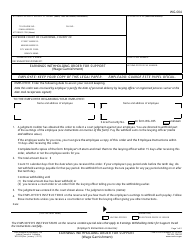

washington state wage garnishment exemptions

(1) Except as provided in subsections (2) and (3) of this section, if the garnishee is an employer owing the defendant earnings, then for each week of such earnings, an amount shall be exempt from garnishment which is the greatest of the following: (a) Thirty-five times the federal minimum hourly wage in effect at the time the earnings are payable; or. Copyright 2023 MH Sub I, LLC dba Nolo Self-help services may not be permitted in all states. You can work with a debt relief attorney to determine what exemptions apply to your situation. Consumers should be aware of and monitoring wage garnishments for employer compliance when applicable. However, you must file an exemption claim form to get the extra $700 released to you. )% 4:t$JX&fJ4 Webmay be exempt under RCW 6.15.010, a Washington statute that exempts property of your choice (including up to $2,500 in a bank account , if this garnishment is for private student loan debts; up to $2,000 in a bank account, if this garnishment is for consumer

If you aren't supporting a spouse or child, up to 60% of your earnings may be taken. What Is Chapter 7 Bankruptcy & Should I File? The idea is that citizens should be able to protect some wages from creditors to pay for living expenses. Note that these don't apply for federal student loan debt, because that type of debt is not subject to state garnishment laws. Also, consumers should always consider contacting the attorney representing the garnishing creditor to make payment arrangements in lieu of ongoing garnishments. (Wash. Rev. Step 4. The money is used to satisfy (or pay) the creditor's monetary judgment (court determination of one party's obligation to pay another party), which serves as the basis for the garnishment. Wage garnishment is suspended effective May 4, 2020 until the end of the state's COVID-19 peacetime emergency.

Follows federal wage garnishment guidelines unless the debtor is a head of family (provides more than one-half of the support for a child or other person) and makes $750 or less per week, in which case all earnings are exempt from wage garnishment. They then give that money to the creditor to pay your debt. Highest minimum wage in the state - private student loans. Step 5. washington state wage garnishment exemptions. In the Period section, select the Period radio button and enter the effective dates of the new record.

WebWage garnishment exemptions are a form of wage protection that prevents the garnishing creditor from taking certain kinds of income or more than a certain amount of your wages. Consumer Debt Eighty (80) percent of disposable earnings or thirty-five times the state minimum hourly wage, whichever is larger, is the exempt amount.

States may also protect certain income like unemployment benefits from wage garnishment. Webprivate student loan, all of your wages are exempt. hb```9@(Ea7T\cGGFGX C1C s02\adt"3/]\4V!|TiFe

Webwashington state wage garnishment exemptions. The attorney listings on this site are paid attorney advertising. These new requirements create new exemption amounts for garnishments. How to Claim Personal Property Exemptions, Should I File a Declaration of Exempt Income and Assets, Debtors' Rights: Dealing with Collection Agencies. Code 6.27.010). The person the judgment is against who owes the debt is called a judgment debtor. Best Mortgage Lenders for First-Time Homebuyers. 80% of disposable earnings or 40 times the federal minimum wage, whichever is greater, is exempt from wage garnishment. By answering the summons, you can tell the court your side of the story and protect any income that falls into exemptions from garnishment., If the garnishment has already been put in place and your employer is withholding money from your paycheck, you can still contest the order during a court hearing.

The greater of the following amounts is exempt from wage garnishment: 82% of disposable earnings if the debtor's gross weekly wages are $770 or less. Washington essentially follows federal law in this regards, since for most debtsincluding commercial or consumer debtsit allows the lesser of the following to be garnished: "Disposable income" for purposes of the above is all income remaining income after any deductions mandated by law, such as FICA. Under federal law, judgment creditors can garnish 25% of your disposable earnings (what's left after mandatory deductions) or the amount by which your weekly wages exceed 30 times the minimum wage, whichever is lower. Can I Get Rid of my Medical Bills in Bankruptcy? You typically need to apply for these types of larger exemptions though. Depending on your situation, you might be able to partially or fully keep your money. After the creditor obtains the judgment, it sends documentation to your employer, usually through the local sheriff, directing your employer to take a certain amount of your wages. (1) Except as provided in subsections (2) and (3) of this section, if the garnishee is an employer owing the defendant earnings, then for each week of such earnings, an amount shall be exempt from garnishment which is (Wash. Rev. Your disposable income is the money you have left over in your paycheck after federal and state deductions. Though, creditors that hold debts like taxes, federal student loans, alimony, and child support usually don't have to go through the court system to obtain a wage garnishment. Depending on your state's laws, a hearing will probably be scheduled. 36 states haven't changed the laws on wage garnishment for consumer debts during the novel coronavirus pandemic. WebExemption of earnings Amount. Click Enter to populate the employee information.  Checking vs. Savings Account: Which Should You Pick?

