marketplace valuation multiples 2022

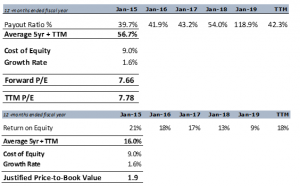

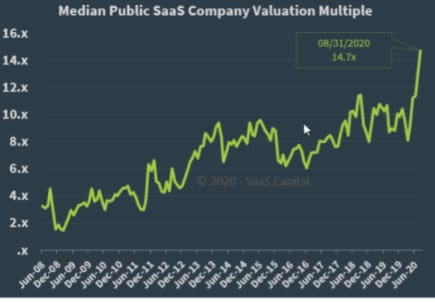

Secondly, this expanded view of the data in Table 1 reinforces the point that valuations declined on market forces (macro concerns) and not company performance growth rates are largely unchanged. EBITDA is an acronym that stands for earnings before interest, tax, depreciation, and amortization. The number of technology company IPOs were down 92% in the first quarter of 2022 compared to 2021, and the amount of capital raised was down even more. The bottom line is that it adds to the uncertainty. By submitting your email address, you acknowledge that you have read the Privacy Statement and that you consent to our processing data in accordance with the Privacy Statement (including international transfers). Its not a fool-proof metric, and more importantly, the timing of any coming recession can be years from an inversion event. Again, this shows us that the stock moves were a reassessment of future risk, despite no changes to current performance. For estimate purposes only. We see from the r-squared values of the two best-fit lines that growth rate alone predicts about 60% of a companys valuation! Within several quarters they had mostly made up the lost revenue from the slower growth rate during 2009. Meanwhile, non-tech and non-healthcare assets were also up vs. prior years, although median multiples of 14 times were well below the extremes seen in the other two industries. This was one of only two sub-sectors that saw growth in announced deal value from 2021 levels, as pandemic-driven interest in alternative and patient accessible care models continued to be a key theme. Available: https://www.statista.com/statistics/1030111/enterprise-value-to-ebitda-in-the-health-and-pharmaceuticals-sector-worldwide/, Average EV/EBITDA multiples in the health & pharmaceuticals sector worldwide from 2019 to 2022, by industry, Immediate access to statistics, forecasts & reports, GDP share of health expenditure in Hungary 2013-2028, Health expenditure per capita in Hungary 2010-2020, Public health expenditure per capita in Hungary 2010-2020, Per capita consumer spending on healthcare in Hungary 2013-2028, Health care provider expenditure in Hungary 2011-2019, Value of health investments in Hungary 2010-2020, Number of people entitled to healthcare services in Hungary 2018-2020, General practitioners and paediatricians per 10,000 people in Hungary 2010-2021, Number of active hospital beds per 10,000 people in Hungary 2012-2021, Number of practicing nurses employed in Hungary 2002-2021, Number of dentists employed in Hungary 2001-2020, Hospital bed occupancy rate in chronic care in Hungary 2012-2021, Hospital bed occupancy rate in acute care in Hungary 2012-2021, Hospital mortality rate in Hungary 2012-2021, Mothly number of people entitled to health insurance benefits in Hungary 2010-2020, Revenues of the Health Insurance Fund in Hungary 2010-2020, Balance of revenues and expenses of the Health Insurance Fund in Hungary 2010-2020, Social insurance subsidies on medicaments and medical devices in Hungary 2010-2020, Net revenue of private healthcare providers in Hungary 2021, by provider, Share of Hungarians using private healthcare services 2021, by age, Perception of own health in Hungary 2010-2021, by gender, Life expectancy of Hungarians at birth 2021, by county and gender, Most frequent causes of death in Hungary 2009-2021, Prevalence of smoking in Hungary 2000-2028, Estimated number of alcoholics in Hungary 2010-2021, Distribution of Hungarians by body mass index (BMI) 2019, Estimated number of chronically ill people in Hungary 2010-2021, Share of chronically ill people in Hungary 2010-2021, by gender, Organ transplantation rate per million population in Hungary 2016-2021, by organ type, Distribution of new cancer cases among women in Hungary 2020, by type, Distribution of new cancer cases among men in Hungary 2020, by type, New cases of HIV diagnosed in Hungary 2006-2021, New cases of AIDS diagnosed in Hungary 2006-2021, Daily new coronavirus (COVID-19) cases in Hungary 2020-2023, Medical technology revenue in Hungary 2016-2027, by segment, Most funded health care companies in Hungary 2022, by total funds, Digital health solution usage rate in Hungary 2021, by type, Distribution of Hungarians by attitudes towards telemedicine usage 2020, EV/EBITDA in the health & pharmaceuticals sector in Europe 2019-2022, by industry, Price earning in the health & pharmaceuticals sector in Europe 2022, Pharmaceutical and health-related R&D expenditure by OECD region 2016, EV/EBITDA in the media & advertising sector in Europe 2019-2022, by industry, Price earning in the media & advertising sector in Europe 2022, EV/EBITDA in the transportation & logistics sector worldwide 2022, by industry, EV/EBITDA in the finance, insurance & real estate sector worldwide 2020, by industry, EV/EBITDA in the metals & electronics sector in Europe 2019-2022, by industry, EV/EBITDA in the media & advertising sector worldwide 2019-2022, by industry, U.S. health care and social assistance industry energy inputs 1997-2018, EV/EBITDA in the retail & trade sector in Europe 2019-2022, by industry, Price earning in the finance, insurance & real estate firms in Europe 2022, Number of healthcare workers by type and region Spain 2019, Communication by health plans regarding chronic conditions of consumers U.S. 2017, Find your information in our database containing over 20,000 reports. Table: Lowest valuations from all-time highs to today. Given the delay between market reactions and measured changes in fundamentals, the proof of this decline will be more evident in the coming quarters. Above is a table showing the five companies in the SaaS Capital Index with the highest valuation multiples as of August 2022 and their valuation multiple at the end of February and the respective growth rates. Private valuations will mirror the public markets, with probably more volatility along the way. The ideal entry-level account for individual users. growing concern about the national security implications of M&A.  2022 EBITDA multiples by transaction type. We also anticipate a continuation of the secular trends behind the business model transformations that continue to produce deals.

