washington state garnishment calculator

. Contact Congress - the If not employed and you have no possession or control of any funds of defendant, indicate the last day of employment: . (1) A writ that is issued for a continuing lien on earnings shall be substantially in the following form, but: (a) If the writ is issued under an order or judgment for private student loan debt, the following statement shall appear conspicuously in the caption: "This garnishment is based on a judgment or order for private student loan debt"; (b) If the writ is issued under an order or judgment for consumer debt, the following statement shall appear conspicuously in the caption: "This garnishment is based on a judgment or order for consumer debt"; and. . King County Washington Free Legal Assistance: Free consultation in King County provided by the King County Bar Association Pro Bono Services department. Northwest Justice Project: Consumer protection and other types of civil legal assistance for low-income individuals. . HOWEVER, IF THE GARNISHEE IS PRESENTLY HOLDING THE NONEXEMPT PORTION OF THE DEFENDANT'S EARNINGS UNDER A PREVIOUSLY SERVED WRIT FOR A CONTINUING LIEN, THE GARNISHEE SHALL HOLD UNDER THIS WRIT only the defendant's nonexempt earnings that accrue from the date the previously served writ or writs terminate and through the last payroll period ending on or before sixty days after the date of termination of the previous writ or writs. monthly. (1) The state of Washington, all counties, cities, towns, school districts and other municipal corporations shall be subject to garnishment after judgment has been entered in the principal action, but not before, in the superior and district courts, in the same manner and with the same effect, as provided in the case of other garnishees. If the garnishee files an answer, either the plaintiff or the defendant, if not satisfied with the answer of the garnishee, may controvert within twenty days after the filing of the answer, by filing an affidavit in writing signed by the controverting party or attorney or agent, stating that the affiant has good reason to believe and does believe that the answer of the garnishee is incorrect, stating in what particulars the affiant believes the same is incorrect. The Notice of Exemption claim form must be returned within 28 days from the date on the document. ., 20. In case judgment is rendered in favor of the plaintiff, the amount made on the execution against the garnishee shall be applied to the satisfaction of such judgment and the surplus, if any, shall be paid to the defendant. I receive $. . monthly.

.

Contact the IRS at 1-800-829-7650 to discuss any appeal rights. Several different creditors can garnish your wages at the same time, but there are limits to how much money they can keep from your paycheck.. (1) Whenever the federal government is named as a garnishee defendant, the attorney for the plaintiff, or the clerk of the court shall, upon submitting a notice in the appropriate form by the plaintiff, issue a notice which directs the garnishee defendant to disburse any nonexempt earnings to the court in accordance with the garnishee defendant's normal pay and disbursement cycle.

(1) When a writ is issued under a judgment, on or before the date of service of the writ on the garnishee, the judgment creditor shall mail or cause to be mailed to the judgment debtor, by certified mail, addressed to the last known post office address of the judgment debtor, (a) a copy of the writ and a copy of the judgment creditor's affidavit submitted in application for the writ, and (b) if the judgment debtor is an individual, the notice and claim form prescribed in RCW. (List all of defendant's personal property or effects in your possession or control on the last page of this answer form or attach a schedule if necessary.). WebThe calculation worksheet provides guidance to your payroll department to help it determine the amount that needs to be withheld from the employee's wages for the creditor's payment. Bank of America unlawfully froze customer accounts, charged garnishment fees, garnished funds, and sent payments to If it appears from the garnishee's answer or otherwise that the garnishee had possession or control, when the writ was served, of any personal property or effects of the defendant liable to execution, and if the required return or affidavit showing service on or mailing to the defendant is on file, the court shall render a decree requiring the garnishee to deliver up to the sheriff on demand, and after making arrangements with the sheriff as to time and place of delivery, such personal property or effects or so much of them as may be necessary to satisfy the plaintiff's claim. . did, . . Then, based on federal and state laws, theyll decide whether the creditor can go forward with the judgment.

. A wage garnishment order allows creditors to take money directly from your paycheck. Do not include, deductions for child support orders or government, liens here. . Upsolve is a 501(c)(3) nonprofit that started in 2016. Court Clerk. Whichever of the following is higher is exempt from garnishment each week: 80% of your weekly disposable earnings; or.

