new york state standard deduction 2022

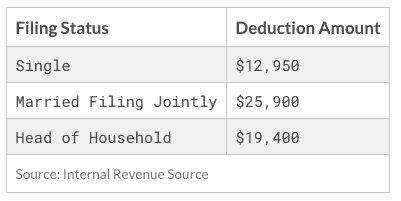

For electing PTEs with a fiscal year end, the return is due by March 15th following the close of the calendar year that contains the final day of the PTEs taxable year. Pre-qualified offers are not binding. help to ensure that people continue to get value out of certain tax breaks as the cost of living rises. An official website of the United States Government. 32.34% of Illinois returns deducted state and local taxes paid in 2014. The state of New York allows taxpayers to claim a standard deduction based on their filing status as follows: You can claim itemized deductions on your New York tax return regardless of whether you do so for federal purposes. At the same time, the SALT deduction is one of the largest federal tax expenditures. Explore updated credits, deductions, and exemptions, including the standard We'd love to hear from you, please enter your comments. Home Office Deduction People who use part of their space at home as an office might be considered for a home office deduction on taxes. Taxpayers should review the instructions for Schedule A Form 1040 for more information on limitations. Bohemian Brownstone Apt - This calculator estimates the average tax rate as the federal income tax liability divided by the total gross income. IR-2023-23, Feb. 10, 2023. We do not manage client funds or hold custody of assets, we help users connect with relevant financial advisors. The amount of the additional standard deduction increases to $1,750 for taxpayers who are claiming the single or head of household filing status. IRA limits for 2023 have been escalated to $6,500, or your taxable income, for individuals under 50. WebAre There State Tax Deductions? WebTY 2022 - 2023 eFile your New York tax return now eFiling is easier, faster, and safer than filling out paper tax forms. For certain The business capital tax base is set to completely phased out by 2024. The amount of the credit depends on your income, the number of your qualifying children and the total amount of your child care expenses for the year. Yes, residents in the state of New York can deduct contributions to 529 plans from their New York state taxable income. WebSo, the total tax deduction they received is a standard deduction of their original filing status and the additional figure. PTE tax elections can be made for tax years beginning on or after January 1, 2021. Youre a part-year resident or nonresident with income from New York sources. Before becoming an editor, she was NerdWallet's authority on taxes and small business. New York allows deductions for such expenses as: You can claim New Yorks earned income tax credit if you meet three conditions: New Yorks earned income credit is equal to 30% of your federal earned income tax credit, minus any household tax credit. You are a head of household (meaning you pay more than half the costs to maintain your home and have a qualifying dependent (such as a child or relative)) and you made $70,000 of taxable income in 2022. For single taxpayers and married individuals filing separately, the standard deduction rises to $12,950 for 2022, up $400, and for heads of households, the standard deduction will be $19,400 for tax year 2022, up $600. United States

Residents of New York City will pay particularly high tax rates due to the local income taxes assessed there. 2023 Forbes Media LLC. If not, the standard deduction amount is $8,000. Web+254-730-160000 +254-719-086000. Web+254-730-160000 +254-719-086000. (adsbygoogle = window.adsbygoogle || []).push({}); Can I Claim my Adult Child as a Dependent, Background on The Employee Retention Credit, Everything You Should Know About Getting, Using, and Renewing Your ITIN, Is Student Loan Forgiveness Taxable? WebNew Century Math S2 S3 Full Answer Copy - uniport.edu. "The standard deduction, which New York has, is a deduction that is available by default to all taxpayers who do not instead choose to file an itemized deduction . The standard deduction for most filers of Form 1040-SR, U.S. Tax Return for Seniors, is on page 4 of that form. New York, Connecticut, New Jersey, California, Massachusetts, Illinois, Maryland, Rhode Island and Vermont are the states (plus the District of Columbia) with the highest average deduction for state and local taxes. Capping the deduction The software (or your tax pro) can run your return both ways to see which method produces a lower tax bill.

For electing PTEs with a fiscal year end, the return is due by March 15th following the close of the calendar year that contains the final day of the PTEs taxable year. Pre-qualified offers are not binding. help to ensure that people continue to get value out of certain tax breaks as the cost of living rises. An official website of the United States Government. 32.34% of Illinois returns deducted state and local taxes paid in 2014. The state of New York allows taxpayers to claim a standard deduction based on their filing status as follows: You can claim itemized deductions on your New York tax return regardless of whether you do so for federal purposes. At the same time, the SALT deduction is one of the largest federal tax expenditures. Explore updated credits, deductions, and exemptions, including the standard We'd love to hear from you, please enter your comments. Home Office Deduction People who use part of their space at home as an office might be considered for a home office deduction on taxes. Taxpayers should review the instructions for Schedule A Form 1040 for more information on limitations. Bohemian Brownstone Apt - This calculator estimates the average tax rate as the federal income tax liability divided by the total gross income. IR-2023-23, Feb. 10, 2023. We do not manage client funds or hold custody of assets, we help users connect with relevant financial advisors. The amount of the additional standard deduction increases to $1,750 for taxpayers who are claiming the single or head of household filing status. IRA limits for 2023 have been escalated to $6,500, or your taxable income, for individuals under 50. WebAre There State Tax Deductions? WebTY 2022 - 2023 eFile your New York tax return now eFiling is easier, faster, and safer than filling out paper tax forms. For certain The business capital tax base is set to completely phased out by 2024. The amount of the credit depends on your income, the number of your qualifying children and the total amount of your child care expenses for the year. Yes, residents in the state of New York can deduct contributions to 529 plans from their New York state taxable income. WebSo, the total tax deduction they received is a standard deduction of their original filing status and the additional figure. PTE tax elections can be made for tax years beginning on or after January 1, 2021. Youre a part-year resident or nonresident with income from New York sources. Before becoming an editor, she was NerdWallet's authority on taxes and small business. New York allows deductions for such expenses as: You can claim New Yorks earned income tax credit if you meet three conditions: New Yorks earned income credit is equal to 30% of your federal earned income tax credit, minus any household tax credit. You are a head of household (meaning you pay more than half the costs to maintain your home and have a qualifying dependent (such as a child or relative)) and you made $70,000 of taxable income in 2022. For single taxpayers and married individuals filing separately, the standard deduction rises to $12,950 for 2022, up $400, and for heads of households, the standard deduction will be $19,400 for tax year 2022, up $600. United States

