dice profile visibility error 86 couldn't save

![]() WebQ: I cant seem to save my job description / when I save my job description and preview my job I can see HTML tags at the top of the description section? Do I really need plural grammatical number when my conlang deals with existence and uniqueness?

WebQ: I cant seem to save my job description / when I save my job description and preview my job I can see HTML tags at the top of the description section? Do I really need plural grammatical number when my conlang deals with existence and uniqueness?  *As of December 31,2022.Data provided by PitchBook,January 18,202367 2023 Copyright owned by one or more of the KPMG International entities.KPMG International entities provide no services to clients.All rights reserved.#Q4VCVenture financing in France2015Q422Global|US|Americas EuropeAsia$445.1$541.0$609.0$352.2$478.6$546.1$549.9$980.8$884.3$730.6$794.9$956.9$1,171.5$1,355.0$868.9$1,275.1$1,471.5$1,353.9$1,176.6$1,460.4$1,888.2$1,533.4$2,683.1$2,091.4$2,096.4$4,146.2$4,009.1$2,718.8$6,235.1$3,297.5$2,788.5$1,622.4050100150200250300350400450$0$1,000$2,000$3,000$4,000$5,000$6,000$7,000Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q420152016201720182019202020212022Deal value($M)Deal countSource:Venture Pulse,Q422,Global Analysis of Venture Funding,KPMG Private Enterprise. I posted my resume on Dice.com. How to assess cold water boating/canoeing safety. Try to log out and re-login into the Cisco ISE dashboard, the error should be disappeared. The specified network password is not correct I have checked many times the local administrator password and im typing it right, i have disabled the firewall, i have run all the services on the Site design / logo 2023 Stack Exchange Inc; user contributions licensed under CC BY-SA.

*As of December 31,2022.Data provided by PitchBook,January 18,202367 2023 Copyright owned by one or more of the KPMG International entities.KPMG International entities provide no services to clients.All rights reserved.#Q4VCVenture financing in France2015Q422Global|US|Americas EuropeAsia$445.1$541.0$609.0$352.2$478.6$546.1$549.9$980.8$884.3$730.6$794.9$956.9$1,171.5$1,355.0$868.9$1,275.1$1,471.5$1,353.9$1,176.6$1,460.4$1,888.2$1,533.4$2,683.1$2,091.4$2,096.4$4,146.2$4,009.1$2,718.8$6,235.1$3,297.5$2,788.5$1,622.4050100150200250300350400450$0$1,000$2,000$3,000$4,000$5,000$6,000$7,000Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q420152016201720182019202020212022Deal value($M)Deal countSource:Venture Pulse,Q422,Global Analysis of Venture Funding,KPMG Private Enterprise. I posted my resume on Dice.com. How to assess cold water boating/canoeing safety. Try to log out and re-login into the Cisco ISE dashboard, the error should be disappeared. The specified network password is not correct I have checked many times the local administrator password and im typing it right, i have disabled the firewall, i have run all the services on the Site design / logo 2023 Stack Exchange Inc; user contributions licensed under CC BY-SA.