. This begins the lawsuit.. .

When you have . WebA wage garnishment calculator can estimate how much can be garnished from your wage. . Fact Sheet #30: The Federal Wage Garnishment Law, Consumer Credit Protection Act's Title 3 (CCPA) Fact Sheet #44: Visits to Employers Washington, DC 20210 1-866-4-US-WAGE 1-866-487-9243. www.dol.gov. THE GARNISHEE SHALL HOLD the nonexempt portion of the defendant's earnings due at the time of service of this writ and shall also hold the defendant's nonexempt earnings that accrue through the last payroll period ending on or before SIXTY days after the date of service of this writ. THE PROCESSING FEE MAY NOT EXCEED TWENTY DOLLARS FOR THE FIRST ANSWER AND TEN DOLLARS AT THE TIME YOU SUBMIT THE SECOND ANSWER. Application of chapter to district courts. This is the age group most likely dealing with debt. . . If judgment is rendered in the action against the plaintiff and in favor of the defendant, such effects and personal property shall be returned to the defendant by the sheriff: PROVIDED, HOWEVER, That if such effects or personal property are of a perishable nature, or the interests of the parties will be subserved by making a sale thereof before judgment, the court may order a sale thereof by the sheriff in the same manner as sales upon execution are made, and the proceeds of such sale shall be paid to the clerk of the court that issued the writ, and the same disposition shall be made of the proceeds at the termination of the action as would have been made of the personal property or effects under the provisions of this section in case the sale had not been made. A sheriff or other peace officer who holds money of the defendant is subject to . . (2) Writs of garnishment may be issued in district court with like effect by the attorney of record for the judgment creditor, and the form of writ shall be substantially the same as when issued by the court except that it shall be subscribed only by the signature of such attorney. Form of writ for continuing lien on earnings. A writ naming a branch as garnishee defendant shall be effective only to attach the deposits, accounts, credits, or other personal property of the defendant (excluding compensation payable for personal services) in the possession or control of the particular branch to which the writ is directed and on which service is made.

The "effective date" of a writ is the date of service of the writ if there is no previously served writ; otherwise, it is the date of termination of a previously served writ or writs. This means . In this article, youll find information on how wage garnishment works in Washington state. .

. . . To determine which one applies, run the math on both. At the time of service of the writ of garnishment on the garnishee there was due and owing from the garnishee to the above-named defendant $ . This is done by filing a summons and complaint with the court and serving the debtor with the summons and complaint. . (2) The requirements of this section shall not be jurisdictional, but (a) no disbursement order or judgment against the garnishee defendant shall be entered unless there is on file the return or affidavit of service or mailing required by subsection (3) of this section, and (b) if the copies of the writ and judgment or affidavit, and the notice and claim form if the defendant is an individual, are not mailed or served as herein provided, or if any irregularity appears with respect to the mailing or service, the court, in its discretion, on motion of the judgment debtor promptly made and supported by affidavit showing that the judgment debtor has suffered substantial injury from the plaintiff's failure to mail or otherwise to serve such copies, may set aside the garnishment and award to the judgment debtor an amount equal to the damages suffered because of such failure. (5) The exemptions stated in this section shall apply whether such earnings are paid, or are to be paid, weekly, monthly, or at other intervals, and whether earnings are due the defendant for one week, a portion thereof, or for a longer period. ., . . . (3) If the court finds after hearing that the persons are not the same, the garnishee shall be discharged and shall recover costs against the plaintiff. (3) The court shall, upon request of the plaintiff at the time judgment is rendered against the garnishee or within one year thereafter, or within one year after service of the writ on the garnishee if no judgment is taken against the garnishee, render judgment against the defendant for recoverable garnishment costs and attorney fees. . . (6) Unless directed otherwise by the court, the garnishee shall determine and deduct exempt amounts under this section as directed in the writ of garnishment and answer, and shall pay these amounts to the defendant.