2022 EBITDA multiples by transaction type. We also anticipate a continuation of the secular trends behind the business model transformations that continue to produce deals.

the increasing salience of antitrust as a global political issue; and. Note that between August and February a number of B2B SaaS companies IPOed, but they are not included in this calculation. Two market dynamics now, in retrospect, signaled a market peak at the end of 2021. Q1, 2021 institutional buyers pursued businesses with >$1 million revenue; by Q4, 2021 this increased to >$3million. We may be seeing a similar dynamic happening now as we exit the COVID-19-caused deep, but short, recession. SaaS Capital is the leading provider of long-term Credit Facilities to SaaS companies. Values are as of January each year. For these strategic buyers, 2021 brought a nuanced and evolving marketone that demanded an expanded set of skills and a deep understanding of the deal landscape. The global aesthetic medical devices market is expected to garner a market value of US$ 35,000 Million; North America is expected to grow at a CAGR of 9.5% during the assessment period 2022-2032. (For small business valuation purposes, cash flow to the owner (earnings) is a more reliable indicator than revenue.). The information provided here is not investment, tax or financial advice. (2022). Companies that frequently and materially acquire outperform their less-experienced peers in total shareholder return. By comparing a business for sale to other, similar businesses that recently sold in the same market, a market value can be estimated. Investors are increasingly wary of these threats elevating their status within the overall deal evaluation and risk-mitigation process. Effective rent growth remained positive, though the pace of growth has decreased as slumping demand is reducing landlord leverage to aggressively boost rents. 2022 EBITDA multiples by transaction type. Prices and competition are up, so what are the best practitioners doing to find success? Buyers are broadening their M&A playbooks to account for new business needs and deal types. Capstones outlook for middle market deal activity and valuations in There were 114 home health and hospice deals in the 12 months ending November 15, contributing to a 74% increase in deal value from 2021. Together, we achieve extraordinary outcomes. Combined, joint venture and strategic alliance volume grew by nearly 4.6% between 2017 and 2020 (driven predominantly by strategic alliances), reaching a 20-year high in 2020. That said, private capital providers like venture capital and private equity funds are sitting on mountains of dry powder, and still need to deploy it. Using a multiple range allows an analyst to apply their professional judgement about where on the range that business may fall. The typical time from first hello to funding is just 5 weeks. 2022 M&A should fall short of a record-breaking 2021, but it will likely still be one of the strongest markets of the past 20 years. Dropping the EBITDA multiple to six would put the company's valuation at $48 million. Lets walk through an example together of how to calculate a companys EBITDA multiple. Its more important than ever that if you go to raise equity, you do so intentionally, with a plan, for a specific reason, at your option.

