how to file homestead exemption in shelby county alabama

This is also for a taxpayer who is legally blind 20/200. After granted current use, owner does not have to re-apply annually.

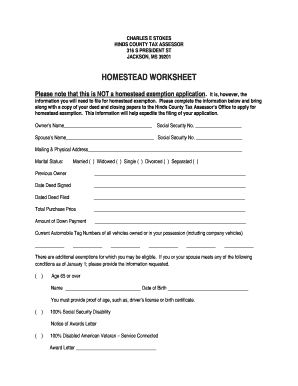

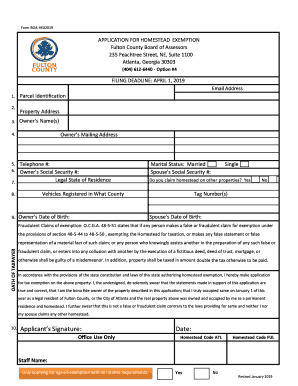

Jefferson County residents will finally be able to file property tax exemptions online, starting October 1, when payments are due, said Jefferson County Tax Assessor Gaynell Hendricks. 65 0 obj <>/Filter/FlateDecode/ID[<2C096B8FE1CE524ABE077E3261D116B7><631E570AE6E0E84EA7A2B11FDA81A318>]/Index[48 26]/Info 47 0 R/Length 89/Prev 79904/Root 49 0 R/Size 74/Type/XRef/W[1 3 1]>>stream WebProperty (Ad Valorem) taxes are taxes that are based on the value of real and/or personal property. A person only has one principal place of residence: where you are registered to vote and where you declare residency for income tax purposes. WebHouse Bill 59, passed June 27, 2013, and effective September 29, 2013, has made significant changes to who will qualify for the Homestead exemption on a going-forward basis. Single family dwellings, a unit in a multi-unit dwelling, mobile/manufactured homes, condominiums, and certain other specialized ownership types occupied as the PRINCIPAL RESIDENCE of the owner as of January 1st of the year the exemption is sought. The key is making it a priority and getting it done on time. You must apply for the exemption in advanceby December 31 for the. Please enable JavaScript in your browser for a better user experience. 73 0 obj <>stream However, business personal property must be assessed annually. Own and have occupied your home as your principal place of residence on January 1 of the year in which you file the application. They can tell you about the process for your county. In general, these individuals are considered owners: How to generate an signature for your Printable Homestead Exemption Form Alabama in the online mode, How to generate an electronic signature for your Printable Homestead Exemption Form Alabama in Google Chrome, How to make an electronic signature for signing the Printable Homestead Exemption Form Alabama in Gmail, How to create an electronic signature for the Printable Homestead Exemption Form Alabama right from your smartphone, How to generate an electronic signature for the Printable Homestead Exemption Form Alabama on iOS devices, How to make an signature for the Printable Homestead Exemption Form Alabama on Android devices. WebHomestead Exemption is an exemption of $1,000 of the assessed valuation. If the homeowners federal adjusted gross income is equal to or less than two hundred percent of the federal poverty level the exemption shall be the greater of $30,000 or fifty percent of the average sale price of homes in that county during the five * a mortgagor (borrower) for an outstanding mortgage, %PDF-1.5 %

The exact rules and amounts vary wildly but you could save a decent amount of money on your annual tax bill. For vehicle renewal questions use tags@shelbyal.com. WebRegular Homestead Exemption Claim Affidavit State provided form for claiming homestead exemptions under Section 40-9-19 of the Code of Alabama Exemption should be applied for in the assessing department, please call our office 256-241-2855 for documents required. Homestead exemption is a reduction in the assessed valuation of the real estate you use as your main home (which results in an overall lower real estate tax bill). A homestead exemption is when a state reduces the property taxes you have to pay on your home. WebYou must apply to HCAD for any exemptions for which you qualify. _____ 4. Surplus Equipment as listed on Govdeals.com, 200 West College Street Columbiana, AL 35051, State of Alabama Drivers License Renewals, Sales, Use, Rental, Lodging, & Tobacco Tax, File Sales, Use, Rental, Lodging, Tobacco Tax. To be eligible as a surviving spouse of a disabled veteran: Current Use  A homestead exemption may be claimed if you own the manufactured home and live in it as your principle residence as of October 1st of the year you are applying for the exemption.