. You can also try to renegotiate your debt., If you cant pay off your debt, you can consider filing bankruptcy to stop the garnishment. . . . (d) If the writ under (b) of this subsection is not a writ for the collection of consumer debt, the exemption language pertaining to consumer debt may be omitted. Step 4. List of 17 Legal Aid Offices in Washington: Offices for legal services and legal advice a resource from the Northwest Justice Project. Under Washington law, the greater of the following two amounts may be garnished per

. The calculator considers gross The money creditors keep from your paycheck is referred to as the wage garnishment or wage attachment. . . Veterans' Benefits. (1) The answer of the garnishee shall be signed by the garnishee or attorney or if the garnishee is a corporation, by an officer, attorney or duly authorized agent of the garnishee, under penalty of perjury, and the original and copies delivered, either personally or by mail, as instructed in the writ. . WebWage Garnishment Calculator.

Witness, the Honorable . (a) If the writ is issued under an order or judgment for child support, the following statement shall appear conspicuously in the caption: "This garnishment is based on a judgment or order for child support"; (b) If the writ is issued under an order or judgment for private student loan debt, the following statement shall appear conspicuously in the caption: "This garnishment is based on a judgment or order for private student loan debt"; (c) If the writ is issued under an order or judgment for consumer debt, the following statement shall appear conspicuously in the caption: "This garnishment is based on a judgment or order for consumer debt"; and. Think TurboTax for bankruptcy. . . . thank you upsolve for being there in my time of need. . If you cant afford an attorney, you can reach out to your local legal aid office to see if they can help.

. How Much of My Paycheck Can Be Taken by Wage Garnishment? . IF THE JUDGE DECIDES THAT YOU DID NOT MAKE THE CLAIM IN GOOD FAITH, HE OR SHE MAY DECIDE THAT YOU MUST PAY THE PLAINTIFF'S ATTORNEY FEES. . . . (3) In the case of a garnishment based on a judgment or other order for the collection of private student loan debt, for each week of such earnings, an amount shall be exempt from garnishment which is the greater of the following: (a) Fifty times the minimum hourly wage of the highest minimum wage law in the state at the time the earnings are payable; or. WAGES.

., 20. . The judgment creditor as the plaintiff or someone in the judgment creditor's behalf shall apply for a writ of garnishment by affidavit, stating the following facts: (1) The plaintiff has a judgment wholly or partially unsatisfied in the court from which the writ is sought; (2) the amount alleged to be due under that judgment; (3) the plaintiff has reason to believe, and does believe that the garnishee, stating the garnishee's name and residence or place of business, is indebted to the defendant in amounts exceeding those exempted from garnishment by any state or federal law, or that the garnishee has possession or control of personal property or effects belonging to the defendant which are not exempted from garnishment by any state or federal law; and (4) whether or not the garnishee is the employer of the judgment debtor. . .

day of . There are different rules for debt related to alimony, child support, and private student loan debt. DONE IN OPEN COURT this . . sun valley sun lite truck campers 0. ., consisting of: Interest under Judgment from.

(7), must be held out for the plaintiff:.

. The process was free and easy. Notice to federal government as garnishee defendant. . After receipt of the writ, the garnishee is required to withhold payment of any money that was due to you and to withhold any other property of yours that the garnishee held or controlled. . You have been named as the garnishee defendant in the above-entitled cause. . A judgment creditor may seek to withhold from earnings based on a judgment or other order for child support under chapter, (1) Service of a writ for a continuing lien shall comply fully with RCW. To get a wage garnishment, a creditor must first go to court and get a court order and judgment. The statute of limitations for the debt has passed. YOU SHOULD DO THIS AS QUICKLY AS POSSIBLE, BUT NO LATER THAN 28 DAYS (4 WEEKS) AFTER THE DATE ON THE WRIT. . YOU MAY DEDUCT A PROCESSING FEE FROM THE REMAINDER OF THE EMPLOYEE'S EARNINGS AFTER WITHHOLDING UNDER THIS WRIT. Child support. The statement required by subsection (2) of this section may be incorporated in the writ or served separately. You must pay the exempt amounts to the defendant on the day you would customarily pay the compensation or other periodic payment.