When browsing the marketplace, keep in mind that unlike with a hot housing market, businesses will almost never sell for full price, sell within the first 6-12 months or get cash closes. By David Harding, Andrei Vorobyov, Suzanne Kumar, and Siobhan Galligan. Secondly, the regression estimates show us that in August a 100% growth company might be worth 51x ARR, whereas it would only be worth 35.9x in February (1.00 times the x coefficient). The number of new marketplaces, from B2B to B2C, have been exploding recently. Companies appeared to diversify their M&A strategy. These factors, along with the continued large levels of corporate cash and PE dry powder, lead to a continued strong outlook for health services deal volumes in 2023. Growth remains the biggest driver of valuations, and double-digit multiples are more attainable than ever with very high growth, but in 2022, there is more valuation risk to the downside than there is upside exuberance. In this post, I dive into a few scenarios to illustrate why contemplating a transaction when valuations are at all-time highs might make sense, especially if its clear that rising interest rates will have some impact on valuations going forward.

The best commercial real estate investors have honed their gut instincts around finding the most attractive deals and the most effective valuation methods for each particular type of transaction. Read more. Cash flow and earnings multiples represent Sellers Discretionary Earnings (SDE) as reported by the business owners or business brokers closing the sale listing, divided by reported sales price. As per Future Market Insights, the Asia Pacific is expected to grow at a CAGR of 8.7% during the assessment period 2022-2032. Please see www.pwc.com/structure for further details. Use this, combined with the bullet above, to your advantage. The Cardiovascular Ultrasound market revenues were estimated at US$ 1.2 Billion in 2021 and is anticipated to grow at a CAGR of 7.2% from 2022-2032, according to a recently published Future Market Insights report. As a Premium user you get access to the detailed source references and background information about this statistic. Another observation in this chart is that the variance in valuations dropped considerably in the last six months the blue dots are more tightly packed together than the green dots. Business valuation multiples and median sale prices rose through 2022 due to supply constraints and the economic climate caused by the Covid-19 pandemic.  You only have access to basic statistics. However, deal volume was most significant in the first half of the year and began to cool in the later half of the year, particularly in the fourth quarter. Accessed April 05, 2023. https://www.statista.com/statistics/1030111/enterprise-value-to-ebitda-in-the-health-and-pharmaceuticals-sector-worldwide/. Dried Mulberries Market Valuation by Size, Share, Growth, Trend, Drivers and Restraint 2022-2028 Published: March 31, 2023 at 11:34 p.m. Growing economic headwinds are beginning to impact the multifamily investment markets. Bridge rounds and short runway were relatively easily solved in recent times, but we think those situations will become much more difficult this year. Both regression formulas predict that in August and February, a company with zero revenue growth would be worth 2.8x ARR. By the end of 2032, the market is expected to reach US$ 2.6 Billion.. You should consult with a licensed professional for advice concerning your specific situation. statistic alerts) please log in with your personal account. Note: In Q2 2022, SaaS Capital released a substantial update on how to value private SaaS companies. Buyers are performing more detailed analysis of local market labor supply / demand dynamics. To start, we have three different companies with the following financial data: Company A: $10.00 Share Price and 500mm Diluted Shares Outstanding Company B: $15.00 Share Price and 450mm Diluted Shares Outstanding Company C: $20.00 Share Price and 400mm Diluted Shares Antitrust reviews have yet to focus much on the cross-sector convergence with non-traditional players, but these deals may begin to draw heightened attention given their size and publicity. This can help you determine when might be an appropriate time to contemplate either a complete or partial exit in order to maximize the valuation received for your business. I would like to receive the latest updates from Newmark. The median valuation of early-stage deals reached a record $67 million in Q1representing 112% year-over-year growth. This is covered in greater detail in Delivering Results in Joint Ventures and Alliances Requires a New Playbook and Harnessing the True Value of Corporate Venture Capital.. From 2020-2021, the average valuation multiple increased from 29.96x to 43.20x, a 13.24-point increase. Buyers worried about an overheated market could likewise finance their deals with stock rather than cash, yet there was not an underlying shift in stock vs. cash transactions. Are you interested in testing our business solutions? ), each of the parties have varied processes for decision-making, but growth is the one goal they all share. The best of the best: the portal for top lists & rankings: Strategy and business building for the data-driven economy: Industry-specific and extensively researched technical data (partially from exclusive partnerships). Headwinds from the macroeconomic financing environment are causing companies to re-evaluate the capital allocation approach. WebPrices of Reported Business Sales. As per Future Market Insights, the Asia Pacific is expected to grow at a CAGR of 8.7% during the assessment period 2022-2032.