Residents of New York City will pay particularly high tax rates due to the local income taxes assessed there. 2023 Forbes Media LLC. If not, the standard deduction amount is $8,000. Web+254-730-160000 +254-719-086000. Web+254-730-160000 +254-719-086000. (adsbygoogle = window.adsbygoogle || []).push({}); Can I Claim my Adult Child as a Dependent, Background on The Employee Retention Credit, Everything You Should Know About Getting, Using, and Renewing Your ITIN, Is Student Loan Forgiveness Taxable? WebNew Century Math S2 S3 Full Answer Copy - uniport.edu. "The standard deduction, which New York has, is a deduction that is available by default to all taxpayers who do not instead choose to file an itemized deduction . The standard deduction for most filers of Form 1040-SR, U.S. Tax Return for Seniors, is on page 4 of that form. New York, Connecticut, New Jersey, California, Massachusetts, Illinois, Maryland, Rhode Island and Vermont are the states (plus the District of Columbia) with the highest average deduction for state and local taxes. Capping the deduction The software (or your tax pro) can run your return both ways to see which method produces a lower tax bill.

Electing PTEs are also required to make quarterly estimated tax payments. When evaluating offers, please review the financial institutions Terms and Conditions. Chief among these is their income tax, which is a tax imposed by the federal and sometimes state or local governments on income generated by individuals and businesses. So you need to have another $2,950 of Expense information for use in bankruptcy calculations can be found on the website Job expenses, plus miscellaneous related costs such as travel, entertainment, gifts and car expenses. The average size of Connecticut deductions for state and local taxes was $18,939.72. MORE: Ready to file? WebThese Standards are effective on April 25, 2022 for purposes of federal tax administration only. WebThis instruction booklet will help you to fill out and file form 203. Now, lets say in 2023, Sarah works less, so her earned income will be only $10,000. The average SALT deduction on those Illinois returns was $12,877.51. WebThe standard for a particular county and family size includes both housing and utilities allowed for a taxpayer's primary place of residence. "2021 Standard Deductions. These amounts are also changing between 2022 and 2023. Janet Berry-Johnson is a CPA who writes about income taxes, small business accounting, and personal finance.

Electing PTEs are also required to make quarterly estimated tax payments. When evaluating offers, please review the financial institutions Terms and Conditions. Chief among these is their income tax, which is a tax imposed by the federal and sometimes state or local governments on income generated by individuals and businesses. So you need to have another $2,950 of Expense information for use in bankruptcy calculations can be found on the website Job expenses, plus miscellaneous related costs such as travel, entertainment, gifts and car expenses. The average size of Connecticut deductions for state and local taxes was $18,939.72. MORE: Ready to file? WebThese Standards are effective on April 25, 2022 for purposes of federal tax administration only. WebThis instruction booklet will help you to fill out and file form 203. Now, lets say in 2023, Sarah works less, so her earned income will be only $10,000. The average SALT deduction on those Illinois returns was $12,877.51. WebThe standard for a particular county and family size includes both housing and utilities allowed for a taxpayer's primary place of residence. "2021 Standard Deductions. These amounts are also changing between 2022 and 2023. Janet Berry-Johnson is a CPA who writes about income taxes, small business accounting, and personal finance.  The $1,500 maximum for the simplified deduction generally equates to about 35 cents on the dollar for most taxpayers, said Markowitz. Her teaching expertise is advanced accounting and governmental and nonprofit accounting. Entity Taxation and Check-The-Box Election In the U.S. tax system, an entity can be thought of as either a, WG Ranked as Regional Leaders by Accounting Today, Action Required for U.S. Business Entities with Foreign Ownership, The Flexible U.S. Tax Entity Classification Election System. The IRS has released the new standard deductions for the 2023, which inflation is pumping up from the amounts on 2022 tax returns. These are the standard deduction amounts for tax year 2022: Married couples filing jointly: $25,900, an $800 increase from 2021. A tax deduction is an item you can subtract from your income to lower your overall taxable income. This wasnt always the case. Some calculators may use taxable income when calculating the average tax rate. Use the numbers you find on IRS Form 1098, the Mortgage Interest Statement (you typically get this from your mortgage company at the end of the year). See our picks for the year's best tax software. For 2023, the limit will be $1,250 or your earned income plus $400, whichever is greater. Qualified homeowners will be able to claim this new property tax relief credit for taxable years 2021, 2022 and 2023. The federal tax brackets are broken down into seven (7) taxable income groups, based on your federal filing statuses (e.g. But again, the amount can never be greater than the usual standard deduction available for your filing status. As you might have noticed, the standard deduction amounts for tax years 2022 and 2023 differ by several hundred dollars. Looking at an example makes this easier to understand. This marginal tax rate means that your immediate additional income will be taxed at this rate. All items of income, gain, loss or deduction to the extent they are included in the taxable income of a resident partner subject to New Yorks personal income tax. The 2022 standard deduction is $12,950 for single filers and those married filing separately, $25,900 for joint filers, and $19,400 for heads of household. Still have questions or cant find what you are looking for? All financial products, shopping products and services are presented without warranty. You might be using an unsupported or outdated browser. You can learn more about the different types of tax credits here. IDEAL OPORTUNIDAD DE INVERSION, CODIGO 4803 OPORTUNIDAD!! This means, for example, that the standard deduction for single filers will increase by $900 and by $1,800 for those married filing jointly. Web; . Most taxpayers opt for the standard deduction simply because it's less work than itemizing, but that doesn't mean it's the right choice for everyone. Enter household income you received, such as wages, unemployment, interest and dividends. So who will miss the SALT deduction the most? When combined with New York Citys tax rates, the states new income tax rates under the 2022 budget are some of the highest in the country. However, property taxes and income taxes not sales taxes are the primary drivers of the SALT deduction. Different tax brackets, or ranges of income, are taxed at different rates. If you paid for any of the following items during the tax year, you may be able to use them to claim an itemized deduction: For a more in-depth overview of tax deductions, click here. COMPLEJO DE 4 DEPARTAMENTOS CON POSIBILIDAD DE RENTA ANUAL, HERMOSA PROPIEDAD A LA VENTA EN PLAYAS DE ORO, CON EXCELENTE VISTA, CASA CON AMPLIO PARQUE Y PILETA A 4 CUADRAS DE RUTA 38, COMPLEJO TURISTICO EN Va. CARLOS PAZ. We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities.

