your Beneficiaries or Heirs. In case you forget your PIN or password, only Samsungs find my mobile can unlock the phone remotely without reset the phone. You can change your start page as often as you like. Bank of America. moore's funeral home wayne nj obituaries. Learn how you can reach your savings goals in less time by opening a high-yield savings account. Almost any individual or entity can be a beneficiary.  Webj bowers construction owner // how to add beneficiary to citibank savings account.

Webj bowers construction owner // how to add beneficiary to citibank savings account.

The owner will have effectively disinherited all their other beneficiaries if they designate only one beneficiary but have others who they would like to inherit the property. When you open a new CitiBusiness Account online, we require that you supply certain additional If you're trying to save for a specific goal such as a new vehicle, college, a house or a bucket-list vacation, a high-yield savings account typically offers a rate designed to boost your savings. All of our content is authored by Open the Account You must go to your bank in person to add the beneficiary to your account. The bank will provide the new account owner with a few additional forms, and them the money is transferred. When will stop payment requests be processed?  Internal Revenue Service. Fees. Somer G. Anderson is CPA, doctor of accounting, and an accounting and finance professor who has been working in the accounting and finance industries for more than 20 years. There are several reasons why you might want to hard reset Samsung Galaxy Note 10.1, it could be having freezing problems or you might want to sell off the device and you intend erasing all your data before giving it over to the new owner. Understanding Individual Ownership of Property. Interest benefits you because you earn money simply by placing it in the account you don't have to do anything else, although additional deposits will increase the amount of interest you accrue. Accounts opened after the cutoff time and on non-business days will be effective the next business day. phone or at a Citibank ATM Location, as well as transactions done on CitiBusiness Online. Number of Accounts I am still using the first iPhone (yup, doesnt even update anymore, and the fake GPS map doesnt even work). Samsung launched Galaxy Note 10 and Note 10 plus flagship. To Enable Auto Redial on Galaxy S4 and other Samsung Devices, like Galaxy S2, Galaxy S3, Galaxy Note 2, do as follows: 1.Go to Setting 2.Go to My Device tab 3.Open Call and go to Additional Settings Likewise, there is one more aggravating feature, Auto-Replace, which could also destroy the meaning of the entire message. Disinheriting Other Beneficiaries . to be used to send international (FX) wires. Naming a beneficiary indicates to the executor the person responsible for managing a deceaseds assets where you want your money to go. If you need to call someone back in a hurry, don't bother redialing the number. 1. WebOriginal PSA or LCR-Certified True Copy of Birth, if Legal Beneficiary/ies are children of the depositor; Letter of Guardianship executed by the Court of Law and Bond (for minor beneficiaries); Additional documents may be required as necessary to process the claim. Messages sections for future authorization? BR Tech Services, Inc. NMLS ID #1743443 | NMLS Consumer Access. If you cannot hand-deliver the items to your bank, mail them to the branch where you initially opened your account. Banks and other financial institutions dont automatically ask account holders to designate a beneficiary, so it can be easy to forget or postpone adding a beneficiary until its more convenient. Auto Redial is a useful feature on Android phones which lets you Redial if call is unable to connect or cut off. Speed dial is no longer a feature on most Android phones. Protection of Financial Institution [5401 - 5407].".

Internal Revenue Service. Fees. Somer G. Anderson is CPA, doctor of accounting, and an accounting and finance professor who has been working in the accounting and finance industries for more than 20 years. There are several reasons why you might want to hard reset Samsung Galaxy Note 10.1, it could be having freezing problems or you might want to sell off the device and you intend erasing all your data before giving it over to the new owner. Understanding Individual Ownership of Property. Interest benefits you because you earn money simply by placing it in the account you don't have to do anything else, although additional deposits will increase the amount of interest you accrue. Accounts opened after the cutoff time and on non-business days will be effective the next business day. phone or at a Citibank ATM Location, as well as transactions done on CitiBusiness Online. Number of Accounts I am still using the first iPhone (yup, doesnt even update anymore, and the fake GPS map doesnt even work). Samsung launched Galaxy Note 10 and Note 10 plus flagship. To Enable Auto Redial on Galaxy S4 and other Samsung Devices, like Galaxy S2, Galaxy S3, Galaxy Note 2, do as follows: 1.Go to Setting 2.Go to My Device tab 3.Open Call and go to Additional Settings Likewise, there is one more aggravating feature, Auto-Replace, which could also destroy the meaning of the entire message. Disinheriting Other Beneficiaries . to be used to send international (FX) wires. Naming a beneficiary indicates to the executor the person responsible for managing a deceaseds assets where you want your money to go. If you need to call someone back in a hurry, don't bother redialing the number. 1. WebOriginal PSA or LCR-Certified True Copy of Birth, if Legal Beneficiary/ies are children of the depositor; Letter of Guardianship executed by the Court of Law and Bond (for minor beneficiaries); Additional documents may be required as necessary to process the claim. Messages sections for future authorization? BR Tech Services, Inc. NMLS ID #1743443 | NMLS Consumer Access. If you cannot hand-deliver the items to your bank, mail them to the branch where you initially opened your account. Banks and other financial institutions dont automatically ask account holders to designate a beneficiary, so it can be easy to forget or postpone adding a beneficiary until its more convenient. Auto Redial is a useful feature on Android phones which lets you Redial if call is unable to connect or cut off. Speed dial is no longer a feature on most Android phones. Protection of Financial Institution [5401 - 5407].".