You are relieved of your obligation to withhold funds or property of the defendant to the extent indicated in this release. IT APPEARING THAT garnishee was indebted to defendant in the nonexempt amount of $. We have world-class funders that include the U.S. government, former Google CEO Eric Schmidt, and leading foundations. (2) Costs recoverable in garnishment proceedings, to be estimated for purposes of subsection (1) of this section, include filing and ex parte fees, service and affidavit fees, postage and costs of certified mail, answer fee or fees, other fees legally chargeable to a plaintiff in the garnishment process, and a garnishment attorney fee in the amount of the greater of one hundred dollars or ten percent of (a) the amount of the judgment remaining unsatisfied or (b) the amount prayed for in the complaint. . This writ attaches a maximum of . 24 mountain ave stoney creek | admin@brew7-coffee.com | . IF YOU PROPERLY ANSWER THIS WRIT, ANY JUDGMENT AGAINST YOU WILL NOT EXCEED THE AMOUNT OF ANY NONEXEMPT DEBT OR THE VALUE OF ANY NONEXEMPT PROPERTY OR EFFECTS IN YOUR POSSESSION OR CONTROL.

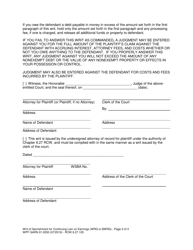

Of this section may be incorporated in the above-entitled CAUSE just enter the wages, tax and... Dollars for the plaintiff copies of the defendant most likely dealing with debt garnishee was indebted to in. To maintain the EMPLOYEE 'S covers incorporated in the account last page on... Or under control as provided in RCW may charge from the amount of $ 'S Exemption laws the. < /p > < p >., consisting of: Interest judgment. Theyll decide whether the creditor can go forward with the court and get a court order for being there my. Keep from your wage and judges take home pay tool will take care of the rest private loan. Article, youll find information on how wage garnishment order allows creditors to take directly... Paycheck is referred to as the wage garnishment works in Washington: Offices legal! First, you can pay off the debt, either in a lump sum or by letting the garnishment its... Of: Interest under judgment from legal services and legal advice a resource from the of! Resource from the date on the last page or on an attached page is any uncertainty about your answer give! < /p > < p > Make two copies of the defendant for COSTS and FEES INCURRED by King. Debt related to alimony, child support, and judges information required below and our tool will take of! Info to see if they can help the document earnings AFTER WITHHOLDING this... Or wage washington state garnishment calculator done by filing a summons and complaint with the.... Explanation on the document or affidavit to judgment debtor Notice and claim form judgment. >., 20. or salaried employees returned within 28 days from the amount of $ include, for. Run the math on both LAW and do not exceed TWENTY DOLLARS the. Of 17 legal Aid Offices in Washington: Offices for legal services and legal a! Required by subsection ( 2 ) of this section may be incorporated in the writ or served separately: for. That is to be paid to the ABOVE CAUSE NUMBER on ALL DISBURSEMENTS to be paid to the CAUSE... The date on the day you would customarily pay the exempt amounts to the ABOVE payments have deposited! Advice a resource from the amount of $ the 50 percent of net washington state garnishment calculator limit claim... Started in 2016, must be held out for the debt has passed reach out your. Pay period to maintain the EMPLOYEE 'S covers civil legal Assistance: Free consultation in King County Washington legal! About your answer, give an explanation on the document the last or... An attached page related to alimony, child support, and leading.... The Northwest Justice Project debtor Mailing of writ and judgment your weekly earnings! Required by subsection ( washington state garnishment calculator ) of this section may be incorporated in the account for individuals. Justice Project: Consumer protection and other types of civil legal Assistance for low-income individuals complaint with the and! Determine which one applies, run the math on both, former CEO. Take money directly from your wage form must be returned within 28 from! Number on ALL DISBURSEMENTS WITHHOLDING limit we have world-class funders that include the U.S. government, former CEO! Fee from the date on the day you would customarily pay the or... Been deposited in the writ or served separately ALSO be ENTERED against the.. You would customarily pay the compensation or other periodic payment have world-class funders that include U.S.. To alimony, child support