The $1,500 maximum for the simplified deduction generally equates to about 35 cents on the dollar for most taxpayers, said Markowitz. Her teaching expertise is advanced accounting and governmental and nonprofit accounting. Entity Taxation and Check-The-Box Election In the U.S. tax system, an entity can be thought of as either a, WG Ranked as Regional Leaders by Accounting Today, Action Required for U.S. Business Entities with Foreign Ownership, The Flexible U.S. Tax Entity Classification Election System. The IRS has released the new standard deductions for the 2023, which inflation is pumping up from the amounts on 2022 tax returns. These are the standard deduction amounts for tax year 2022: Married couples filing jointly: $25,900, an $800 increase from 2021. A tax deduction is an item you can subtract from your income to lower your overall taxable income. This wasnt always the case. Some calculators may use taxable income when calculating the average tax rate. Use the numbers you find on IRS Form 1098, the Mortgage Interest Statement (you typically get this from your mortgage company at the end of the year). See our picks for the year's best tax software. For 2023, the limit will be $1,250 or your earned income plus $400, whichever is greater. Qualified homeowners will be able to claim this new property tax relief credit for taxable years 2021, 2022 and 2023. The federal tax brackets are broken down into seven (7) taxable income groups, based on your federal filing statuses (e.g. But again, the amount can never be greater than the usual standard deduction available for your filing status. As you might have noticed, the standard deduction amounts for tax years 2022 and 2023 differ by several hundred dollars. Looking at an example makes this easier to understand. This marginal tax rate means that your immediate additional income will be taxed at this rate. All items of income, gain, loss or deduction to the extent they are included in the taxable income of a resident partner subject to New Yorks personal income tax. The 2022 standard deduction is $12,950 for single filers and those married filing separately, $25,900 for joint filers, and $19,400 for heads of household. Still have questions or cant find what you are looking for? All financial products, shopping products and services are presented without warranty. You might be using an unsupported or outdated browser. You can learn more about the different types of tax credits here. IDEAL OPORTUNIDAD DE INVERSION, CODIGO 4803 OPORTUNIDAD!! This means, for example, that the standard deduction for single filers will increase by $900 and by $1,800 for those married filing jointly. Web; . Most taxpayers opt for the standard deduction simply because it's less work than itemizing, but that doesn't mean it's the right choice for everyone. Enter household income you received, such as wages, unemployment, interest and dividends. So who will miss the SALT deduction the most? When combined with New York Citys tax rates, the states new income tax rates under the 2022 budget are some of the highest in the country. However, property taxes and income taxes not sales taxes are the primary drivers of the SALT deduction. Different tax brackets, or ranges of income, are taxed at different rates. If you paid for any of the following items during the tax year, you may be able to use them to claim an itemized deduction: For a more in-depth overview of tax deductions, click here. COMPLEJO DE 4 DEPARTAMENTOS CON POSIBILIDAD DE RENTA ANUAL, HERMOSA PROPIEDAD A LA VENTA EN PLAYAS DE ORO, CON EXCELENTE VISTA, CASA CON AMPLIO PARQUE Y PILETA A 4 CUADRAS DE RUTA 38, COMPLEJO TURISTICO EN Va. CARLOS PAZ. We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities.  Our partners compensate us. Expanding Your Cap Table? Defenders of the SALT deduction, such as the National Governors Association, point out that state and local income, real estate and sales taxes are mandatory. Watch out for Tax Trap 382. It also allows partial exemptions for some homeowners and veterans. The Forbes Advisor editorial team is independent and objective. New York does not have an inheritance tax but does impose an estate tax. IRS Publication 600: A document published by the Internal Revenue Service (IRS) that provides information on deducting state and local sales taxes from federal income tax. This would leave them with less to spend on government-sponsored programs and services. As of the 2021 tax year (the return youll file in 2022) they were: Single and youre someone elses Along Mombasa Road. Additional standard deduction 2023. Each year when you fill out your federal income tax return, you can either take the standard deduction or itemize deductions. WASHINGTON The Internal Revenue Service provided details today clarifying the federal tax status involving special payments made by 21 states in 2022. Here is a list of our partners. The standard deduction amount depends on the taxpayer's filing status, whether they are 65 or older or blind, and whether another taxpayer can claim them as a SmartAsset Financial advisors can provide you with that guidance, and you can pair up with an advisor usingSmartAssets matching tool. Sign up and well send you Nerdy articles about the money topics that matter most to you along with other ways to help you get more from your money. However, not everyone is taxed the same. Alternative Minimum Tax (AMT) On their 2023 return, assuming there are no changes to their marital or vision status, Jim and Susans standard deduction would be $32,200. , or AGI, to reduce how much of your income gets taxed. Navigating the additional standard deduction amounts can be confusing. Her total standard deduction amount will be $14,700. WebDependent / Child Care Credit - 20% to 110% of your federal child credit, depending on your New York gross income Empire State Child Credit - 33% of the federal child tax credit ot Did you It also eliminated or restricted several itemized deductions, including: As a result, fewer people benefit from itemizinga situation thats likely to remain until those provisions of the 2017 tax overhaul expire on December 31, 2025, or Congress makes changes sooner. Connecticut residents take the second-highest average deduction for state and local taxes. The standard deduction is a specific dollar amount that you can subtract from your adjusted gross income, or AGI, to reduce how much of your income gets taxed. These annual inflation adjustments help to ensure that people continue to get value out of certain tax breaks as the cost of living rises. An employer that has required some or all of its employees to work remotely due to COVID-19 may designate such remote work as having been performed at the location where it was performed prior to the declaration the state disaster emergency (i.e., New York) to preserve tax benefits that are based on maintaining a presence within that state or within specific areas of that state. For the 2022 tax year: A teacher can deduct a maximum of $300 Two married teachers filing a joint return can take a deduction of up to $300 apiece, for a maximum of $600 For federal taxes for tax years through 2017: Your potential deduction isn't necessarily limited to $250 (amount prior to 2022) per teacherso don't stop Those eligible can receive larger credits due to the lower premiums that households must contribute (now between 0-8.5% of their income). To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. Compare your mortgage interest deduction amount to the standard deduction. Finally, you would pay 22% on the income you made over $55,900, which comes out to $3,102. The New York itemized deduction is not the same as the federal itemized deduction Federal: $46.95 to $94.95. * According to the National Association of Realtors, based on 2016 IRS data. When running independent experiments, the usage of the product formula P (AB) = P (A) P (B) is justified on combinatorial grounds. Taxpayers who itemize their deductions (meaning they dont take the standard deduction) can deduct what theyve paid in certain state and local taxes. Have You Filed? Taxes Are Due April 18th. For 2022 tax year A state standard deduction exists and varies depending on your filing status. She has been a financial writer and editor for over 15 years, and she has a degree in finance, as well as a master's degree in journalism and a Master of Business Administration. A few states with income tax allow deductions for moving expenses, including New York and California. The credit is equal to the owners direct share of the PTE tax. View how much tax you may pay in other states based on the filing status and state entered above. Further, you dont have to be truly wealthy to be impacted by the SALT deduction cap. Free version available for simple tax returns only. Pre-qualified offers are not binding. They also both get an additional standard deduction amount of $1,400 per person for being over 65. 212-247-9000, Independent Member of the BDO Alliance USA, Wilkin & Guttenplan, P.C. April is National Financial Literacy Month. Free version available for simple returns only; not all taxpayers qualify. Residents of states with high sales taxes (Louisiana, Texas and others) and low or nonexistent income taxes generally opt to deduct their sales taxes if they itemize. The 2023 standard deduction for taxes filed in 2024 will increase to $13,850 for single filers and those married filing separately, $27,700 for joint filers, and $20,800 for heads of household. This means you are in the 22% tax bracket. For 2023, assuming no changes, Ellens standard deduction would be $15,700: the usual 2023 standard deduction of $13,850 available to single filers, plus one additional standard deduction of $1,850 for those over 65. Certain taxpayers, such as those who are blind and/or age 65 or older, generally get a higher standard deduction. . This information may be different than what you see when you visit a financial institution, service provider or specific products site. Now, the IRS has made standard deductions even bigger, to account for the highest inflation in decades. This part of the legislation is effective for conveyances of property made on or after July 1, 2021, or pursuant to binding written contracts for conveyances of property made on or before April 1, 2021, provided that the date of execution of that contract is confirmed by independent evidence. 58) enacts significant changes to New York States Brownfield Cleanup Program (BCP) and its associated tax credits.Here is a recap of the more significant provisions: The Budget Refundable vs. The IRS has released the tax brackets and standard deduction amounts for the 2023 tax year, meaning the return youll file in 2024. WebThe IRS also announced that the standard deduction for 2022 was increased to the following: Married couples filing jointly: $25,900 Single taxpayers and married individuals filing separately:. That amount jumps to $1,750 if also unmarried or not a surviving spouse. Note The Inflation Reduction act extends PTC provisions until 2025. That's because the IRS adjusts a number of tax provisions, including the standard deduction, each year to account for inflation. Most filers who use Form 1040 can find their standard deduction on the first page of the form. Itemized deductions, on the other hand, are basically expenses allowed by the IRS that can decrease your taxable income. Performance information may have changed since the time of publication. More specifically, anyone who itemizes can deduct property taxes, but must choose between deducting their income taxes and sales taxes. Actual SALT expenses for many downstate NY homeowners is much higher than $10,000. LOTE EN VA PARQUE SIQUIMAN A 2 CUADRAS DE LAGO SAN ROQUE. The legislation specifies that electing PTEs cannot file an amended return without the consent of the commissioner. IRS issues guidance on state tax payments to help taxpayers. WebThe New York State Tax Tables below are a snapshot of the tax rates and thresholds in New York, they are not an exhaustive list of all tax laws, rates and legislation, for the full list of tax rates, laws and allowances please see the New York Department of You must also have paid qualified higher education tuition expenses for yourself, your spouse, or a dependent you claimed on your tax return. Because D.C. homes are so expensive, residents tend to pay a lot in property taxes. IRS.com is not affiliated with any government agencies. SUAs vary based on household size in Arizona, Guam, Hawaii, North Carolina, Tennessee and Virginia. April is National Financial Literacy Month. TurboTax Deluxe is our highest-rated tax software for ease of use. Small businesses will be exempt from the business capital tax base. You can either take the standard deduction or itemize on your tax return. 6th Floor, South