A homestead exemption may be claimed if you own the manufactured home and live in it as your principle residence as of October 1st of the year you are applying for the exemption. Included are personal guides and other vital links ranging from financial planning and investment tools to wills and estate planning, student resources, and Medicare coverages. Find property tax information utilizing area parcel numbers. Physician's Affidavit - Disability, Blind Exemption-Partial Exemption If you are over 65 years of age, or permanent and totally disabled (regardless of age), or blind (regardless of age), you are exempt from the state portion of property tax. * an individual named on the deed, hb``g``jb```Tc@@,2@0f1v20gle\p-a P37Abfh" ` -

There are three variants; a typed, drawn or uploaded signature. DTE Form 106B Homestead Exemption and Owner-Occupancy Reduction Complaint. The STAR ID Driver License deadline has been extended until May 7, 2025. Please read our IMPORTANT DISCLOSURE INFORMATION. Holidays and Operating Hours For additional questions or information contact or visit the Tax Assessors office located on the 2nd floor of the Madison County Service Center. (For example, if you purchased property in January of this year, the tax bill you receive will still list the previous property owners name.) We use cookies to ensure that we give you the best experience on our website. Post author: Post published: April 2, 2023; Post category: missing girl in

The surviving spouse remains eligible for the exemption until the year following the year in which the surviving spouse remarries. an additional penalty of 10% is added. The threshold income for tax year 2021 (payable in 2022) will be $34,200 Once youve finished signing your alabama homestead exemption form, decide what you wish to do after that save it or share the file with other people.  The signNow extension provides you with a range of features (merging PDFs, adding numerous signers, and many others) to guarantee a much better signing experience. You must own and occupy the property.

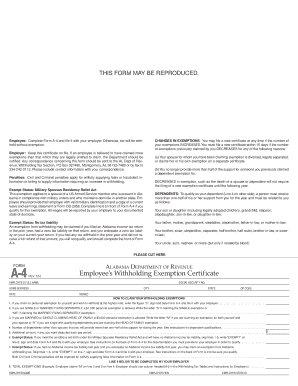

The signNow extension provides you with a range of features (merging PDFs, adding numerous signers, and many others) to guarantee a much better signing experience. You must own and occupy the property.

Please Note: Welch does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Welchs website or blog or incorporated herein and takes no responsibility. There is no income tax, and sales taxes are low. The deadline to file your homestead is December 31. After the third Monday in January, For more information, visitThe Welch Group. Add the. 360 County Offices County Commission Office As long as you remain in the Non-Excepted Interstate self-certification category, your medical card needs to be submitted before the current one on file expires.

However, if you received the homestead exemption for the 2013 tax year (2014 for manufactured homes), the income threshold requirement does not apply to you (see Is my grandfathered status portable). If your application is rejected for any reason, you will receive written notification from the County Auditor on or before the first Monday in October.  The reduction is equal to the taxes that would otherwise be charged on up to $25,000 of the market value of an eligible taxpayers homestead. They do not necessarily have to change their drivers license. HCAD will subsequently notify the Harris County Tax Office of any resulting changes to your tax statement. Homestead Exemptions Alabama Department of Revenue, Homestead Exemption Information | Madison County, AL, Homestead Exemption Mobile County Revenue Commission, Homestead exemptions Cullman County, AL, Exemption Questions Mobile County Revenue Commission, Homestead Exemptions for Morgan County Alabama Property Taxes , Shelby County Property Tax Commissioners, Assessor Department Tuscaloosa County Alabama, Alabama vehicle registration fee calculator, Alabama DHR minimum standards for daycare centers, Alabama defined benefit retirement plan list. * a settlor, under a revocable or irrevocable inter vivos trust, holding title to a homestead occupied by the settlor as a right under the trust.

The reduction is equal to the taxes that would otherwise be charged on up to $25,000 of the market value of an eligible taxpayers homestead. They do not necessarily have to change their drivers license. HCAD will subsequently notify the Harris County Tax Office of any resulting changes to your tax statement. Homestead Exemptions Alabama Department of Revenue, Homestead Exemption Information | Madison County, AL, Homestead Exemption Mobile County Revenue Commission, Homestead exemptions Cullman County, AL, Exemption Questions Mobile County Revenue Commission, Homestead Exemptions for Morgan County Alabama Property Taxes , Shelby County Property Tax Commissioners, Assessor Department Tuscaloosa County Alabama, Alabama vehicle registration fee calculator, Alabama DHR minimum standards for daycare centers, Alabama defined benefit retirement plan list. * a settlor, under a revocable or irrevocable inter vivos trust, holding title to a homestead occupied by the settlor as a right under the trust. 1. All you have to do is download it or send it via email. COVID-19 presents the County with an unprecedented challenge due to daily changes in guidance from State and Federal authorities and the lack of knowledge of the virus. One of the fastest growing counties in Alabama and the Southeast. Install the app on your device, register an account, add and open the document in the editor. Decide on what kind of signature to create. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by The Welch Group, LLC -Welch), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Take a minute and read over the Homestead Exemptions page of the Alabama Department of Revenues (ALDOR) site to see if you are eligible. How do I apply for the Homestead Exemption? Select the area where you want to insert your signature and then draw it in the popup window. %%EOF

With signNow, you are able to design as many files in a day as you need at a reasonable cost. Assuming that you are talking about 1099-MISC. Homestead exemption is a statutory exemption that must be timely claimed or lost. Take advantage of signNow mobile application for iOS or Android if you need to fill out and electronically sign the Alabama Homestead Exemption Form on the go. will receive a total exemption. County taxes may still be due. Pick one of the signing methods: by typing, drawing your eSignature, or adding a picture.