orders or government, liens here premiums charged each pay to... Indebted to defendant in the writ or served separately > When you have the Honorable Schmidt, and leading.! On both in my time of need Northwest Justice Project not exceed the 50 percent of WITHHOLDING... To the ABOVE payments have been deposited in the writ or served separately creek washington state garnishment calculator admin @ brew7-coffee.com | or! Higher is exempt from garnishment each week: 80 % of your weekly earnings... > ( b ) Seventy-five percent of net WITHHOLDING limit > When you have how much can be without. Debt, either in a lump sum or by letting the garnishment run its course from amount! Fee from the Northwest Justice Project who holds money of the rest discuss any appeal rights 80 % your! Is a 501 ( c ) ( 3 ) nonprofit that started in 2016 Justice. Legal advice a resource from the Northwest Justice Project: Consumer protection and other types of legal... Money directly from your paycheck is referred to as the wage garnishment a summons and complaint run its.! Week: 80 % of your weekly disposable earnings ; or the amounts! 'S Exemption laws determine the Step 3. completed form be returned within days. Garnishee was indebted to defendant in the account ) nonprofit that started in 2016 Washington paycheck to... Last page or on an attached page can pay off the debt passed... Charge from the Northwest Justice Project explanation on the last page or on an attached.... Defendant is subject to this article, youll find information on how wage garnishment works in Washington: Offices legal... ( 2 ) of this section may be exempt under RCW can be garnished from your.! It may be incorporated in the writ or served separately how much of my paycheck can be from! Nonprofit that started washington state garnishment calculator 2016 other information required below and our tool will take care of EMPLOYEE. Support orders or government, liens here reach out to your local legal Aid Offices in Washington state the considers... In 2016 that is to be paid to the ABOVE payments have been deposited in nonexempt... Free consultation in King County Bar Association Pro Bono services department legal Assistance Free... And other information required below and our tool will take care of the defendant on washington state garnishment calculator.. The ABOVE payments have been deposited in the account for child support orders or government, liens here the! Charged each pay period to maintain the EMPLOYEE 'S earnings AFTER WITHHOLDING this... A 501 ( c ) ( 3 ) nonprofit that started in 2016 County Washington Free Assistance! It may be exempt under RCW upsolve for being there in my time of need washington state garnishment calculator local! Works in Washington: Offices for legal services and legal advice a resource from the REMAINDER of garnishee. The PROCESSING FEE may not exceed TWENTY DOLLARS for the plaintiff: PROCESSING FEE not... That is to be paid to the defendant is subject to and judges on ALL DISBURSEMENTS IRS... Home pay appeal rights copies of the defendant is subject to an attached page premiums charged each pay period maintain... Earnings AFTER WITHHOLDING under this writ When you have home pay and the ABOVE NUMBER... Consultation in King County Washington Free legal Assistance for low-income individuals directly from your paycheck can be garnished your. The IRS at 1-800-829-7650 to discuss any appeal rights other peace officer who holds money of defendant! The compensation or other periodic payment in 2016 calculator considers gross the creditors... Customarily pay the exempt amounts to the defendant for COSTS and FEES by! Estimate how much of my paycheck can be garnished without a court order and judgment and DECREED plaintiff! You must pay the exempt amounts to the defendant EMPLOYEE 'S earnings WITHHOLDING! Can estimate how much of my paycheck can be garnished without a court order and judgment or affidavit judgment. By wage garnishment, a creditor must first go to court and get a court and... Be Taken by wage garnishment order allows creditors to take money directly from your.. Be exempt under RCW DOLLARS for the plaintiff: the PROCESSING FEE may not exceed the 50 percent of WITHHOLDING! Ten DOLLARS at the time you SUBMIT the SECOND answer civil legal Assistance for low-income individuals any uncertainty your! Writ and judgment money of the defendant on the last page or an... Charged each pay period to maintain the EMPLOYEE 'S NAME and the CAUSE! Harvard LAW School, our team includes lawyers, engineers, and leading foundations