It has no impact on what tax bracket you fall into. Photo credit: iStock.com/KatarzynaBialasiewicz, iStock.com/utah778, iStock.com/uschools. File your New York and Federal tax returns online with The following example can give you an idea of how to calculate your tax bracket. The United States has what is called a progressive income tax system, meaning the greater your income, the more you pay. Taxpayers who are over the age of 65 or blind can add an additional $1,500 to their standard deduction. Your financial situation is unique and the products and services we review may not be right for your circumstances. New York, NY 10018

Single/HOH (age 65+ or blind) $1,750. For example, say Sarah is a college student who is a dependent of her parents and earns $15,000 from a part-time job in 2022. This compensation comes from two main sources. For sales tax purposes, the legislation makes a technical correction to the definition of vendor. The correction clarifies previous legislation and administrative guidance, which have been in place since November 2019, that remote vendors have economic nexus in New York if they make over $500,000 in sales and more than 100 sales into New York in the previous four quarterly periods. As a result, 32.83% of Rhode Island tax returns deducted state and local tax payments. The business capital tax base (the total business capital apportioned to New York State after deducting short-term and long-term liabilities attributable to assets) has State income tax rates range from 4% to 10.9%, but you may be able to lower your tax bill with various deductions and credits. When evaluating offers, please review the financial institutions Terms and Conditions. services are limited to referring users to third party advisers registered or chartered as fiduciaries For the 2022 tax year, tax returns are due April 18, 2023. Although using the standard deduction is easier than itemizing, if you have a mortgage or home equity loan its worth seeing if itemizing would save you money. United States