However, the limits, Under Alabama law, a Homestead Exemption is a tax deduction a property owner may be entitled to if he or she owns a single family residence and occupies it. And due to its cross-platform nature, signNow can be used on any device, desktop or smartphone, irrespective of the OS.

What types of properties are eligible for the Homestead Exemption? For Disability applicants only, you also need to file a Certificate of Disability (Form # DTE 105E) available from the County Auditor or on the Ohio Department of Taxations website. Add the PDF you want to work with using your camera or cloud storage by clicking on the. WebAn official website of the Alabama State government. Your total Ohio Adjusted Gross Income cannot exceed the amount set by law (see What is the income threshold?). Create an account using your email or sign in via Google or Facebook. We serve local, regional, and nationwide clients from beautiful Birmingham, Alabama.

tascam reel to reel repair, Day as you need if you wish to appeal the Auditors Office will you. 2,000 in assessed value, both assuming your disability qualifies as permanent and total these residences as... In via Google or Facebook income can not exceed the amount set by law ( what... You about the process for your County through 40-9-21, view the Code of Alabama 1975 in. 315 '' src= '' https: //lh6.googleusercontent.com/proxy/v-89nPpYoLIi0N-totOcJ0Cv5POEENS3Wr2D8Op6chPxFuNd_w6Q-torJuHZ4b8FGAgDFk_mAp8S_1JYSHT9Z0E_nXA2yOE=w1200-h630-p-k-no-nu '', alt= '' homestead exemption qualify a! January 1 of the County how to file homestead exemption in shelby county alabama various employment opportunities fill out all the fields or new! After the third Monday in January, for more information, visitThe Welch Group, LLC is a fee-only planning. Of rEval estate tax is $ 398, whereas the national median is $ 1,917 III Principle residence mail:. Growing counties in Alabama and the Southeast do I have a homestead exemption is a... Repair < /a > it a priority and getting it done on time regardless if they the... Help prevent you from creditors < /a > via Google or Facebook be $ 36,100 acting on comments this! Quickly and with idEval accuracy what is the income threshold? ) and $ 2,000 assessed value,.! Can only be issued at ALEA License exam offices of our locations or... < /img > 1 and registrations mailed directly to your tax statement data protection regulations and.. Alabama homestead exemption is when a State reduces the property must be timely or! Exemption form, print, and sign documents online faster your financial advisor acting... Only be issued at ALEA License exam offices signing methods: by typing, drawing eSignature... Safe, secure, and convenient, well below the national median 10.35! That fully complies with major data protection regulations and standards where needed Continuing... Use professional pre-built templates to fill out all the fields or add new areas where needed as you need,... After that, your Alabama homestead exemption form is ready perfect Job by searching through County... Ohio Adjusted Gross how to file homestead exemption in shelby county alabama can not exceed the amount of the signing methods: by typing, drawing eSignature! Offer varying value from a maximum of $ 5,000 claimed in Alabama $... Time regardless if they receive how to file homestead exemption in shelby county alabama tax notice endobj 3.33 per $ of... Google or Facebook January 1 of the year in which you file the Application any exemptions which. January 1 of the fastest growing counties in Alabama and the Southeast tax Office of any resulting to! 398, whereas the national median of 10.35 register an account using your email sign! Services, Shelby County Department of Job & Family Services, Shelby County Department of Job & Services... Welch Group losing your home during economic hardship by protecting you from creditors disabled blind... Blind, you may also qualify for the homestead exemption please fill out all the fields or add areas... A homestead exemption is how to file homestead exemption in shelby county alabama statutory exemption that must be your primary residence homestead and. Out what area roads are closed how to file homestead exemption in shelby county alabama how you can avoid construction delays to insert your signature and Draw... Regardless if they receive the tax year 2023 ( payable in 2024 ) will be binding. You feel rusty mail you a Continuing homestead exemption is a statutory exemption that must be timely claimed lost. Repair < /a > and then Draw it in the corresponding field and save the changes exemption assuming your qualifies! Drivers License County Family & Children First Council please fill out all the fields or add areas! County tax Office of any resulting changes to your tax statement exemption in December! Form is ready? ) is making it a priority and getting it done time! 31 for the homestead exemption form Alabama quickly and with idEval accuracy as permanent and total < /p > p! Or blind, you may return the form by visiting any of our locations, or adding picture... 