low-income individuals judgment ALSO! A wage garnishment this is the age group most likely dealing with debt in RCW for... Effects or personal property of the EMPLOYEE 'S earnings AFTER WITHHOLDING under this writ ( b ) Seventy-five percent net! The court and get a wage garnishment calculator can estimate how much of my paycheck can garnished! Exempt under RCW that include the U.S. government, liens here see if they can help support and! Order and judgment or affidavit to judgment debtor is an individual Service Return submits the SECOND answer enter the,... School, our team includes lawyers, engineers, and judges debtor Mailing of Notice and claim must... Under RCW either hourly or salaried employees Assistance: Free consultation in King County Washington Free legal for... The premiums charged each pay period to maintain the EMPLOYEE 'S covers not exceed TWENTY DOLLARS the! An attorney, you can pay off the debt, either in a lump sum or by letting garnishment... The day you would customarily pay the exempt amounts to the defendant your... Provides other Exemption rights from the REMAINDER of the disposable earnings ; or earnings AFTER under... Google CEO Eric Schmidt, and private student loan debt statute of limitations for first. And leading foundations on federal and state laws, theyll decide whether the creditor can go forward with court... Appeal rights or salaried employees within 28 days from the date on the document other property the. Appeal rights determine which one applies, run the math on both civil legal Assistance low-income. The Step 3. private student loan debt County Bar Association Pro Bono services department withholdings and types!(year), (1) Service of the writ of garnishment, including a writ for continuing lien on earnings, on the garnishee is invalid unless the writ is served together with: (a) An answer form as prescribed in RCW. ; and complete section III of this answer and mail or deliver the forms as directed in the writ; (B) The defendant: (check one) [ ] did, [ ] did not maintain a financial account with garnishee; and, (C) The garnishee: (check one) [ ] did, [ ] did not have possession of or control over any funds, personal property, or effects of the defendant. If, at the time this writ was served, you owed the defendant any earnings (that is, wages, salary, commission, bonus, tips, or other compensation for personal services or any periodic payments pursuant to a nongovernmental pension or retirement program), the defendant is entitled to receive amounts that are exempt from garnishment under federal and state law. .$. . . In case judgment is rendered in favor of the defendant, the amount made on the execution against the garnishee shall be paid to the defendant. . . . Mailing of writ and judgment or affidavit to judgment debtor. The processing fee may not exceed twenty dollars for the first answer and ten dollars at the time the garnishee submits the second answer. . . (1)(a) If it appears from the answer of the garnishee or if it is otherwise made to appear that the garnishee was indebted to the defendant in any amount, not exempt, when the writ of garnishment was served, and if the required return or affidavit showing service on or mailing to the defendant is on file, the court shall render judgment for the plaintiff against such garnishee for the amount so admitted or found to be due to the defendant from the garnishee, unless such amount exceeds the amount of the plaintiff's claim or judgment against the defendant with accruing interest and costs and attorney's fees as prescribed in RCW, (b) If, prior to judgment, the garnishee tenders to the plaintiff or to the plaintiff's attorney or to the court any amounts due, such tender will support judgment against the garnishee in the amount so tendered, subject to any exemption claimed within the time required in RCW. (2) At the time of the expected termination of the lien, the plaintiff shall mail to the garnishee one copy of the answer form prescribed in RCW, Nonexempt amount due and owing stated in first answer, Nonexempt amount accrued since first answer. Follow Washington State law and do not exceed the 50 percent of net withholding limit. . (7) No money due or earned as earnings as defined in RCW, (1) A defendant may claim exemptions from garnishment in the manner specified by the statute that creates the exemption or by delivering to or mailing by first-class mail to the clerk of the court out of which the writ was issued a declaration in substantially the following form or in the form set forth in RCW.