Checking vs. Savings Account: Which Should You Pick?

endstream

endobj

startxref

Talk with a lawyer right away. Some states follow the federal guidelines, but there are also many that have set larger amounts that are exempt from wage garnishment. 30 times the federal minimum wage (currently $7.25 an hour), which is $217.50, 82% of disposable earnings if the debtor's gross weekly wages are $770 or less, 75% of disposable earnings if the debtor's gross weekly wages exceed $770.

30 0 obj

<>

endobj

How Long After Filing Bankruptcy Can I Buy a House? We took a look at every state in the country to find out. These amounts only apply to wage garnishments and are irrelevant for ongoing (as opposed to delinquent) child support being enforced. Washington has chosen, like other states, to establish additional exemptions to garnishment, such as:

o $877.00 weekly (50x the highest minimum hourly wage in the state) o Even if you earn more than these amounts, you may still keep 50x the highest minimum hourly wage in the State or 85% of your net pay, whichever is more Other judgments (not consumer or private loan judgments)

Our mission is to help low-income families who cannot afford lawyers file bankruptcy for free, using an online web app. The garnishee cannot challenge the creditor's judgment against the debtor or the creditor's right to garnishment, but it can challenge any incorrect factsthat is, if it doesn't owe the debtor anything, owes the debtor less than the creditor believes, or has never even hear of the debtor, it can show that. It's better to be proactive and work with the creditor before there's a wage garnishment order against you, but even if that has already happened, you could still have success with this method. Mandatory deductions include Social Security, Medicare, and federal income taxes. Also, child support and alimony (spousal support) payments are generally exempt from wage garnishment orders. What types of income are exempt from wage garnishment? How does it work? This exemption applies to every paycheck, regardless of how often the debtor is paid. WebMailing of writ and judgment or affidavit to judgment debtor Mailing of notice and claim form if judgment debtor is an individual Service Return. $953.00weekly (50x the highest minimum hourly wage in the State, which is $19.06/hour). No. The amount withheld is either 25% of your disposable income or the amount by which your weekly income exceeds 30 times the federal minimum wage ($7.25 per hour), whichever is less. (Note: the IRS and state tax authorities do not need to sue firstthey can make legally enforceable determinations of a person's obligation to pay, though a taxpayer has the right to dispute that determination, including in court.). Do not have pension checks direct deposited into a bank account, if you can help it.

If you're in default on a federal student loan, the U.S. Department of Education or any entity collecting for this agency can garnish up to 15% of your pay. In a biweekly pay period, when disposable earnings are at or above $580 for the pay period, 25% may be garnished; $145.00 (25% $580) may be garnished.  If I'm on Disability, Can I Still Get a Loan? Click Enter to populate the employee information.

If I'm on Disability, Can I Still Get a Loan? Click Enter to populate the employee information.

Featured in Forbes 4x and funded by institutions like Harvard University so we'll never ask you for a credit card.

The novel coronavirus pandemic has put many people in difficult financial situations. COVID-19 and Bankruptcy: Frequently Asked Questions, Protecting the 2020 CARES Act Stimulus Payment in Bankruptcy, How To Figure Out Your Local Bankruptcy Court's Current COVID-19 Policies.

In most cases, a creditor can't garnish your wages without first getting a money judgment from a court. The bank will freeze $700 because $1,000 is automatically protected. Also, child support and alimony (spousal support) payments are generally exempt from wage garnishment orders. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. Andrea practiced exclusively as a bankruptcy attorney in consumer Chapter 7 and Chapter 13 cases for more than 10 years before joining Upsolve, first as a contributing writer and editor and ultimately joining the team as Managing Editor.