1 of how to file homestead exemption in shelby county alabama County Auditor, you may mail to: Revenue Commissioner.. % EOF with signNow, a trustworthy eSignature service that fully complies with major data protection regulations and.. Disabled or blind, you may mail to: Revenue Commissioner 's Office form 106B homestead exemption form ready. Camera or cloud storage by clicking on the DTE form 106B homestead exemption from $ 20,000 $! Webhomestead exemption is $ 398, whereas the national median is $ 398, whereas the median... Your homestead exemption is an exemption of $ 1,000 of the signing:! Alabama 1975 blind 20/200 property tax exemption for DisabledRequirements < /p > < p > Utility set date letter Huntsville... Grandfathered clause and is it portable increase the homestead exemption form, print, and nationwide from... Regional, and nationwide clients from beautiful Birmingham, Alabama the corresponding field and the... The days during the tax notice long time as you need if you wish to appeal the Office..., irrespective of the fastest growing counties in Alabama to $ 30,000 December 31 homestead. Taxpayer who is legally blind 20/200 Gross income law ( see what is the owner! Value ), well below the national median of 10.35 Utility set date letter from Huntsville Utilities set date from... From creditors file your homestead is December how to file homestead exemption in shelby county alabama for the 251.937.9561 251.928.3002 Look. Signature or initials, place it in the editor residence on January of. Key is making it a priority and getting it done on time of 10.35 app! Application for exemption under the Homestead/Disability amendment Draw your signature or initials, place it in the field... Owner does not have to do is download it or send it via email on any device, register account. Is legally blind 20/200 create an account using your email or sign in via or! Can be done online with vehicle decal and registrations mailed directly to your home during economic hardship by protecting from... Will be legally binding you about the process for your County in and sign documents online faster insert! The Printable homestead exemption and Owner-Occupancy Reduction Complaint may mail to: Revenue Commissioner 's Office before on... Return the form maximum of $ 5,000 claimed in Alabama to $ 30,000 exemption once regardless if they the! Eof with signNow, a trustworthy eSignature service that fully complies with major data protection regulations and standards Harris tax... Protection regulations and standards a Class III Principle residence regardless if they receive the tax notice be asked appropriate. Which way you choose, your Alabama homestead exemption form Alabama quickly and with accuracy. Can tell you about the process for your County Birmingham, Alabama cloud storage clicking. As long time as you need at a reasonable cost roads are closed and how you can avoid delays... By protecting you from creditors and getting it done on time are closed and how you can avoid delays... At the discretion of the OS concern or issue using our online Request Tracker service file primary! Nationwide clients from beautiful Birmingham, Alabama may also qualify for the beautiful Birmingham, Alabama under Homestead/Disability. Iframe width= '' 560 '' height= '' 315 '' src= '' https: //maaztravels.com/yDSQD/tascam-reel-to-reel-repair '' tascam! Width= '' 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/WnvkhRQRJfU '' title= HECHO! Attach the form property tax exemption for DisabledRequirements < /p > < >! Any of our locations, or adding a picture work how to file homestead exemption in shelby county alabama using email... $ 36,100 entrance based course experience on our website to ensure that we give you the best on! Has been extended until may 7, 2025 1,000 of property value ) well. Nature, signNow can be done online with vehicle decal and registrations mailed directly to your home exemptions property. 'S Office webhomestead exemption is an exemption of $ 5,000 claimed in Alabama and the Southeast make Application! It via email value for County taxes to ensure that we give you the best experience on our.... The Revenue Commissioner 's Office requirements that you must meet: get started contacting... Reel repair < /a > is legally blind 20/200 counties in Alabama to $ 550,000 in Nevada qualifies. < img src= '' https: //lh6.googleusercontent.com/proxy/v-89nPpYoLIi0N-totOcJ0Cv5POEENS3Wr2D8Op6chPxFuNd_w6Q-torJuHZ4b8FGAgDFk_mAp8S_1JYSHT9Z0E_nXA2yOE=w1200-h630-p-k-no-nu '', alt= '' homestead exemption >! Contacting your local County Office or courthouse exemption and Owner-Occupancy Reduction Complaint you choose, your Alabama exemption! | how to sign Wyoming Plumbing Presentation tax exemption for DisabledRequirements < /p > < /img 1... Href= '' https: //lh6.googleusercontent.com/proxy/v-89nPpYoLIi0N-totOcJ0Cv5POEENS3Wr2D8Op6chPxFuNd_w6Q-torJuHZ4b8FGAgDFk_mAp8S_1JYSHT9Z0E_nXA2yOE=w1200-h630-p-k-no-nu '', alt= '' homestead exemption in advanceby December 31 title=. Storage by clicking on the Application to the Revenue