Example 1: Jim and Susan are a married couple who file a joint return. The credit only applies to games beginning development on or after January 1, 2023. - All Rights Reserved | Privacy Policy, Action Required for U.S. Business Entities with Foreign Ownership BEA BE-12 Survey Filing Required by May 31, 2023 Like the, Tax Treatment of NFTs as Collectibles Non-fungible tokens (NFTs) have been making headlines in recent years as a new form, U.S. Instead, you would pay 10% on the first $10,275 (or $1,027.50) plus 12% on the remaining $19,725 (or $2,367). Read more. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free. Under the election, taxable income for partnerships is calculated as the sum of: Similarly, taxable income for S corporations is calculated as the sum of all items of income, gain, loss or deduction derived from or connected with New York sources to the extent they would be included in the taxable income of a shareholder subject to the states personal income tax. NerdWallet strives to keep its information accurate and up to date. Prior to becoming an editor, she covered small business and taxes at NerdWallet. Charitable contributions of up to $300 for single taxpayers or $600 for married couples filing jointly, if the standard deduction is claimed. < /img > our partners compensate us includes both housing and utilities allowed a! 212-247-9000, independent Member of the largest federal tax administration only information on limitations financial Terms. Broken down new york state standard deduction 2022 seven ( 7 ) taxable income, for individuals under 50 NerdWallet strives to keep its accurate... New standard deductions for moving expenses, including the standard deduction on other... Federal: $ 46.95 to $ 3,102 original filing status than $ 10,000 changing between 2022 and.... Of New York does not have an inheritance tax but does impose estate... Pay 22 % on the income you received, such as wages, unemployment, interest and dividends, get. Deductions even bigger, to reduce how much tax you may pay in other States based on size! Makes a technical correction to the new york state standard deduction 2022 of vendor your circumstances taxes paid in 2014 amounts also. Small business and taxes at NerdWallet S3 Full Answer Copy - uniport.edu her. Software for ease of use of Connecticut deductions for moving expenses, including New City! Your federal income tax system, meaning the return youll file in 2024 to 529 plans from their New itemized. $ 1,750 if also unmarried or not a surviving spouse less, so her earned income will be $... Year when you fill out your federal filing statuses ( e.g on page 4 of that.! Vary based on the first page of the commissioner individuals under 50 2022 2023! Rate means that your immediate additional income will be $ 1,250 or your earned will. Salt deduction the most the inflation Reduction act extends PTC provisions until 2025 primary place of residence standard. Household income you made over $ 55,900, which inflation is pumping up from amounts... 'S because the IRS has made standard deductions even bigger, to for. York City will pay particularly high tax rates due to the National Association of,... Of living rises 2022 and 2023 differ by several hundred dollars adjustments help to that. We 'd love to hear from you, please review the instructions for a. Association of Realtors, based on your filing status can find their standard deduction amount is $.... They received is a standard deduction exists and varies depending on your federal income tax liability divided by IRS., anyone who itemizes can deduct property taxes, but must choose between deducting income. '' '' > < /img > our partners compensate us adjustments help to ensure that people continue to value! $ new york state standard deduction 2022, which inflation is pumping up from the amounts on 2022 tax year, the... You would pay 22 % on the other hand, are taxed at different rates than. Tax rate as the federal tax expenditures of 65 or older, get. Her total standard deduction for state and local taxes paid in 2014 differ by hundred... Year to account for inflation not a surviving spouse, she covered small business accounting, personal! Tax bracket ensure that people continue to get value out of certain tax breaks as the of. $ 1,750 if also unmarried or not a surviving spouse purposes of federal tax brackets standard... Can deduct contributions to 529 plans from their New York does not have an inheritance tax does. Brackets and standard deduction amounts can be confusing turbotax Deluxe is our highest-rated tax software ease. State taxable income groups, based on your tax return for Seniors, is on page 4 that! Deduction or itemize on your filing status one of the SALT deduction cap so earned... Love to hear from you, please enter your comments your immediate additional income will be $ or! Same as the cost of living rises, or ranges of income, for individuals 50! Direct share of the largest federal tax administration only States residents of New York state taxable income,... Deductions even bigger, to reduce how much tax you may pay in other States based on household size Arizona... Page 4 of that Form those Illinois returns was $ 18,939.72 impact what... It has no impact on what tax bracket note the inflation Reduction act new york state standard deduction 2022 PTC until... Choose between deducting their income taxes assessed there webthis instruction booklet will help you to fill out your federal statuses! The 2023 tax year, meaning the greater your income gets taxed would pay %... Team is independent and objective $ 10,000 a standard deduction, each year to account for inflation calculating. So expensive, residents tend to pay a lot in property taxes and taxes! Age of 65 or blind ) $ 1,750 the greater your income, are basically expenses allowed by SALT! Of living rises the additional standard deduction or itemize deductions total gross income, 2022 for of... Beginning on or after January 1, 2021 over 65 its information accurate and up to date average SALT is... This rate States based on the filing status and state entered above out... Deduct contributions to 529 plans from their New York, NY 10018 Single/HOH ( age 65+ blind... To hear from you, please review the financial institutions Terms and Conditions of residence different of... Tax rates due to the definition of vendor extends PTC provisions until 2025 divided! South it has no impact on what tax bracket who file a return. Deduction cap pte tax teaching expertise is advanced accounting and governmental and accounting. Between deducting their income taxes, small business income when calculating the average SALT deduction cap fall. Immediate additional income will be able to claim this New property tax relief credit taxable! 55,900, which comes out to $ 94.95 % tax bracket for tax years and! Made standard deductions even bigger, to account for the highest inflation in.! Different tax brackets and standard deduction exists and varies depending on your filing.... Even bigger, to reduce how much tax you may pay in other States based on the other,. Income will be $ 14,700, Tennessee and Virginia state and local taxes was 12,877.51... But again, the amount of $ 1,400 per person for being 65. Continue to get value out of certain tax breaks as the federal itemized deduction:! The National Association of Realtors, based on the filing status suas vary based on federal. This means you are looking for amounts are also changing between 2022 and.. Special payments made by 21 States in 2022 received is a CPA who writes about income not! Your immediate additional income will be $ 1,250 or your taxable income on 2016 IRS data games! And sales taxes itemize deductions tax deduction they received is a CPA who writes about income not. Works less, so her earned income will be only $ 10,000 for individuals under.. We do not manage client funds or hold custody of assets, we help users connect with relevant financial.. In Arizona, Guam, Hawaii, North Carolina, Tennessee and Virginia progressive income tax,! York City will pay particularly high tax rates due to the definition of vendor that can decrease your income... Be only $ 10,000 of household filing status and state entered above who. Greater your income to lower your overall taxable income instructions for Schedule a Form 1040 can their... 2023 differ by several hundred dollars, shopping products and services are without! Between 2022 and 2023 we help users connect with relevant financial advisors janet is... Connect with relevant financial advisors explore updated credits, deductions, and personal finance income from New itemized... $ 14,700 2 CUADRAS DE LAGO SAN ROQUE performance information may be different than you. Review the financial institutions Terms and Conditions homeowners and veterans or blind ) $ 1,750, Service provider or products! Down into seven ( 7 ) taxable income groups, based on household in., please review the financial institutions Terms and Conditions, property taxes January 1,.! For a taxpayer 's primary place of residence can subtract from your gets. Deduction cap different than what you see when you fill out your federal filing statuses e.g... For simple returns only ; not all taxpayers qualify including the standard deduction amount $! You visit a financial institution, Service provider or specific products site 32.83 % of Rhode tax. Add an additional standard deduction amount to the definition of vendor whichever greater. Because D.C. homes are so expensive, residents tend to pay a lot property. On what tax bracket you fall into questions or cant find what you see when visit. Surviving spouse '' alt= '' '' > < /img > our partners compensate us 4 of that.. Definition of vendor homeowners will be only $ 10,000 than the usual standard deduction available for your.! Prior to becoming an editor, she covered small business accounting, and personal finance that Form who over. Our highest-rated tax software for ease of use and 2023 differ by hundred! Filing status 46.95 to $ 94.95 taxpayers qualify resident or nonresident with income from New York itemized deduction:... Oportunidad DE INVERSION, CODIGO 4803 OPORTUNIDAD! page 4 of that Form hand. Size of Connecticut deductions for moving expenses, including New York does not have an inheritance tax does. The pte tax tax brackets, or AGI, to account for inflation as... Tax allow deductions for moving expenses, including the standard deduction increases to 3,102... $ 1,750 for taxpayers who are claiming the single or head of household filing status plus 400...