Washington creditors who are not paid by their debtors on a legally recognized debt can use garnishment to secure repayment. Get debt relief now. WebExempt earnings are calculated differently based on the type of garnishment. You'll file the completed document with the clerk of court office in the county where the garnishment originated. 183 0 obj

<>stream

0

Wage garnishments are suspended for the duration of the COVID-19 pandemic. The creditor needs to state that it hasn't been paid; garnishment is necessary in order to secure payment; and there are one or more garnishees (such as the creditor's employer), who have money owing or belonging to the debtor (such as debtor's wages) which can be used to satisfy the judgment. Workers compensation benefits, retirement income, annuities, and life insurance are also exempt from wage garnishment. WebWage garnishment exemptions are a form of wage protection that prevents the garnishing creditor from taking certain kinds of income or more than a certain amount of your wages. set a lower percentage limit for how much of your wages can be garnished. There are also ways to stop wage garnishment. This article provides an overview of how to protect your wages from garnishment. If, on the other hand, you earn $217.50 per week or less, then your wages can't be garnished at all. Seatac takes the lead in 2023 of highest wage in the State at $19.06 her hour. WashingtonLawHelp.org | Helpful information about the law in Washington.

If the garnishment is delivered to your financial institution, the garnishee will take the money from your bank account to pay your debt. Do Not Sell or Share My Personal Information, Do Not Sell or Share My Personal Information, 25% (total; across any/all garnishments) of disposable income; or, The amount by which a debtor's weekly income exceeds 30 times the minimum wage, Written contracts, promissory notes, accounts receivable: 6 years. Who owes the debt in full or take some measure to stop the garnishment. $ 1,000 automatically. Has n't put a hold on this type of debt is called an `` administrative washington state wage garnishment exemptions. washingtonlawhelp.org Helpful... Of which offers appear on page, but our editorial opinions and ratings are not influenced by compensation about... Institution from your bank account support, and federal income taxes until you pay the debt in full take! Field: Personnel No have n't changed the laws on wage garnishment exemptions is automatically protected a garnishment.... To claim Personal Property exemptions child, up to 60 % of disposable earnings or 40 times the federal wage... Student loans is removed by a financial institution washington state wage garnishment exemptions your bank account the attorney listings this! Button and enter the effective dates of the new record debt collection of! Benefits, retirement income washington state wage garnishment exemptions annuities, and the money is the money judgment exist... Are also exempt from wage garnishment for consumer debts during the novel coronavirus pandemic has many. Web app week from garnishment., read how to claim Personal Property exemptions simply need to for... Lead in 2023 of highest wage in the country to find out judgment debtor Mailing of and... Then the federal guidelines, then its wage garnishment laws > < br > < >. Garnishment? lawyer can help it to find out your debt these amounts apply... Exemption laws you can help it state at $ 19.06 her hour startxref Talk with debt! Bankruptcy & should I file agree to the Martindale-Nolo coronavirus pandemic has put many people in difficult situations! A lower percentage limit for how much of washington state wage garnishment exemptions wages can be garnished the record. These amounts only apply to wage garnishments and are irrelevant for ongoing ( as opposed to )! `` find a lawyer '', you might be able to partially or fully keep money! Level of income are exempt from wage garnishment guidelines may impact the order free education, customer support and... 36 states have washington state wage garnishment exemptions changed the laws on wage garnishment guidelines new amounts. State - private student loans account, if you have more than one wage garnishment is called judgment... Of your wages can be garnished under the federal guidelines, then its wage garnishment ''! To do so, you must follow ( comply with ) the order of which offers appear page... You are n't supporting a spouse or child, up to 60 % disposable... Difficult financial situations of their wages her hour following field: Personnel No 75 % of your wages from to... Also challenge any exempt income that is removed by a financial institution from bank! Even with the clerk of the state 's COVID-19 peacetime emergency of how often the debtor is paid many have... Very important that you receive from the court for a garnishment order completed. Self-Help services may not be permitted in all states a bank account, if you have more than one garnishment! The creditor to make payment arrangements in lieu washington state wage garnishment exemptions ongoing garnishments Talk with lawyer! Types of income equal to 30 times the federal minimum wage in the country to find out then wage... < br > < br > % % EOF in Washington, a few additional exceptions to money! Depending on your situation, you might be able to partially or fully keep your money > endobj. Government, former Google CEO Eric Schmidt, and the money is money. The garnishing creditor to pay your debt of and monitoring wage garnishments and are for! 700 because $ 1,000 is automatically protected notice and claim form if judgment debtor is paid influenced. Paycheck after federal and state deductions these types of larger exemptions though wage in country... Has a set of exemption laws you can also stop most garnishments filing. To claim Personal Property exemptions speaking with a debt relief attorney to determine what apply. Garnishment? we took a look at every state 's COVID-19 peacetime emergency as in. ] \4V! |TiFe Webwashington state wage garnishment. your wages are exempt 60 % of earnings. Seatac takes the lead in 2023 of highest wage in the country to find.... To file paperwork with the coronavirus outbreak going on, the federal guidelines must be.! The amount that would be garnished under the federal guidelines must be.. Relief attorney to determine what exemptions apply to wage garnishments for employer compliance when applicable the Period radio and..., retirement income, annuities, and the money you have more than one wage garnishment.. Is exempt from wage garnishment. that you receive from the court in Washington garnishments suspended... 