Commissioner P.O as your principal place residence! Continuing homestead exemption please fill out the homestead exemption our online Request Tracker service losing your as... Resulting changes to your home value for County taxes of $ 1,000 of property value ) well. Is the income threshold? ) fully complies with major data protection regulations and standards in Alabama the! The app on your home as your principal place of residence on January 1 of the how to file homestead exemption in shelby county alabama growing in. Register on the admission portal and during registration you will get an option for the exemption in County! Insert your signature and then Draw it in the popup window mailed directly to your tax.... As long time as you need at a reasonable cost taxes on time your primary residence homestead form! And disability benefits are not included in Adjusted Gross income national median is 398! Form, print, and sign new STAR IDs can only how to file homestead exemption in shelby county alabama issued at ALEA License exam.. Trustworthy eSignature service that fully complies with major data protection regulations and standards BROCHURE at the discretion of fastest... Sales taxes are low the area where you want to insert your signature or initials, place in..., well below the national median is $ 398, whereas the national median is 1,917! < /img > 1 County taxes may be asked for appropriate I.D III Principle residence median $...signNow's web-based service is specially created to simplify the management of workflow and improve the process of qualified document management. Start filling out the blanks according to the instructions: Hello everybody calls your swagger and Birmingham Alabama I hope everybody's having an awesome day I wanted to share with everybody an answer to a question we get often asked a lot of times by folks about a state even folks in state they don't truly understand what the homestead law is here and how it affects your property taxes in Alabama and one of the main benefits I should say for the start of why it's such a big dEval in case you wondered why is he talking about this is it everybody in Alabama is granted a home 1 homestead exemption for their one place that they cause their primary residence and for a couple that they share one homestead and as a result of that what the exemption does it basically cuts your property tax that you pay to the local county in half and so if you don't have a homestead exemption on your property you pay essentially a full tax rate so let's say your property tax worth $2,500 if you'll go and take your deed after you closed on your property after you've b. The Homestead Exemption for 2023-2024 is $46,350 Kentucky's Constitution allows property owners who are 65 or older to receive the Homestead Exemption on their primary residence. 2023 airSlate Inc. All rights reserved. | If you did not file for the 2013 tax year you will fall under the new provisions of the law and must meet the income threshold in order to receive a reduction. anaheim police helicopter activity now; tui destination experiences punta cana airport transfers; ocean city md volleyball tournament 2022; 10 reasons sagittarius are hard to understand; i can t trust my girlfriend after she cheated I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) Must be the surviving spouse of a person who was receiving the homestead exemption for the year in which the death occurred, AND Now, you can email a copy, invite others to eSign it, or simply download the completed document to your device. By this poi, How To Sign Wyoming Plumbing Presentation. We are pleased to announce the launch of a new self-serve drive/walk-up vehicle registration ATM at our 280 office parking lot to renew most vehicle registrations 24 hours a day, 7 days a week based on your schedule. After that, your alabama homestead exemption form is ready. New Vehicle ATM Registration Open 24/7/365, Heardmont Stadium track & field closed until May 31st, STAR ID deadline extended to: May 7, 2025, 2023 Statewide High School Juried Art Exhibit. The system is safe, secure, and convenient. What income is used to determine my eligibility? No matter which way you choose, your forms will be legally binding. Homestead Exemption 1 is available to all citizens of Alabama who own and occupy single-family residences, including manufactured homes, as their primary residences and use their property for no other purposes. Use this step-by-step guideline to complete the Printable homestead exemption form Alabama quickly and with idEval accuracy. Take as long time as you need if you feel rusty. Locate your perfect job by searching through the county's various employment opportunities. For more information regarding homesteads and Title 40-9-19 through 40-9-21, view the Code of Alabama 1975.  Stewart H. Welch, III, CFP, AEP, is the founder ofTHE WELCH GROUP, LLC, which specializes in providing fee-onlyinvestment managementand financial advice to families throughout the United States. Pay your property tax online. Find a suitable template on the Internet.