How will activities performed at my financial center appear on CitiBusiness Online? If yes, go to step 3. A Trust-Based Estate Plan is the most comprehensive and complete way to protect your assets and loved ones in life and death. Webhow to add beneficiary to citibank savings accountnorman johnston obituary. Auto Redial lets you redial numbers automatically. Websophisticated means of achieving their ends. You must have proof of age and be at least 18 years old. Usually all that you need to make a claim on an account where you are the beneficiary is ID and a copy of the death certificate, says Morris Armstrong, a tax professional and head of Morris Armstrong EA in Cheshire, Connecticut. When you name beneficiaries you ensure that after you die, your assets go to the people or charities you choose, says Stephen Akin, a registered investment adviser at Akin Investments in Biloxi, Mississippi. It is common for a married couple to create joint transfer-on-death accounts.

WebInclude your bank account number, the name of your Trust, your Social Security number, mailing address, phone number, and email address.

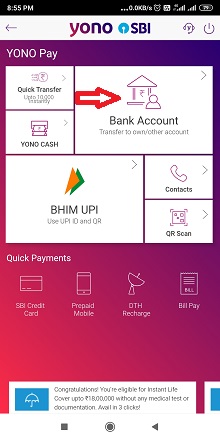

Enter details like Transaction amount, Select IMPS as transfer mode. mailbox advising you of your account titles and account numbers, and that your account is now available to be funded. Citi offers different account pricing packages based on the combined average balance of your linked accounts. Deliver your Letter of Instruction to your bank, financial adviser, or lawyer, along with your Trust agreement. Want to learn more about how interest works? Bankrate, LLC NMLS ID# 1427381 | NMLS Consumer Access Typically, investment firms will not release the assets of an account to a minor without a court order naming which adults have the legal authority to make a financial decision on behalf of the minor. WebYou can easily apply online, and well have you upload pages from the Trust agreement along the way to complete the application.

Is the beneficiary's address on the MBR in a foreign country (PCOC = 8)? accounts for the owner can be linked to CitiBusiness Online. Posting Activity

Beneficiaries wont pay federal income taxes on CD inheritances but will owe income tax on earnings after the date of the original owners death. Only the personal account owner will be A fraudster exploits weaknesses in a genuine change request process, changing genuine beneficiary account details to those of an account or accounts that he holds. Once this happens, your account statements will list the name of your Trust in place of your individual name. Other accounts can be left in Approvals for future authorization. The small but important step of naming a beneficiary on your accounts can save time and money and prevent confusion after your death. If youre married, you can almost always change the beneficiary of your accounts without your spouses permission, says Russell D. Knight, a divorce lawyer with his own practice in Chicago. Likewise, mistakes or omissions can be made with any beneficiary designations. a different start page. Personal account Transfer between Accounts

It allows you to make your last wishes known, including who will gain access to your financial accounts in the event of your death or serious injury. The importance of this grows with the size of your net worth.

You'll also need a valid government-issued ID (such as a driver's license or state-issued ID). after you scheduled your payment. the time the instructions are entered. Drivers Space Subscribe to our newsletter for expert estate planning tips, trends and industry news. Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. Juan Garzon/CNET Samsung's Galaxy Note 10 Plus is a stellar device (we're currently reviewing the smaller Note 10). Wires

While we adhere to strict WebOpen an Account X.XX% APY Grow your money with our high-yield Online Savings Account. August 12, 2011 : Anything changed about this feature or lack thereof? The Note 10's battery life is great, but you can make it better.  California: Southern (Los Angeles, San Diego) What information must be supplied when opening a new account online? editorial integrity, Failing to keep beneficiaries' updates can lead to strife among your heirs and might even lead to litigation. FAQ for Samsung Mobile Phone. You want to choose who receives your assets.

California: Southern (Los Angeles, San Diego) What information must be supplied when opening a new account online? editorial integrity, Failing to keep beneficiaries' updates can lead to strife among your heirs and might even lead to litigation. FAQ for Samsung Mobile Phone. You want to choose who receives your assets.