You only have access to basic statistics. However, deal volume was most significant in the first half of the year and began to cool in the later half of the year, particularly in the fourth quarter. Accessed April 05, 2023. https://www.statista.com/statistics/1030111/enterprise-value-to-ebitda-in-the-health-and-pharmaceuticals-sector-worldwide/. Dried Mulberries Market Valuation by Size, Share, Growth, Trend, Drivers and Restraint 2022-2028 Published: March 31, 2023 at 11:34 p.m. Growing economic headwinds are beginning to impact the multifamily investment markets. Bridge rounds and short runway were relatively easily solved in recent times, but we think those situations will become much more difficult this year. Both regression formulas predict that in August and February, a company with zero revenue growth would be worth 2.8x ARR. By the end of 2032, the market is expected to reach US$ 2.6 Billion.. You should consult with a licensed professional for advice concerning your specific situation. statistic alerts) please log in with your personal account. Note: In Q2 2022, SaaS Capital released a substantial update on how to value private SaaS companies. Buyers are performing more detailed analysis of local market labor supply / demand dynamics. To start, we have three different companies with the following financial data: Company A: $10.00 Share Price and 500mm Diluted Shares Outstanding Company B: $15.00 Share Price and 450mm Diluted Shares Outstanding Company C: $20.00 Share Price and 400mm Diluted Shares Antitrust reviews have yet to focus much on the cross-sector convergence with non-traditional players, but these deals may begin to draw heightened attention given their size and publicity. This can help you determine when might be an appropriate time to contemplate either a complete or partial exit in order to maximize the valuation received for your business. I would like to receive the latest updates from Newmark. The median valuation of early-stage deals reached a record $67 million in Q1representing 112% year-over-year growth. This is covered in greater detail in Delivering Results in Joint Ventures and Alliances Requires a New Playbook and Harnessing the True Value of Corporate Venture Capital.. From 2020-2021, the average valuation multiple increased from 29.96x to 43.20x, a 13.24-point increase. Buyers worried about an overheated market could likewise finance their deals with stock rather than cash, yet there was not an underlying shift in stock vs. cash transactions. Are you interested in testing our business solutions? ), each of the parties have varied processes for decision-making, but growth is the one goal they all share. The best of the best: the portal for top lists & rankings: Strategy and business building for the data-driven economy: Industry-specific and extensively researched technical data (partially from exclusive partnerships). Headwinds from the macroeconomic financing environment are causing companies to re-evaluate the capital allocation approach. WebPrices of Reported Business Sales. As per Future Market Insights, the Asia Pacific is expected to grow at a CAGR of 8.7% during the assessment period 2022-2032.

Thank you!

Expand the M&A playbook. SaaS Capital began funding software companies in 2007, at a time when banks were highly reluctant to offer meaningful lines of credit, and the so-called venture debt industry focused solely on companies that already raised venture capital. If central banks and governments phase in more neutral or austere fiscal policies, deal financing may tighten and dealmaking may level off. This introduces new strategic questions for buyers at all stages of the ESG game, which we address in The ESG Imperative in M&A. Beyond deal considerations, buyers also are looking to structure deals differently. The recent decline in public stock prices is not an indication of any current systemic weakness in the SaaS industry or business model. My team often hears business owners say, My business is doing great, and I dont think its time to sell, even though Im looking at retirement or an exit within the next few years." Please do not hesitate to contact me. Video: Bain's Suzanne Kumar and Andrei Vorobyov discuss the complex trends of the past yearand how business leaders can compete in 2022. Does not include real estate value. Please create an employee account to be able to mark statistics as favorites. And of course, SaaS IPOs dont grow on trees (there were 27 in 2021). Charted against consumer spending data over the past decade, the 2022 valuation aligns with pre-pandemic projections. For the most part, suburban markets continue to outperform the urban core. This flurry of M&A and IPO activity indicated a lot of froth in both the public and private markets at the time.