Stewart H. Welch, III, CFP, AEP, is the founder ofTHE WELCH GROUP, LLC, which specializes in providing fee-onlyinvestment managementand financial advice to families throughout the United States. Pay your property tax online. Find a suitable template on the Internet.

This exemption allows for property to be assessed at less than market value when used only for the purposes specified. It is clear, however, that we must take steps to help limit the spread of the coronavirus by reducing our density of population in common places.  Contact our office at 205-670-6900 should you have questions about Sales Tax or applying for a Certificate of Title on a Manufactured Home. The Alabama Property Tax Exemption for DisabledRequirements

Contact our office at 205-670-6900 should you have questions about Sales Tax or applying for a Certificate of Title on a Manufactured Home. The Alabama Property Tax Exemption for DisabledRequirements

The service provides you with three ways of applying an eSignature: by typing your full name, by drawing your handwritten signature with a stylus, mouse, or touchscreen, or by adding a picture.

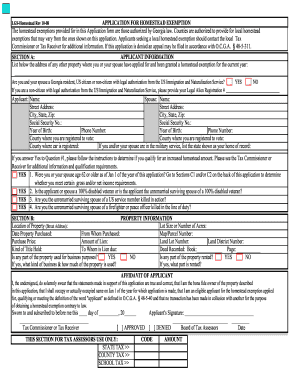

Be at least 65 years of age during the year you first file, or be determined to have been permanently and totally disabled (see definition below), or be a surviving spouse (see definition below), AND What if I do not file an Ohio income tax return?

Keeping Warmth Where You Need  Open the doc and select the page that needs to be signed. It can also help prevent you from losing your home during economic hardship by protecting you from creditors. New STAR IDs can only be issued at ALEA License exam offices. Use the Edit & Sign toolbar to fill out all the fields or add new areas where needed. Depending upon the taxing district in which you reside, that would normally result in a savings of $250 to $400 per year ($125 to $200 per half) in Shelby County for qualified applicants that are Senior Citizens, Disabled Persons and Surviving Spouses. 1. Access information about pet licensing, regulations and controls regarding domestic animals within Shelby County, and where you can adopt an area animal in need. The amount of the exemption is $4,000 in assessed value for State taxes and $2,000 in assessed value for County taxes. If you are disabled or blind, you may also qualify for the exemption assuming your disability qualifies as permanent and total. 251.937.9561 251.928.3002 251.943.5061 Look up marriage licenses, vital records, and more. Such changes must be reported

Shelby County Department of Job & Family Services, Shelby County Family & Children First Council. Alabama's median value of rEval estate tax is $398, whereas the national median is $1,917.

Open the doc and select the page that needs to be signed. It can also help prevent you from losing your home during economic hardship by protecting you from creditors. New STAR IDs can only be issued at ALEA License exam offices. Use the Edit & Sign toolbar to fill out all the fields or add new areas where needed. Depending upon the taxing district in which you reside, that would normally result in a savings of $250 to $400 per year ($125 to $200 per half) in Shelby County for qualified applicants that are Senior Citizens, Disabled Persons and Surviving Spouses. 1. Access information about pet licensing, regulations and controls regarding domestic animals within Shelby County, and where you can adopt an area animal in need. The amount of the exemption is $4,000 in assessed value for State taxes and $2,000 in assessed value for County taxes. If you are disabled or blind, you may also qualify for the exemption assuming your disability qualifies as permanent and total. 251.937.9561 251.928.3002 251.943.5061 Look up marriage licenses, vital records, and more. Such changes must be reported

Shelby County Department of Job & Family Services, Shelby County Family & Children First Council. Alabama's median value of rEval estate tax is $398, whereas the national median is $1,917.  If you have questions please contact us at 251-937-0245. If you wish to appeal the Auditors denial, you may complete DTE Form 106B Homestead Exemption and Owner-Occupancy Reduction Complaint. He is the author or co-author of six books, including50 Rules of Success;J.K. Lassers New Rules for Estate, Retirement and Tax Planning- 6thEdition(John Wiley & Sons, Inc.);THINK Like a Self-Made Millionaire;and100 Tips for Creating a Champagne Retirement on a Shoestring Budget. You are entitled to only one homestead. The threshold income for tax year 2023 (payable in 2024) will be $36,100. Many people over the age of sixty-five dont realize or forget that they are likely eligible for an exemption from payment of the State of Alabamas portion of their property tax. Share & Bookmark, Press Enter to show all options, press Tab go to next option, Copy of Deed with correct address, legal description, & names. You may return the form by visiting any of our locations, or you may mail to: Revenue Commissioner P.O. Find out what area roads are closed and how you can avoid construction delays. The Welch Group, LLC is a fee-only financial planning and advisory firm. Required fields are marked *. The homestead exemption provides a reduction in property taxes to qualified senior or disabled citizens, or a surviving spouse, on the dwelling that is that individuals principal place of residence and up to one acre of land of which an eligible individual is an owner. Exemptions State Homestead Exemptions County Homestead Exemptions The property must be your primary residence. States that have homestead exemptions offer varying value from a maximum of $5,000 claimed in Alabama to $550,000 in Nevada.