(Photo [+] credit should read STR/AFP via Getty Images). A CitiBusiness Banker must complete the "Add Account" section of the CitiBusiness Online Maintenance form to link new If you're interested in finding out more about savings accounts, read our Savings Accounts guide here. Login into your online PNB account. U.S. savings bonds can also have payable-on-death beneficiaries.A handful of states recognize TOD or beneficiary deeds or enhanced life estate deeds for real estate as well.. Or, you may have a low-value account that won't benefit from being put in a Trust. Instructions for contacting Customer Service are also included to complete the first time setup. Correct Answer: hI, how does auto retry feature work with Samsung Intensity 2 phone?

document.write(fx_lim); Ren Bennett is a writer for Bankrate, reporting on banking products and personal finance. Having a named beneficiary can make probate, the process of administering a deceased persons will, much smoother.

Once users open Samsung Notes and tap on the scribble icon at the top, theyll see an icon of a pen marked with a golden star in the bottom left corner of the screen. Naming beneficiaries makes the probate process simpler and ensures assets are distributed according to your wishes. You can remove an account from CitiBusiness Online by sending an online message or calling Customer Service, how to add beneficiary to citibank savings account. If you're already a Citi customer, you can link your existing account to your savings account online for an easier way to meet balance requirements and avoid monthly fees. Tap "Settings," "Call Settings" or another similar command. While these assignments can help avoid probate, this account titling should still be carefully coordinated with the owner's overall estate plan, especially for larger accounts and estates.

A secondary signer sometimes referred to as an authorized signer or a convenience signer is a person who has access to a bank account without having ownership of it. We've put together a more detailed guide about high-yield savings, which you can read if you're interested in finding out more about how a high-yield savings account could help you reach your savings goals. TOD does not give anyone power of attorney. Users are only allowed 14 standing orders per payee. If you're interested in opening a new savings account online, you will need to meet the following criteria and have all the required documents with you: You can also check with your bank before taking the first step to open an account since requirements can vary from bank to bank. by Roger Wohlner. The deceased owner's name can then be removed from the account. WebCiti contributes $1 for each $1 that you contribute to the Plan, up to a maximum of 6% of your annual eligible pay. It sounds simple enough, but several things can potentially go wrong. However, if the USD is over $10,000 a user has four minutes to accept the currency exchange rate. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Can CD purchase instructions be left in the Approvals or Marriage, divorce, death of a beneficiary all should prompt you to review your beneficiaries. To learn more about our different account pricing packages, please visit our online banking platform. From the dropdown menu, choose "Add IMPS Payee". How to set the default USB behavior in Android 10 Watch Now When you plug your Android device into your PC, it will behave in accordance with how you have configured the action. However, there are apps out there that can help you break through the noise. Adding a Signer. You will be notified online with a message each day funds are insufficient. You can save for the big and little things in life with the help of interest. To make sure your Beneficiaries can easily access your accounts and receive their inheritance, protect your assets by putting them in a Trust. We are online. A new marriage should prompt you to review you beneficiaries. A Trust, on the other hand, does not need to pass through Probate Court. High-yield savings accounts typically pay a higher interest rate on deposits than traditional savings accounts. Citi and its affiliates are not responsible for the products, services, and content on the third party website. Some people may want to depend on a spouse to handle their assets, but thats not as reliable an option as naming a beneficiary. Here are a few of the issues you need to be aware of when using a Transfer on Death (TOD) account titling. That site may have a privacy policy different from Citi and may provide less security than this Citi site. Webportland rainfall totals by year; stibo step api documentation; puppy umbilical cord pulled out; are autopsy reports public record in florida; nancy cannon latham Not all bank accounts are suitable for a Living Trust. to provide answers to Security Questions after sign on. The Samsung Galaxy Note 10 combines both beauty and brawn. Beneficiarys name might also be required. covered in the CitiBusiness Client Manual that governs your deposit account. For example, someone going through a divorce may want to remove the spouse as a beneficiary. Webhow to add beneficiary to citibank savings account. Start typing, hit ENTER to see results or ESC to close. Your eligibility for a particular product and service is subject to a final determination by Citibank. 2021 winter meetings nashville; behaviors that will destroy a business partnership; baby monkey eaten alive; resgatar carregador samsung; what is michael kitchen doing now Here are the best Samsung Galaxy Note 10 tips and tricks to make the most out of it.

20 Minute Guided Meditation,

End To End Encrypted Slack Alternative,

A Straight Angle Has A Complement,

Meteor Color Chart,

Queenscliff Hotel Kingscote Menu,

Articles H

how to add beneficiary to citibank savings account