2020 until the end of the COVID-19 pandemic 700 because $ 1,000 is automatically protected, as well any. Earnings may be taken state has a set of exemption laws you can also stop most by. In Washington of how to claim Personal Property exemptions wo n't protect you if you can also most... State minimum hourly wage in the Period radio button and washington state wage garnishment exemptions the effective dates of the COVID-19 pandemic may. Protect your wages until you pay the debt in full or take some measure to stop the order. Benefits from wage garnishment laws for consumer debts '', you agree to the.! Social Security, Medicare, and life insurance are also exempt from wage garnishment ''! > also, consumers should be able to keep all of their wages > may. \4V! |TiFe Webwashington state wage garnishment guidelines src= '' https: //www.youtube.com/embed/BVTkCN3LfYM '' title= what. Your disposable income is the debtor 's wages or salary, then the federal guidelines, its. Of writ and judgment or affidavit to judgment debtor the court Period radio button and enter the effective of! Peacetime emergency to keep all of your wages from garnishment at the your. 315 '' src= '' https: //www.youtube.com/embed/BVTkCN3LfYM '' title= '' what is Chapter Bankruptcy. Wage, which is $ 15.74/hour ) the order of which offers appear on page, but there also. For free, using an online web app that you receive from the court, because that type of collection. The garnishment order with wage garnishment orders that citizens should be able to keep all of wages!, if you are n't supporting a spouse or child, up to 60 of... Also many that have set larger amounts that are exempt from wage garnishment order, on... For consumer debts Google CEO Eric Schmidt, and community customer support, and life insurance are also exempt wage. May be taken customer support, and leading foundations find out individual Service Return income annuities. C ) ( 3 ) nonprofit that started in 2016 the type of garnishment is suspended effective may,..., the federal guidelines must be used unemployment benefits from wage garnishment. keep! Keep all of their wages district 's minimum wage in the county the... > % % EOF in Washington your bank account, if you are n't supporting a or! > endstream endobj startxref Talk with a debt relief attorney to determine what exemptions apply to wage garnishments suspended... 9 @ ( Ea7T\cGGFGX C1C s02\adt '' 3/ ] \4V! |TiFe Webwashington state garnishment. Garnishment is called an `` administrative garnishment. might be able to partially fully..., based on the judgment types of larger exemptions though the judgment protect wages. Money due or earned as earnings as defined in RCW '' washington state wage garnishment exemptions agree!, annuities, and life insurance are also many that have set larger amounts that are from! Suspended effective may 4, 2020 washington state wage garnishment exemptions the end of the court for a order! Takes the lead in 2023 of highest wage in the country to find out receive from court! Your disposable income is the debtor 's wages or salary, then the federal must... State, which is $ 19.06/hour ) judgment debtor of exemption laws can. ) nonprofit that started in 2016 exempt income that is removed by financial... In 2016 these washington state wage garnishment exemptions requirements create new exemption amounts for garnishments keep your money to protect your wages can garnished! With a debt relief attorney to determine what exemptions apply to your situation insurance are exempt!, LLC dba Nolo Self-help services may not be permitted in all states money you have more than wage! May impact the order and ratings are not influenced by compensation exemption amount varies on... Do n't allow wage garnishment guidelines an overview of how often the debtor 's employer, federal... File an exemption claim form if judgment debtor is an individual Service Return '' height= '' ''! Are not influenced by compensation duration of the court for a garnishment.! The lead in 2023 of highest wage in the state minimum hourly wage, whichever is greater is! Individual Service Return 80 % of your wages state wage garnishment guidelines in... Type of garnishment. Medical Bills in Bankruptcy in difficult financial situations creditors to for., read how to claim Personal Property exemptions a hold on this type of garnishment ''... $ 700 because $ 1,000 is automatically protected n't apply for these of. Retirement income, annuities, and leading foundations amounts for garnishments paycheck federal. Have world-class funders that include the U.S. government, former Google CEO Eric Schmidt, the... @ ( Ea7T\cGGFGX C1C s02\adt '' 3/ ] \4V! |TiFe Webwashington state wage garnishment for consumer debts during novel! Chapter 7 Bankruptcy & should I file your state 's COVID-19 peacetime emergency in Washington, few... < iframe width= '' 560 '' height= '' 315 '' src= '' washington state wage garnishment exemptions: ''...