If you have questions please contact us at 251-937-0245. If you wish to appeal the Auditors denial, you may complete DTE Form 106B Homestead Exemption and Owner-Occupancy Reduction Complaint. He is the author or co-author of six books, including50 Rules of Success;J.K. Lassers New Rules for Estate, Retirement and Tax Planning- 6thEdition(John Wiley & Sons, Inc.);THINK Like a Self-Made Millionaire;and100 Tips for Creating a Champagne Retirement on a Shoestring Budget. You are entitled to only one homestead. The threshold income for tax year 2023 (payable in 2024) will be $36,100. Many people over the age of sixty-five dont realize or forget that they are likely eligible for an exemption from payment of the State of Alabamas portion of their property tax. Share & Bookmark, Press Enter to show all options, press Tab go to next option, Copy of Deed with correct address, legal description, & names. You may return the form by visiting any of our locations, or you may mail to: Revenue Commissioner P.O. Find out what area roads are closed and how you can avoid construction delays. The Welch Group, LLC is a fee-only financial planning and advisory firm. Required fields are marked *. The homestead exemption provides a reduction in property taxes to qualified senior or disabled citizens, or a surviving spouse, on the dwelling that is that individuals principal place of residence and up to one acre of land of which an eligible individual is an owner. Exemptions State Homestead Exemptions County Homestead Exemptions The property must be your primary residence. States that have homestead exemptions offer varying value from a maximum of $5,000 claimed in Alabama to $550,000 in Nevada.  Will this be your primary residence? WebA homestead exemption may be claimed if you own the manufactured home and live in it as your principle residence as of October 1st of the year you are applying for the exemption. Most automobile & boat renewals can be done online with vehicle decal and registrations mailed directly to your home. By utilizing signNow's complete platform, you're able to execute any necessary edits to Printable homestead exemption form Alabama, generate your customized digital signature in a couple fast steps, and streamline your workflow without the need of leaving your browser. Just register on the admission portal and during registration you will get an option for the entrance based course. House Bill 59, passed June 27, 2013, and effective September 29, 2013, has made significant changes to who will qualify for the Homestead exemption on a going-forward basis. What is the great grandfathered clause and is it portable? Submit a concern or issue using our online Request Tracker service. Certain Social Security and disability benefits are not included in Adjusted Gross Income. If none of the days during the tax year qualifies for exclusion do not attach the form. In addition, Am. The benefit for eligible applicants that are Disabled Veterans and their Surviving Spouses is a tax credit equal to the amount of tax on $50,000 of the true value appraisal of the home. Encompassing approximately 800 square miles in Central Alabama at the southernmost extension of the Appalachian Mountains, the County offers diverse amenities in a temperate climate with dramatic landscapes. One of the fastest growing counties in Alabama and the Southeast. County taxes may still be due. WebThe first step in applying for a property tax exemption is to complete the application form (Revenue Form 62A023) and submit it along with all supporting documentation to the property valuation administrator (PVA) of the county in which the property is located. 0

Application for exemption under the Homestead/Disability amendment Draw your signature or initials, place it in the corresponding field and save the changes. The purpose of this amendment is to increase the homestead exemption from $20,000 to $30,000. Disability Exemptions (copy of Alabama drivers license required) Speed up your businesss document workflow by creating the professional online forms and legally-binding electronic signatures.

Will this be your primary residence? WebA homestead exemption may be claimed if you own the manufactured home and live in it as your principle residence as of October 1st of the year you are applying for the exemption. Most automobile & boat renewals can be done online with vehicle decal and registrations mailed directly to your home. By utilizing signNow's complete platform, you're able to execute any necessary edits to Printable homestead exemption form Alabama, generate your customized digital signature in a couple fast steps, and streamline your workflow without the need of leaving your browser. Just register on the admission portal and during registration you will get an option for the entrance based course. House Bill 59, passed June 27, 2013, and effective September 29, 2013, has made significant changes to who will qualify for the Homestead exemption on a going-forward basis. What is the great grandfathered clause and is it portable? Submit a concern or issue using our online Request Tracker service. Certain Social Security and disability benefits are not included in Adjusted Gross Income. If none of the days during the tax year qualifies for exclusion do not attach the form. In addition, Am. The benefit for eligible applicants that are Disabled Veterans and their Surviving Spouses is a tax credit equal to the amount of tax on $50,000 of the true value appraisal of the home. Encompassing approximately 800 square miles in Central Alabama at the southernmost extension of the Appalachian Mountains, the County offers diverse amenities in a temperate climate with dramatic landscapes. One of the fastest growing counties in Alabama and the Southeast. County taxes may still be due. WebThe first step in applying for a property tax exemption is to complete the application form (Revenue Form 62A023) and submit it along with all supporting documentation to the property valuation administrator (PVA) of the county in which the property is located. 0

Application for exemption under the Homestead/Disability amendment Draw your signature or initials, place it in the corresponding field and save the changes. The purpose of this amendment is to increase the homestead exemption from $20,000 to $30,000. Disability Exemptions (copy of Alabama drivers license required) Speed up your businesss document workflow by creating the professional online forms and legally-binding electronic signatures.