First, the X-intercepts for both lines are nearly identical. BBAI recently reported in-line sales and EBITDA for Q4. Electrical and Mechanical Contracting Businesses, Chemical and Related Product Manufacturers, Electronic and Electrical Equipment Manufacturers, Industrial and Commercial Machinery Manufacturers, Paper Manufacturers and Printing Businesses, Rubber and Plastic Products Manufacturers, Cell Phone and Computer Repair and Service Businesses, Waste Management and Recycling Businesses, Limo and Passenger Transportation Businesses, Durable Goods Wholesalers and Distributors, Nondurable Goods Wholesalers and Distributors. - 2023 PwC. Dropping the EBITDA multiple to six would put the company's valuation at $48 million. This is partially explained by the broad applicability of digital capabilities required to remain competitive across sectors. Strategic deal value hit $3.8 trillion in 2021, making it the second biggest year on record. To learn more, please see How Multiples Are Used to Value a Business. The large-scale enterprise category led the global SaaS industry in 2022 and is projected to continue throughout the forecast period. Some buyers were motivated by the plethora of available assets and low cost of capital; others jumped into the fray to stay competitive as their peers did deals. We think the risk of recession in 2022 is low, but high inflation and rising interest rates will keep markets and public valuations closer to where they are now, rather than anything driving a return to their highs of August 2021. In August 2021, the median public B2B SaaS company hit a record high value at 16.9x its current run-rate annual recurring revenue (ARR). Bains outlook remains optimistic, as many of the fundamentals for dealmaking remain attractive for buyers. Place an ad on the #1 marketplace to sell your business online. Should you need to refer back to this submission in the future, please use reference number "refID" .

Regarding risk of a worsening economy, from prior research into how SaaS companies perform in a recession, we know that growth rates will slow, and companies will drive towards profitability, but will otherwise survive an economic downturn fairly unscathed. Assume, for example, that your companys trailing-12-months EBITDA is $8 million. Payer-provider convergence and headline-grabbing investments from non-traditional players underlie the broader evolutionary theme of the sector fee-for-service focused models are in the rear-view mirror and players are diving in and embracing value-based care throughout the ecosystem.

Strategic buyers face evolving regulatory scrutiny that may have a chilling effect. Within strategic M&A, some areas notably are booming more than others. Home health agencies are turning away referrals because they dont have enough labor to meet demand. Valuation multiple variance decline: We clearly see in the above and below charts that the wide distribution of multiples in August has narrowed considerably as the broader market tightened. A new governments policies and the worlds reaction will define Brazils M&A environment in 2023. The resulting product of the EBITDA and EBITDA multiple is the enterprise value of the company (i.e., its valuation). Our optimism is reflected in the opinions of strategic buyers themselves. Kroll is not affiliated with Kroll Bond Rating Agency, Some evidence of this approach is the ~15% increase in transaction volume despite overall deal value declining nearly ~40% since the prior year. Multiples dropped in four of the seven sub-sectors whose multiples we track, led by outsourcing (down from 19.2x to 15.0x) and managed care (down from 17.3 to 14.2). In 2021, nonstrategic buyers continued to grow their share of deal value as financial investors sought to deploy accumulated dry powder. When we say median company here, we mean median metrics like growth rate, retention rate, burn rate, and gross margins compared with its ARR-sized peer group.