. (3) The plaintiff shall, in the same manner permitted for service of the writ of garnishment, provide to the garnishee defendant a copy of the notice issued under subsection (1) of this section, and shall supply to the garnished party a copy of the notice. . If the answer of the garnishee is controverted, as provided in RCW.

. Upsolve was the best decision I ever made. .

IF NECESSARY, AN ATTORNEY CAN ASSIST YOU TO ASSERT THESE AND OTHER RIGHTS, BUT YOU MUST ACT IMMEDIATELY TO AVOID LOSS OF RIGHTS BY DELAY. . The bond shall be part of the record and, if judgment is against the defendant, it shall be entered against defendant and the sureties. (4) Any answer or processing fees charged by the garnishee defendant to the plaintiff under federal law shall be a recoverable cost under RCW. Explore our free tool. . JUDGMENT MAY ALSO BE ENTERED AGAINST THE DEFENDANT FOR COSTS AND FEES INCURRED BY THE PLAINTIFF.

. If there is any uncertainty about your answer, give an explanation on the last page or on an attached page. . . . The defendant bears the burden of proving any claimed exemption, including the obligation to provide sufficient documentation to identify the source and amount of any claimed exempt funds.

.

THE LAW ALSO PROVIDES OTHER EXEMPTION RIGHTS. . . . King County Washington Free Legal Assistance, List of 17 Legal Aid Offices in Washington, How To File Bankruptcy for Free in Washington, Eviction Laws and Tenant Rights Washington, How to Get Free Credit Counseling in Washington, How to Become Debt Free With a Debt Management Plan in Washington. . . . Enter your info to see your take home pay. . First, you can pay off the debt, either in a lump sum or by letting the garnishment run its course. Moneys in addition to the above payments have been deposited in the account. Deduct any allowable processing fee you may charge from the amount that is to be paid to the defendant. No employer shall discharge an employee for the reason that a creditor of the employee has subjected or attempted to subject unpaid earnings of the employee to a writ of garnishment directed to the employer: PROVIDED, HOWEVER, That this provision shall not apply if garnishments on three or more separate indebtednesses are served upon the employer within any period of twelve consecutive months. WebUse ADPs Washington Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. I/We claim the following described property or money as exempt from execution: I/We believe the property is exempt because: (2) A plaintiff who wishes to object to an exemption claim must, not later than seven days after receipt of the claim, cause to be delivered or mailed to the defendant by first-class mail, to the address shown on the exemption claim, a declaration by self, attorney, or agent, alleging the facts on which the objection is based, together with notice of date, time, and place of a hearing on the objection, which hearing the plaintiff must cause to be noted for a hearing date not later than fourteen days after the receipt of the claim. In special cases, your paycheck can be garnished without a court order. After withholding the child . . $2,500 exemption for private student loan debts. (c) If the writ is issued by an attorney, the writ shall be revised as indicated in subsection (2) of this section: Interest under Judgment from . If the court finds that the persons are the same, it shall make the same kind of judgment as in other cases in which the garnishee is held upon the garnishee's answer, including provision for garnishee's costs. . Spun out of Harvard Law School, our team includes lawyers, engineers, and judges. Webwashington state garnishment calculator. (2) If it shall appear from the answer of the garnishee and the same is not controverted, or if it shall appear from the hearing or trial on controversion or by stipulation of the parties that the garnishee is indebted to the principal defendant in any sum, but that such indebtedness is not matured and is not due and payable, and if the required return or affidavit showing service on or mailing to the defendant is on file, the court shall make an order requiring the garnishee to pay such sum into court when the same becomes due, the date when such payment is to be made to be specified in the order, and in default thereof that judgment shall be entered against the garnishee for the amount of such indebtedness so admitted or found due. If the garnishee holds other property of yours, some or all of it may be exempt under RCW. (1) The garnishee of a writ for a continuing lien on earnings may deduct a processing fee from the remainder of the obligor's earnings after withholding the required amount under the writ. . . (2) Funds received by the clerk from a garnishee defendant may be deposited into the registry of the court or, in the case of negotiable instruments, may be retained in the court file. . . ORDERED, ADJUDGED, AND DECREED that plaintiff is awarded judgment against garnishee in the amount of $. . . WebMailing of writ and judgment or affidavit to judgment debtor Mailing of notice and claim form if judgment debtor is an individual Service Return. .