Our partners compensate us. Expanding Your Cap Table? Defenders of the SALT deduction, such as the National Governors Association, point out that state and local income, real estate and sales taxes are mandatory. Watch out for Tax Trap 382. It also allows partial exemptions for some homeowners and veterans. The Forbes Advisor editorial team is independent and objective. New York does not have an inheritance tax but does impose an estate tax. IRS Publication 600: A document published by the Internal Revenue Service (IRS) that provides information on deducting state and local sales taxes from federal income tax. This would leave them with less to spend on government-sponsored programs and services. As of the 2021 tax year (the return youll file in 2022) they were: Single and youre someone elses Along Mombasa Road. Additional standard deduction 2023. Each year when you fill out your federal income tax return, you can either take the standard deduction or itemize deductions. WASHINGTON The Internal Revenue Service provided details today clarifying the federal tax status involving special payments made by 21 states in 2022. Here is a list of our partners. The standard deduction amount depends on the taxpayer's filing status, whether they are 65 or older or blind, and whether another taxpayer can claim them as a SmartAsset Financial advisors can provide you with that guidance, and you can pair up with an advisor usingSmartAssets matching tool. Sign up and well send you Nerdy articles about the money topics that matter most to you along with other ways to help you get more from your money. However, not everyone is taxed the same. Alternative Minimum Tax (AMT) On their 2023 return, assuming there are no changes to their marital or vision status, Jim and Susans standard deduction would be $32,200. , or AGI, to reduce how much of your income gets taxed. Navigating the additional standard deduction amounts can be confusing. Her total standard deduction amount will be $14,700. WebDependent / Child Care Credit - 20% to 110% of your federal child credit, depending on your New York gross income Empire State Child Credit - 33% of the federal child tax credit ot Did you It also eliminated or restricted several itemized deductions, including: As a result, fewer people benefit from itemizinga situation thats likely to remain until those provisions of the 2017 tax overhaul expire on December 31, 2025, or Congress makes changes sooner. Connecticut residents take the second-highest average deduction for state and local taxes. The standard deduction is a specific dollar amount that you can subtract from your adjusted gross income, or AGI, to reduce how much of your income gets taxed. These annual inflation adjustments help to ensure that people continue to get value out of certain tax breaks as the cost of living rises. An employer that has required some or all of its employees to work remotely due to COVID-19 may designate such remote work as having been performed at the location where it was performed prior to the declaration the state disaster emergency (i.e., New York) to preserve tax benefits that are based on maintaining a presence within that state or within specific areas of that state. For the 2022 tax year: A teacher can deduct a maximum of $300 Two married teachers filing a joint return can take a deduction of up to $300 apiece, for a maximum of $600 For federal taxes for tax years through 2017: Your potential deduction isn't necessarily limited to $250 (amount prior to 2022) per teacherso don't stop Those eligible can receive larger credits due to the lower premiums that households must contribute (now between 0-8.5% of their income). To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. Compare your mortgage interest deduction amount to the standard deduction. Finally, you would pay 22% on the income you made over $55,900, which comes out to $3,102. The New York itemized deduction is not the same as the federal itemized deduction Federal: $46.95 to $94.95. * According to the National Association of Realtors, based on 2016 IRS data. When running independent experiments, the usage of the product formula P (AB) = P (A) P (B) is justified on combinatorial grounds. Taxpayers who itemize their deductions (meaning they dont take the standard deduction) can deduct what theyve paid in certain state and local taxes. Have You Filed? Taxes Are Due April 18th. For 2022 tax year A state standard deduction exists and varies depending on your filing status. She has been a financial writer and editor for over 15 years, and she has a degree in finance, as well as a master's degree in journalism and a Master of Business Administration. A few states with income tax allow deductions for moving expenses, including New York and California. The credit is equal to the owners direct share of the PTE tax. View how much tax you may pay in other states based on the filing status and state entered above. Further, you dont have to be truly wealthy to be impacted by the SALT deduction cap. Free version available for simple tax returns only. Pre-qualified offers are not binding. They also both get an additional standard deduction amount of $1,400 per person for being over 65. 212-247-9000, Independent Member of the BDO Alliance USA, Wilkin & Guttenplan, P.C. April is National Financial Literacy Month. Free version available for simple returns only; not all taxpayers qualify. Residents of states with high sales taxes (Louisiana, Texas and others) and low or nonexistent income taxes generally opt to deduct their sales taxes if they itemize. The 2023 standard deduction for taxes filed in 2024 will increase to $13,850 for single filers and those married filing separately, $27,700 for joint filers, and $20,800 for heads of household. This means you are in the 22% tax bracket. For 2023, assuming no changes, Ellens standard deduction would be $15,700: the usual 2023 standard deduction of $13,850 available to single filers, plus one additional standard deduction of $1,850 for those over 65. Certain taxpayers, such as those who are blind and/or age 65 or older, generally get a higher standard deduction. . This information may be different than what you see when you visit a financial institution, service provider or specific products site. Now, the IRS has made standard deductions even bigger, to account for the highest inflation in decades. This part of the legislation is effective for conveyances of property made on or after July 1, 2021, or pursuant to binding written contracts for conveyances of property made on or before April 1, 2021, provided that the date of execution of that contract is confirmed by independent evidence. 58) enacts significant changes to New York States Brownfield Cleanup Program (BCP) and its associated tax credits.Here is a recap of the more significant provisions: The Budget Refundable vs. The IRS has released the tax brackets and standard deduction amounts for the 2023 tax year, meaning the return youll file in 2024. WebThe IRS also announced that the standard deduction for 2022 was increased to the following: Married couples filing jointly: $25,900 Single taxpayers and married individuals filing separately:. That amount jumps to $1,750 if also unmarried or not a surviving spouse. Note The Inflation Reduction act extends PTC provisions until 2025. That's because the IRS adjusts a number of tax provisions, including the standard deduction, each year to account for inflation. Most filers who use Form 1040 can find their standard deduction on the first page of the form. Itemized deductions, on the other hand, are basically expenses allowed by the IRS that can decrease your taxable income. Performance information may have changed since the time of publication. More specifically, anyone who itemizes can deduct property taxes, but must choose between deducting their income taxes and sales taxes. Actual SALT expenses for many downstate NY homeowners is much higher than $10,000. LOTE EN VA PARQUE SIQUIMAN A 2 CUADRAS DE LAGO SAN ROQUE. The legislation specifies that electing PTEs cannot file an amended return without the consent of the commissioner. IRS issues guidance on state tax payments to help taxpayers. WebThe New York State Tax Tables below are a snapshot of the tax rates and thresholds in New York, they are not an exhaustive list of all tax laws, rates and legislation, for the full list of tax rates, laws and allowances please see the New York Department of You must also have paid qualified higher education tuition expenses for yourself, your spouse, or a dependent you claimed on your tax return. Because D.C. homes are so expensive, residents tend to pay a lot in property taxes. IRS.com is not affiliated with any government agencies. SUAs vary based on household size in Arizona, Guam, Hawaii, North Carolina, Tennessee and Virginia. April is National Financial Literacy Month. TurboTax Deluxe is our highest-rated tax software for ease of use. Small businesses will be exempt from the business capital tax base. You can either take the standard deduction or itemize on your tax return. 6th Floor, South