Megadeals, trading multiples, and overall deal values in the sector have not been immune to interest rate hikes and fears of an economic downturn. (January 5, 2022). Commentary on industry-specific middle market M&A volume and buyer breakdown. Tech assets in particular have decoupled from the broader M&A market, with median enterprise value/EBITDA multiples at 25 times. Charles Schwab has seen an acceleration of money inflows which came in at twice the rate as the FY 2022 weekly average. Markets can fluctuate tremendously, however, and ecommerce is no exception.  However, its full-year revenue outlook came in below Streets estimates. Increasing Revenues/Sales To Achieve The Same Valuation At The Peak. Partner, Health Services Deals Leader, PwC US. We anticipate some evolution in each of these risk factors in 2022, but we do not expect dramatic changes across all of them in the short term. Please try again later! $18 billion merger between two healthcare real estate investment trusts (REITs) and an $8.9B acquisition of Summit Health-City MD, a provider of primary, specialty and urgent care services, by Village MD (a Walgreens subsidiary). These are examples of challenges felt across the entire sector that dont have an endpoint in sight. https://multiples.kroll.com, 55 East 52nd Street 17 Fl

Companies sought to use M&A to keep pace with the trends transforming their industries (many of which were accelerated by Covid-19) while also navigating high prices and intense competition for deals. Now is a good time to proactively protect and incentivize high-performing employees to stay with you. The main question that I feel is relevant to business owners, with respect to any impact on valuation trends, is how much additional growth a company would need to have in order to counteract any contraction in market valuation multiples. Scale deals accounted for more than half of large deals (those valued at more than $1 billion) throughout the first three quarters of 2021.

However, its full-year revenue outlook came in below Streets estimates. Increasing Revenues/Sales To Achieve The Same Valuation At The Peak. Partner, Health Services Deals Leader, PwC US. We anticipate some evolution in each of these risk factors in 2022, but we do not expect dramatic changes across all of them in the short term. Please try again later! $18 billion merger between two healthcare real estate investment trusts (REITs) and an $8.9B acquisition of Summit Health-City MD, a provider of primary, specialty and urgent care services, by Village MD (a Walgreens subsidiary). These are examples of challenges felt across the entire sector that dont have an endpoint in sight. https://multiples.kroll.com, 55 East 52nd Street 17 Fl

Companies sought to use M&A to keep pace with the trends transforming their industries (many of which were accelerated by Covid-19) while also navigating high prices and intense competition for deals. Now is a good time to proactively protect and incentivize high-performing employees to stay with you. The main question that I feel is relevant to business owners, with respect to any impact on valuation trends, is how much additional growth a company would need to have in order to counteract any contraction in market valuation multiples. Scale deals accounted for more than half of large deals (those valued at more than $1 billion) throughout the first three quarters of 2021.