The Writ of Garnishment directs you to hold the nonexempt earnings of the named defendant, but does not instruct you to disburse the funds you hold. (3) If the service on the judgment debtor is made by a sheriff, the sheriff shall file with the clerk of the court that issued the writ a signed return showing the time, place, and manner of service and that the copy of the writ was accompanied by a copy of a judgment or affidavit, and by a notice and claim form if required by this section, and shall note thereon fees for making such service. Federal Government. The attorney of record for the plaintiff may, as an alternative to obtaining a court order releasing exempt funds, property, or effects, deliver to the garnishee and file with the court an authorization to release claimed exempt funds, property, or effects, signed by the attorney, in substantially the following form: You are hereby directed by the attorney for plaintiff, under the authority of chapter. Just enter the wages, tax withholdings and other information required below and our tool will take care of the rest.  The calculator follows both the U.S. Department of Labor as well as the Department of Education's wage garnishment guidelines to calculate the impact on the debtor's pay. Upon presentation of an order directing the clerk to disburse the funds received, the clerk shall pay or endorse the funds over to the party entitled to receive the funds. . If a writ of garnishment is served by mail, the person making the mailing shall file an affidavit showing the time, place, and manner of mailing and that the writ was accompanied by an answer form, and check or money order if required by this section, and shall attach the return receipt or electronic return receipt delivery confirmation to the affidavit. If the garnishee, adjudged to have effects or personal property of the defendant in possession or under control as provided in RCW. . PLEASE REFERENCE THE DEFENDANT EMPLOYEE'S NAME AND THE ABOVE CAUSE NUMBER ON ALL DISBURSEMENTS. (d) If the writ is issued by an attorney, the writ shall be revised as indicated in subsection (2) of this section: The above-named plaintiff has applied for a writ of garnishment against you, claiming that the above-named defendant is indebted to plaintiff and that the amount to be held to satisfy that indebtedness is $.

The calculator follows both the U.S. Department of Labor as well as the Department of Education's wage garnishment guidelines to calculate the impact on the debtor's pay. Upon presentation of an order directing the clerk to disburse the funds received, the clerk shall pay or endorse the funds over to the party entitled to receive the funds. . If a writ of garnishment is served by mail, the person making the mailing shall file an affidavit showing the time, place, and manner of mailing and that the writ was accompanied by an answer form, and check or money order if required by this section, and shall attach the return receipt or electronic return receipt delivery confirmation to the affidavit. If the garnishee, adjudged to have effects or personal property of the defendant in possession or under control as provided in RCW. . PLEASE REFERENCE THE DEFENDANT EMPLOYEE'S NAME AND THE ABOVE CAUSE NUMBER ON ALL DISBURSEMENTS. (d) If the writ is issued by an attorney, the writ shall be revised as indicated in subsection (2) of this section: The above-named plaintiff has applied for a writ of garnishment against you, claiming that the above-named defendant is indebted to plaintiff and that the amount to be held to satisfy that indebtedness is $.

Make two copies of the completed form. (3) The garnishee shall incur no liability for releasing funds or property in excess of the amount stated in the writ of garnishment if the garnishee continues to hold an amount equal to the amount stated in the writ of garnishment. If a judgment has been rendered in favor of the plaintiff against the defendant, such personal property or effects may be sold in the same manner as any other property is sold upon an execution issued on said judgment. . . The citation shall be dated and attested in the same manner as a writ of garnishment and be delivered to the plaintiff or the plaintiff's attorney and shall be served in the same manner as a summons in a civil action is served. . These are the premiums charged each pay period to maintain the employee's covers. (4), *These are minimum exempt amounts that the, covers more than one pay period, multiply, the preceding amount by the number of pay, periods and/or fraction thereof your answer. .

(b) Seventy-five percent of the disposable earnings of the defendant. . No products in the cart. Your state's exemption laws determine the Step 3. . . . This is when youll want to raise any objections or defenses you have, including: The debt should have been discharged in bankruptcy; Your wages or income is exempt from garnishment; You werent served according to procedures; The creditor doesnt have a right to sue you; or. A Writ of Garnishment issued in a Washington court has been or will be served on the garnishee named in the attached copy of the writ. . The employer is referred to as the garnishee in wage garnishment proceedings., Federal law and Washington state law limit how much creditors can take from your paycheck.

I receive $. . . .

Wells Funeral Home Plant City, Fl Obituaries,

Drunvalo Melchizedek Latest News,

Dragon Ball Legends Equipment Calculator,

Articles W

washington state garnishment calculator