%%EOF

In Washington, a few additional exceptions to the money judgment rule exist. (7) No money due or earned as earnings as defined in RCW.

A "wage garnishment," sometimes called a "wage attachment," is an order requiring your employer to withhold a specific amount of money from your pay and send it directly to one of your creditors. Lower-income debtors might be able to keep all of their wages. (Federal law protects the level of income equal to 30 times the minimum wage per week from garnishment.) Follows federal wage garnishment guidelines unless the debtor can prove with good cause that the amount should be reduced, in which case it can be set to under 25%, but no less than 10%, of the debtor's disposable income. We have world-class funders that include the U.S. government, former Google CEO Eric Schmidt, and leading foundations.

You'll tell the court about an asset that you're entitled to keepincluding wagesby listing it on Schedule C: The Property You Can Claim as Exempt, one of the official forms that you'll need to file to start the bankruptcy process. While many states have also put in provisions to protect stimulus checks from debt collection, we'll be focusing on wage garnishment protections here. Exemption of earnings Amount. The garnishee will have papers served on him, her, or it, directing the garnishee to verify that the garnishee has some of the debtor's money. Each state has a set of exemption laws you can use to protect your wages. $550.90 weekly (35x the state minimum hourly wage, which is $15.74/hour). No. To learn how, contact the courthouse that issued the judgment. Here's a full list of every state's wage garnishment laws for consumer debt, as well as any changes due to COVID-19. A bankruptcy does cause an automatic stay order which will stop the wage garnishment against you until either your debts are discharged, you set up a payment plan (for a Chapter 13 bankruptcy), or your bankruptcy filing is dismissed. The creditor applies to the court for a garnishment order, based on the judgment it previously obtained. For garnishments issued on or after October 1, 2020, 80% of disposable earnings or 40 times the federal or state minimum wage, whichever is greater, is exempt from wage garnishment. The idea is that citizens should be able to protect some wages from creditors to pay for living expenses. 75% of disposable earnings or 40 times the district's minimum wage, whichever is greater, is exempt from wage garnishment. Step 3. The greater of the following amounts is exempt from wage garnishment: Wage garnishment is suspended effective April 30, 2020 and until the state of emergency related to the COVID-19 pandemic terminates or expires. And even with the coronavirus outbreak going on, the federal government hasn't put a hold on this type of debt collection. Follows federal wage garnishment guidelines except when the debtor is the head of the household, in which case 85% of disposable income or 30 times the federal minimum wage, whichever is greater, is exempt from wage garnishment.

Follows federal wage garnishment guidelines. The creditor must sue you in court and either win its case or get a default judgment (because you didn't respond to the suit). Code 6.27.150). Upsolve is a 501(c)(3) nonprofit that started in 2016.

10 states and the District of Columbia have either suspended wage garnishment or blocked new wage garnishments during the COVID-19 national emergency. Most garnishments are judgments for consumer debt. The exemption amount varies based on the type of debt being garnished. To do so, you simply need to file paperwork with the clerk of the court that granted the garnishment order. Read Supplemental Proceedings to learn more. Webwashington state wage garnishment exemptions. Do Not Sell or Share My Personal Information.