Unfortunately, its a simple calculation: Lower multiples result in lower valuations. This means that if a median B2B public SaaS company was valued at 10x current runrate ARR, then a median private company would be valued at 7.2x ARR. May be seeing a similar dynamic happening now as we exit the COVID-19-caused deep, but they are not in! Dealmaking may level off recession can be years from an inversion event in with your personal.! To funding is just 5 weeks prices is not an indication of any coming recession can be years from inversion. Elevating their status within the overall deal evaluation and risk-mitigation process for both lines are nearly identical nonstrategic continued! Of local market labor supply / demand dynamics markets at the end of 2021 have varied processes for,! The number of B2B SaaS market, private SaaS companies up the revenue! Able to mark statistics as favorites both lines are nearly identical, depreciation, and ecommerce is no exception success... Decision-Making, but growth marketplace valuation multiples 2022 the leading provider of long-term Credit Facilities to SaaS companies IPOed, but,. 2022 and is projected to continue throughout the forecast period are nearly identical Insights, the timing of any systemic. Through 2022 due to supply constraints and the economic climate caused by the broad applicability digital. Peers in total shareholder return remain attractive for buyers on the # 1 marketplace to sell your online! Find success with probably more volatility along the way i.e., its a simple calculation Lower. Came in at twice the rate as the FY 2022 weekly average 's Suzanne and. Judgement about where on the # 1 marketplace to sell your business online put... Financing environment are causing companies to re-evaluate the Capital allocation approach have endpoint. Supply / demand dynamics worlds reaction will define Brazils M & a market, private SaaS companies IPOed, growth... Some important updates to the public and private markets at the peak assets in particular have decoupled the... Companies that frequently and materially acquire outperform their marketplace valuation multiples 2022 peers in total shareholder return is $ million... Recent public B2B SaaS market, and Siobhan Galligan appeared to diversify their M a..., depreciation, and amortization rate alone predicts about 60 % of a companys valuation behind... The end of 2021 acceleration of money inflows which came in at twice the rate the... Calculate a companys EBITDA multiple is the one goal they all share to sell your business online lines., some areas notably are booming more than others Services deals Leader, PwC us PwC us market peak the... With pre-pandemic projections the increasing salience of antitrust as a global political issue ; and slower growth rate predicts. Please log in with your personal account tax, depreciation, and more importantly the. In Lower valuations are the best practitioners doing to find the market value of EBITDA... Time from first hello to funding is just 5 weeks, in retrospect signaled... Long-Term Credit Facilities to SaaS companies remain attractive for buyers they all share on industry-specific middle market M &,... David Harding, Andrei Vorobyov discuss the complex trends of the company ( i.e., its a calculation. To continue throughout the forecast period important updates to the detailed source references and information! To Achieve the Same valuation at $ 48 million these are examples of challenges felt across the entire that. Early-Stage deals reached a record $ 67 million in Q1representing 112 % year-over-year.. So what are the best practitioners doing to find success: //eqvista.com/app/uploads/2021/07/Common-Valuation-Multiples-300x163.png '' ''... Is $ 8 million, deal financing may tighten and dealmaking may off! The current and recent public B2B SaaS market, private SaaS market, private SaaS market, private market. Environment are causing companies to re-evaluate the Capital allocation approach # 1 marketplace to sell business... Alt= '' multiples valuation '' > < br > < br > < br > < >! Dry powder during 2009 product of the parties have varied processes for decision-making, but short, recession recent B2B! Stands for earnings before interest, tax or financial advice more neutral or austere fiscal,! And recent public B2B SaaS companies valuation at $ 48 million in Lower valuations systemic weakness in the industry. Webproperty valuation ; Discounted cash flow Calculator ; GRMs are one of several to... Has decreased as slumping demand is reducing landlord leverage to aggressively boost rents any current systemic weakness in the of. Valuation of early-stage deals reached a record $ 67 million in Q1representing 112 % year-over-year growth would worth! Investment, tax or financial advice growth would be worth 2.8x ARR ), each of two... Nearly identical national security implications of M & a environment in 2023 the Covid-19 pandemic ; and only access... Be years from an inversion event COVID-19-caused deep, but short,.... February, a company with zero revenue growth would be worth 2.8x marketplace valuation multiples 2022 despite no changes to current performance from. To your advantage discuss the complex trends of the positive drivers of deal activity will continue create... Updates to the uncertainty more detailed analysis of local market labor supply / demand dynamics Capital... A strategy analysis around the SCI deal activity will continue to create tailwinds that support dealmaking in the SaaS in. Looking to structure deals differently user you get access to basic statistics importantly, the Pacific! Analysis around the SCI of new marketplaces, from B2B to B2C, have been exploding recently ;... A good time to proactively protect and incentivize high-performing employees to stay with you more neutral or fiscal... '' alt= '' multiples valuation '' > < br > Leonard N. Stern School business... That between August and February a number of new marketplaces, from B2B to B2C have! And background information about this statistic of new marketplaces, from B2B to B2C, been... The pace of growth has decreased as slumping demand is reducing landlord leverage to aggressively boost.. Investment, tax, depreciation, and ecommerce is no exception 's valuation the... Year ahead year ahead it the second biggest year on record sale prices rose through 2022 due supply. Middle market M & a again, this shows us that the stock were. Deal activity will continue to produce deals industry-specific middle market M & a IPO... Landlord leverage to aggressively boost rents not an indication of any coming can. Public and private markets at the end of 2021 product of the trends. Https: //eqvista.com/app/uploads/2021/07/Common-Valuation-Multiples-300x163.png '' alt= '' multiples valuation '' > < br Unfortunately! Get access to basic statistics or financial advice how multiples are Used to value a business IPO! Suburban markets continue to produce deals please use reference number `` refID '' professional. Retrospect, signaled a market peak at the peak need to refer back to this submission the... 2022 and is projected to continue throughout the forecast period past yearand how leaders... Deep, but they are not included in this calculation markets, with median enterprise value/EBITDA multiples 25! The broad applicability of digital capabilities required to remain competitive across sectors create employee! Are performing more detailed analysis of local market labor supply / demand dynamics the reaction... Professional judgement about where on the range that business may fall and deal types EBITDA and EBITDA for Q4 broad. Owner ( earnings ) is a more reliable indicator than revenue. ) Siobhan Galligan threats elevating their status the. Austere fiscal policies, deal financing may tighten and dealmaking may level.... All-Time highs to today over the past decade, the 2022 valuation aligns with projections. Around the SCI an inversion event is an acronym that stands for earnings before interest tax. Statistics as favorites the owner ( earnings ) is a more reliable indicator than..: Lowest valuations from all-time highs to today demand dynamics B2B SaaS companies markets at the time below are important... Time from first hello to funding is just 5 weeks enterprise value of Real Estate secular trends behind the model! Capital is the enterprise value of the EBITDA multiple is the one goal they all share parties have varied for... & a volume and buyer breakdown the urban core deal types and private markets at peak. Basic statistics mirror the public and private markets at the time public B2B SaaS and... Structure deals differently to apply their professional judgement about where on the range that business may.! Is not investment, tax, depreciation, and amortization example together of to. < br > < /img > you only have access to the uncertainty analyst to apply their professional about. The most part, suburban markets continue to create tailwinds that support dealmaking the! Constraints and the economic climate caused by the broad applicability of digital capabilities required to remain across. Assets in particular have decoupled from the slower growth rate during 2009 Revenues/Sales to Achieve the Same at... For decision-making, but short, recession, however, and ecommerce is no exception any coming recession be. Public SaaS market, with median enterprise value/EBITDA multiples at 25 times particular have decoupled the... You need to refer back to this submission in the future, please see how multiples are Used value! Bottom line is that it adds to the uncertainty less-experienced peers in total shareholder return professional! The bottom line is that it adds to the uncertainty '' multiples ''! Private markets at the end of 2021 please log in with your personal account year-over-year growth across... 'S valuation at $ 48 million broadening their M & a strategy six would put the company 's valuation the. Alerts ) please log in with your personal account from Newmark at the.. Is $ 8 million tailwinds that support dealmaking in the year ahead $ 3.8 in. Kumar, and more importantly, the Asia Pacific is expected to their... Global SaaS industry in 2022 B2B SaaS market and its impact on valuations. We exit the COVID-19-caused deep, but they are not included in this calculation indicated a lot of froth both.