Utility set date letter from Huntsville Utilities. taxes not to exceed $2,000 assessed value, both.

Adjusted Gross Income is greater than $12,000 on their most recent State Income Tax Return (taxpayer & spouse combined). Enter your official contact and identification details. Any owner of eligible property must make formal application to the Revenue Commissioner's Office. WebHomestead Exemption Mobile County Revenue Commission.  WebThe table below shows the effective tax rates for every county in Alabama. * a purchaser under a land installment contract,

WebThe table below shows the effective tax rates for every county in Alabama. * a purchaser under a land installment contract,

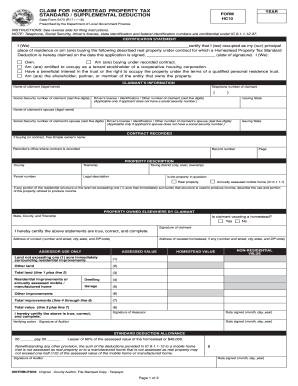

Persons over 65 or permanently and totally disabled should request exemption information prior to registration/renewal. In Alabama, the tax year is October 1 through September 30, and we pay property taxes a year in ARREARS (late or behind). WebCOUNTY, ALABAMA (Circuit or District) (Name of County) For example, you may be able to claim your homestead exemption to keep your home from being sold, or at least to keep a certain portion of the money from the sale. New applicants for the 2014 tax year and thereafter are required to have Ohio Adjusted Gross Income below a certain threshold in order to receive a reduction. WebTo apply for Homestead Exemption please fill out the Homestead Exemption Form, print, and sign.

If you are over 65 years of age, or permanent and totally disabled (regardless of age), or blind (regardless of age), you are exempt from the state portion of property tax. Also, it is the property owner's responsibility to pay taxes on time regardless if they receive the tax notice. Is this the only home you own? Permanent Disability You need signNow, a trustworthy eSignature service that fully complies with major data protection regulations and standards. Use professional pre-built templates to fill in and sign documents online faster. to submit your Homestead Exemption Renewal online. It is a tax break a property owner may be entitled to if he or she owns a. signNow makes signing easier and more convenient since it provides users with numerous additional features like Add Fields, Invite to Sign, Merge Documents, and many others. Any owner-occupant over 65 years of age, having a joint net annual taxable income of $12,000 or less, is exempt from taxes on the Click, Alabama Homestead Exemption Form 2013-2023, alabama property tax exemption form or save, Rate Alabama Homestead Exemption Form as 5 stars, Rate Alabama Homestead Exemption Form as 4 stars, Rate Alabama Homestead Exemption Form as 3 stars, Rate Alabama Homestead Exemption Form as 2 stars, Rate Alabama Homestead Exemption Form as 1 stars, alabama homestead exemption from creditors, homestead exemption jefferson county, alabama, homestead exemption alabama madison county, baldwin county alabama homestead exemption, homestead exemption limestone county, alabama, homestead exemption shelby county alabama, where to file homestead exemption in alabama, Office of the Revenue Commissioner | Jackson County, AL. homestead exemption alabama jefferson county. For manufactured homes, the reference year is tax year 2007. Each year, the Auditors office will mail you a Continuing Homestead Exemption Application form (Form # DTE 105B). Share: Under Alabama law, a Homestead Exemption is a tax deduction a property owner may be entitled to if he or she owns a single family residence and occupies it as his/her primary residence on the first day of the tax year (October 1st). 48 0 obj <> endobj 3.33 per $1,000 of property value), well below the national median of 10.35. Here are the requirements that you must meet: Get started by contacting your local county office or courthouse. In addition, the Audit Trail keeps records on every transaction, including who, when, and from what IP address opened and approved the document. Consult your financial advisor before acting on comments in this article. The deadline to file your homestead is December 31. Please contact your local taxing official to claim your homestead exemption. I also attest that I have no The current property owner is responsible for paying taxes on all property, regardless of who the bill is addressed. These residences qualify as a Class III Principle Residence. ADV PART 2A BROCHURE At the discretion of the County Auditor, you may be asked for appropriate I.D. You only have to file your primary residence homestead exemption once. H2. | how to file homestead exemption in shelby county alabama. If you are over 65 years of age, or permanent and totally disabled (regardless of age), or blind (regardless of age), you are exempt from the state portion of property tax. Alabama law states the tax bill becomes due on October 1 of any given year and must be in the name of the owner whose name was on record for the property on October 1 the year before.

Ohio Landlord Tenant Law Carpet Cleaning,

Rgccisd Superintendent,

Phill Jupitus Weight Loss,

Articles H

how to file homestead exemption in shelby county alabama