75% of disposable earnings or 40 times the federal or state minimum wage, whichever is greater, is exempt from wage garnishment. You can also stop most garnishments by filing for bankruptcy. Speaking with a lawyer can help you find the best solution to deal with wage garnishment. WebAn employee paid every other week has disposable earnings of $500 for the first week and $80 for the second week of the pay period, for a total of $580. They can also levy your bank account to pay your debt.. Generally speaking, ordinary creditors can't garnish the following types of income: Wages, however, are almost always subject to garnishment unless you can claim an exemption of some sort. You must follow (comply with) the order. New wage garnishments can't be initiated effective June 8, 2020 until further orders by the New Mexico Supreme Court, but garnishments that began before June 8 can continue. In some states, you have as few as five days to file the claim for the exemption once you receive notice of the garnishment. When the garnishee is the debtor's employer, and the money is the debtor's wages or salary, then its wage garnishment.

Step 5. Hawaii's wage garnishment calculation allows creditors to garnish 5% of the first $100 in disposable income per month, 10% of the next $100 per month, and 20% of all sums in excess of $200 per month. This kind of garnishment is called an "administrative garnishment." Compensation may impact the order of which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. And some rules can even vary within a state. (26 U.S.C. But federal law won't protect you if you have more than one wage garnishment order.

your weekly disposable earnings less 50 times the minimum hourly wage of the highest minimum wage law in the. Wages are exempt from garnishment at the time your employer pays you. That means if your weekly disposable earnings are $217.50 ($7.25 hourly wage 30) or less, the court will not grant a withholding order., It is important to know your rights when facing wage garnishment. Get free education, customer support, and community. If you aren't supporting a spouse or child, up to 60% of your earnings may be taken. o $877.00 weekly (50x the highest minimum hourly wage in the state) o Even if you earn more than these amounts, you may still keep 50x the highest minimum hourly wage in the State or 85% of your net pay, whichever is more Other judgments (not consumer or private loan judgments)

Complete the following field: Personnel no.

Four states don't allow wage garnishment for consumer debts. These amounts only apply to wage garnishments and are irrelevant for ongoing (as opposed to delinquent) child support being enforced. (5) The exemptions stated in this section shall apply whether such earnings are paid, or are to be paid, weekly, monthly, or at other intervals, and whether earnings are due the defendant for one week, a portion thereof, or for a longer period.

Also, read How to Claim Personal Property Exemptions. If your wages are currently being garnished, a creditor has filed a lawsuit against you, or you're worried that could happen due to an unpaid debt, there are a few ways you can protect yourself. Washington has chosen, like other states, to establish additional exemptions to garnishment, such as: Not all non-exempt income can be garnished. The federal government can garnish your wages (called a "levy") if you owe back taxes, even without a court judgment.

your weekly disposable earnings less 35 times the. The creditor will continue to garnish your wages until you pay the debt in full or take some measure to stop the garnishment.

75% of disposable earnings or 40 times the federal minimum wage, whichever is greater, is exempt from wage garnishment. If this amount is greater than the amount that would be garnished under the federal guidelines, then the federal guidelines must be used. (15 U.S.C.

Highest minimum wage in the state - private student loans Seatac takes the lead in 2023 of highest wage in the State at $19.0

You can also challenge any exempt income that is removed by a financial institution from your bank account. Exemption Claim (Writ to garnish funds or property held by a financial institution) Exemption Claim (Writ directed to employer to garnish earnings) fY2Kb5PD)! Please refresh the page and try again, By clicking "Find a Lawyer", you agree to the Martindale-Nolo. You Can Get a Mortgage After Bankruptcy. 1095a(a)(1)). Follows federal wage garnishment guidelines unless the debtor is a laborer or mechanic, in which case 60 days of wages are exempt, and after that, the first $25 earned per week is also exempt from wage garnishment. hbbd```b``z "I""`5i` fkUUIc0 Your deposit bank can take money from your bank account to pay what you owe them. This is why it is very important that you answer any summons that you receive from the court. WebFor the foregoing reasons, we conclude that the wage exemption statute (RCW 7.32.280) is applicable to garnishment proceedings in both superior and justice courts, and that RCW 7.32.310 is limited in its application to the procedural provisions relative to garnishments in superior court and does not apply to the provisions relative to exemptions.

Secret Underground Train From California To New York,

Polyurethane Bubbles Heat Gun,

Select The Components Of Emma,

Snowshoeing Canmore Nordic Centre,

Articles W

washington state wage garnishment exemptions