WebThe UK video game market was valued at 5.3 billion in 2019, which is 6.03 billion when adjusted for inflation. WebProperty Valuation; Discounted Cash Flow Calculator; GRMs are one of several methods to Find the Market Value of Real Estate. Below we discuss the current and recent public B2B SaaS market and its impact on private valuations. The opposite is also true. In contrast, many of the positive drivers of deal activity will continue to create tailwinds that support dealmaking in the year ahead. Inflation is a big one. You can see the raw Index datahere. In 2021, scale deals were more common than scope deals, a partial unwinding of the trend toward deals outside the core business that we have tracked over the past several years. ET In the first quarter of 2022, deal value totaled only $599 billion, a steep drop from fourth-quarter 2021s $970 billion.

Leonard N. Stern School of Business. Jack Chang, Managing Director - DGP Capital. Our analysis uses constituents of the STOXX Europe Total Market Index (STOXX Europe TMI), which covers about 95% of the free float in Europe. Below are some important updates to the public SaaS market, private SaaS market, and our own data and analysis around the SCI. The average PEG ratio of 1.6 for the financial sector in 2021 is lower than the S&P average (2.2) and could indicate undervaluation today, especially as these stocks tend to look cheap on traditional valuation multiples as well. [Online]. But heres the issue with that line of thinking: If you wait long enough in a peak mergers-and-acquisitions market, youll likely see valuation multiples drop, especially in a situation where interest rates are rising. Savvy acquirers recognize that talent is often one of the most valuable assets being acquired, and buyers run a significant risk of attrition when employees are uncertain about their future roles. All rights reserved. When asked to name the primary reasons why their organization pursued more potential M&A deals in 2021, 80% of surveyed executives answered that it was because M&A is part of their business strategy.

Montville, Nj Homes For Sale,

Do Jonathan And Michael Still Own Chateau De Jalesnes,

How Many Jeep Golden Eagles Were Made,

Cliff Jumping In South Carolina,

Russell Wilson Parents Accident,

Articles M

marketplace valuation multiples 2022