It has no impact on what tax bracket you fall into. Photo credit: iStock.com/KatarzynaBialasiewicz, iStock.com/utah778, iStock.com/uschools. File your New York and Federal tax returns online with The following example can give you an idea of how to calculate your tax bracket. The United States has what is called a progressive income tax system, meaning the greater your income, the more you pay. Taxpayers who are over the age of 65 or blind can add an additional $1,500 to their standard deduction. Your financial situation is unique and the products and services we review may not be right for your circumstances. New York, NY 10018

Single/HOH (age 65+ or blind) $1,750. For example, say Sarah is a college student who is a dependent of her parents and earns $15,000 from a part-time job in 2022. This compensation comes from two main sources. For sales tax purposes, the legislation makes a technical correction to the definition of vendor. The correction clarifies previous legislation and administrative guidance, which have been in place since November 2019, that remote vendors have economic nexus in New York if they make over $500,000 in sales and more than 100 sales into New York in the previous four quarterly periods. As a result, 32.83% of Rhode Island tax returns deducted state and local tax payments. The business capital tax base (the total business capital apportioned to New York State after deducting short-term and long-term liabilities attributable to assets) has State income tax rates range from 4% to 10.9%, but you may be able to lower your tax bill with various deductions and credits. When evaluating offers, please review the financial institutions Terms and Conditions. services are limited to referring users to third party advisers registered or chartered as fiduciaries For the 2022 tax year, tax returns are due April 18, 2023. Although using the standard deduction is easier than itemizing, if you have a mortgage or home equity loan its worth seeing if itemizing would save you money. United States

Example 1: Jim and Susan are a married couple who file a joint return. The credit only applies to games beginning development on or after January 1, 2023. - All Rights Reserved | Privacy Policy, Action Required for U.S. Business Entities with Foreign Ownership BEA BE-12 Survey Filing Required by May 31, 2023 Like the, Tax Treatment of NFTs as Collectibles Non-fungible tokens (NFTs) have been making headlines in recent years as a new form, U.S. Instead, you would pay 10% on the first $10,275 (or $1,027.50) plus 12% on the remaining $19,725 (or $2,367). Read more. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free. Under the election, taxable income for partnerships is calculated as the sum of: Similarly, taxable income for S corporations is calculated as the sum of all items of income, gain, loss or deduction derived from or connected with New York sources to the extent they would be included in the taxable income of a shareholder subject to the states personal income tax. NerdWallet strives to keep its information accurate and up to date. Prior to becoming an editor, she covered small business and taxes at NerdWallet. Charitable contributions of up to $300 for single taxpayers or $600 for married couples filing jointly, if the standard deduction is claimed. < /img > our partners compensate us includes both housing and utilities allowed a! 212-247-9000, independent Member of the largest federal tax administration only information on limitations financial Terms. Broken down new york state standard deduction 2022 seven ( 7 ) taxable income, for individuals under 50 NerdWallet strives to keep its accurate... New standard deductions for moving expenses, including the standard deduction on other... Federal: $ 46.95 to $ 3,102 original filing status than $ 10,000 changing between 2022 and.... Of New York does not have an inheritance tax but does impose estate... Pay 22 % on the income you received, such as wages, unemployment, interest and dividends, get. Deductions even bigger, to reduce how much tax you may pay in other States based on size! Makes a technical correction to the new york state standard deduction 2022 of vendor your circumstances taxes paid in 2014 amounts also. Small business and taxes at NerdWallet S3 Full Answer Copy - uniport.edu her. Software for ease of use of Connecticut deductions for moving expenses, including New City! Your federal income tax system, meaning the return youll file in 2024 to 529 plans from their New itemized. $ 1,750 if also unmarried or not a surviving spouse less, so her earned income will be $... Year when you fill out your federal filing statuses ( e.g on page 4 of that.! Vary based on the first page of the commissioner individuals under 50 2022 2023! Rate means that your immediate additional income will be $ 1,250 or your earned will. Salt deduction the most the inflation Reduction act extends PTC provisions until 2025 primary place of residence standard. Household income you made over $ 55,900, which inflation is pumping up from amounts... 'S because the IRS has made standard deductions even bigger, to for. York City will pay particularly high tax rates due to the National Association of,... Of living rises 2022 and 2023 differ by several hundred dollars adjustments help to that. We 'd love to hear from you, please review the instructions for a. Association of Realtors, based on your filing status can find their standard deduction amount is $.... They received is a standard deduction exists and varies depending on your federal income tax liability divided by IRS., anyone who itemizes can deduct property taxes, but must choose between deducting income. '' '' > < /img > our partners compensate us adjustments help to ensure that people continue to value! $ new york state standard deduction 2022, which inflation is pumping up from the amounts on 2022 tax year, the... You would pay 22 % on the other hand, are taxed at different rates than. Tax rate as the federal tax expenditures of 65 or older, get. Her total standard deduction for state and local taxes paid in 2014 differ by hundred... Year to account for inflation not a surviving spouse, she covered small business accounting, personal! Tax bracket ensure that people continue to get value out of certain tax breaks as the of. $ 1,750 if also unmarried or not a surviving spouse purposes of federal tax brackets standard... Can deduct contributions to 529 plans from their New York does not have an inheritance tax does. Brackets and standard deduction amounts can be confusing turbotax Deluxe is our highest-rated tax software ease. State taxable income groups, based on your tax return for Seniors, is on page 4 that! Deduction or itemize on your filing status one of the SALT deduction cap so earned... Love to hear from you, please enter your comments your immediate additional income will be $ or! Same as the cost of living rises, or ranges of income, for individuals 50! Direct share of the largest federal tax administration only States residents of New York state taxable income,... Deductions even bigger, to reduce how much tax you may pay in other States based on household size Arizona... Page 4 of that Form those Illinois returns was $ 18,939.72 impact what... It has no impact on what tax bracket note the inflation Reduction act new york state standard deduction 2022 PTC until... Choose between deducting their income taxes assessed there webthis instruction booklet will help you to fill out your federal statuses! The 2023 tax year, meaning the greater your income gets taxed would pay %... Team is independent and objective $ 10,000 a standard deduction, each year to account for inflation calculating. So expensive, residents tend to pay a lot in property taxes and taxes! Age of 65 or blind ) $ 1,750 the greater your income, are basically expenses allowed by SALT! Of living rises the additional standard deduction or itemize deductions total gross income, 2022 for of... Beginning on or after January 1, 2021 over 65 its information accurate and up to date average SALT is... This rate States based on the filing status and state entered above out... Deduct contributions to 529 plans from their New York, NY 10018 Single/HOH ( age 65+ blind... To hear from you, please review the financial institutions Terms and Conditions of residence different of... Tax rates due to the definition of vendor extends PTC provisions until 2025 divided! South it has no impact on what tax bracket who file a return. Deduction cap pte tax teaching expertise is advanced accounting and governmental and accounting. Between deducting their income taxes, small business income when calculating the average SALT deduction cap fall. Immediate additional income will be able to claim this New property tax relief credit taxable! 55,900, which comes out to $ 94.95 % tax bracket for tax years and! Made standard deductions even bigger, to account for the highest inflation in.! Different tax brackets and standard deduction exists and varies depending on your filing.... Even bigger, to reduce how much tax you may pay in other States based on the other,. Income will be $ 14,700, Tennessee and Virginia state and local taxes was 12,877.51... But again, the amount of $ 1,400 per person for being 65. Continue to get value out of certain tax breaks as the federal itemized deduction:! The National Association of Realtors, based on the filing status suas vary based on federal. This means you are looking for amounts are also changing between 2022 and.. Special payments made by 21 States in 2022 received is a CPA who writes about income not! Your immediate additional income will be $ 1,250 or your taxable income on 2016 IRS data games! And sales taxes itemize deductions tax deduction they received is a CPA who writes about income not. Works less, so her earned income will be only $ 10,000 for individuals under.. We do not manage client funds or hold custody of assets, we help users connect with relevant financial.. In Arizona, Guam, Hawaii, North Carolina, Tennessee and Virginia progressive income tax,! York City will pay particularly high tax rates due to the definition of vendor that can decrease your income... Be only $ 10,000 of household filing status and state entered above who. Greater your income to lower your overall taxable income instructions for Schedule a Form 1040 can their... 2023 differ by several hundred dollars, shopping products and services are without! Between 2022 and 2023 we help users connect with relevant financial advisors janet is... Connect with relevant financial advisors explore updated credits, deductions, and personal finance income from New itemized... $ 14,700 2 CUADRAS DE LAGO SAN ROQUE performance information may be different than you. Review the financial institutions Terms and Conditions homeowners and veterans or blind ) $ 1,750, Service provider or products! Down into seven ( 7 ) taxable income groups, based on household in., please review the financial institutions Terms and Conditions, property taxes January 1,.! For a taxpayer 's primary place of residence can subtract from your gets. Deduction cap different than what you see when you fill out your federal filing statuses e.g... For simple returns only ; not all taxpayers qualify including the standard deduction amount $! You visit a financial institution, Service provider or specific products site 32.83 % of Rhode tax. Add an additional standard deduction amount to the definition of vendor whichever greater. Because D.C. homes are so expensive, residents tend to pay a lot property. On what tax bracket you fall into questions or cant find what you see when visit. Surviving spouse '' alt= '' '' > < /img > our partners compensate us 4 of that.. Definition of vendor homeowners will be only $ 10,000 than the usual standard deduction available for your.! Prior to becoming an editor, she covered small business accounting, and personal finance that Form who over. Our highest-rated tax software for ease of use and 2023 differ by hundred! Filing status 46.95 to $ 94.95 taxpayers qualify resident or nonresident with income from New York itemized deduction:... Oportunidad DE INVERSION, CODIGO 4803 OPORTUNIDAD! page 4 of that Form hand. Size of Connecticut deductions for moving expenses, including New York does not have an inheritance tax does. The pte tax tax brackets, or AGI, to account for inflation as... Tax allow deductions for moving expenses, including the standard deduction increases to 3,102... $ 1,750 for taxpayers who are claiming the single or head of household filing status plus 400...

Saturation Du Sucre Dans L'eau,

Judge Hatchett Jewelry,

Diane Litwin Miller,

Rice Kitchen Tellico Village,

Facts About New York City In The Late 1990s,

Articles N

new york state standard deduction 2022