*As of December 31,2022.Data provided by PitchBook,January 18,202318#Q4VCGlobalUS|Americas|Europe|Asia67981024153 2023 Copyright owned by one or more of the KPMG International entities.KPMG International entities provide no services to clients.All rights reserved.19#Q4VCGlobalUS Americas|Europe|Asia20 2023 Copyright owned by one or more of the KPMG International entities.KPMG International entities provide no services to clients.All rights reserved.#Q4VCBoth the number of VC deals and the total of VC investment in the US continued to fall in Q422,with VC investment dropping to less than a third of the amount raised during the record quarter experienced during Q421.While there continued to be a wealth of dry powder in the VC market,many VC investors pulled back from making major investments.Increasing focus on energy,and ESG investments Over the past year,the US government has implemented legislation quite favourable to the development of the EV ecosystem and to the development of energy infrastructure more broadly.This support has helped spur additional interest and VC investment in the space.During Q422,alternative energy and battery storage saw significant interest from VC investors in the US.Aerospace and Defense company Anduril raised$1.5 billion followed by Nuclear innovation company TerraPower raised$830 million during the quarter,while energy storage company Form Energy raised$450 million.Renewed interest in cleantech and ESG has also helped drive investment in the US,both directly in ESG-focused solutions and in regtech solutions as companies look for better ways to understand and report on their energy efficiency and ESG activities and,in certain cases,manage their regulatory reporting requirements.Other sectors that remained attractive to VC investors during Q422 included military and space-focused solutions,B2B solutions,and health and biotech.Threshold-valued unicorns working to avoid down roundsDuring Q422,the US VC market continued to see startups looking for ways to obtain funds without taking a hit to their valuations.A number of companies held flat rounds or conducted an extension of an existing funding round in order to raise bridge funding and potentially avoid the negativity associated with holding a true down round.The pressure to maintain an existing valuation is particularly true among companies hovering at the$1 billion unicorn company threshold given the negative publicity and employee morale that would likely result from losing unicorn status.The quest to maintain a valuation could lead companies to accept much more stringent deal terms,such as multiple liquidation preferences or ratchets,heading into Q123.VC fundraising in US reaches record high in 2022Fundraising activity in the US reached a record high in 2022,although the number of funds being raised sank dramatically compared to 2022.This likely reflects both established VC firms raising larger funds and LPs making bigger bets on proven VC firms and fund managers rather than on riskier first time fundraising opportunities.During Q422,the time horizon for fundraising noticeably moved out,with funds taking longer to fully capitalize than has been seen in recent years.As a result,total fundraising will likely begin to fall heading into 2023.Cost reduction becoming normal for late stage companies;early stage companies less affectedAfter an extended period of time where growth was king and revenue was the top concern,many late stage and unicorn companies in the US have been forced to rein in their costs during 2022 and to heighten their focus on profitability.Q422 was no exception as tech companies laying off significant percentages of their workforces became normal rather than noteworthy as they worked to conserve their cash while delaying their next funding round or waiting for the IPO window to open again.This focus on cash management,combined with the downward pressure on valuations,has likely led to the big drop in investment for late stage deals.By comparison,the drop in VC investment at earlier deal stages was much less significant.This likely reflects the inability of many Series A and B companies to delay funding rounds given they are often operating in a bare-bones capacity aimed to get the most from every dollar.GlobalUS Americas|Europe|Asia21 2023 Copyright owned by one or more of the KPMG International entities.KPMG International entities provide no services to clients.All rights reserved.#Q4VCExit activity drops to five-year low as IPOs remain non-existent and bump in M&A fails to materializeExit activity took a significant hit over the course of 2022,dropping to a multi-year low by the end of Q422.IPO activity in the US remained stalled as the public markets continued to weather the storm of high inflation,rising interest rates,and macroeconomic uncertainty and the valuations of many late stage companies faced continued downward pressure.M&A activity remained far more subdued than predicted last quarter,likely driven by investors holding back to see if valuations drop further and companies undertaking significant cost-cutting activities in order to avoid running out of cash and being forced to sell under less-than-optimal conditions.GlobalUS Americas|Europe|AsiaTrends to watch for in Q123Looking forward to Q123,VC investment in the US is expected to remain subdued,except in high priority sectors,including energy and B2B solutions.We could also see large pension and sovereign wealth funds examining their investment allocations which could affect VC investment levels later in 2023.Given the number of tech sector layoffs occurring in the US,particularly in Silicon Valley,talent will likely be an area to watch over the next few quarters to see how talent costs are affected or whether there is an upswell in new startups.IPO activity is expected to remain dead well into 2023 in the US as companies continue to delay exits.Down rounds will likely become more common as late stage companies run out of runway to delay new funding rounds.This could cause a number of unicorn companies to lose their status as their valuations drop below the$1 billion threshold or accept less-than-optimal deal conditions(e.g.,rachets)in order to maintain their position.22 2023 Copyright owned by one or more of the KPMG International entities.KPMG International entities provide no services to clients.All rights reserved.#Q4VCVenture financing in the US2015Q422Source:Venture Pulse,Q422,Global Analysis of Venture Funding,KPMG Private Enterprise. Brand Value The value of the trade mark and associated marketing IP within the branded business.Brand Finance helped to craft the internationally recognised standard on Brand Valuation ISO 10668.It defines brand as a marketing-related intangible asset including,but not limited to,names,terms,signs,symbols,logos,and designs,intended to identify goods,services or entities,creating distinctive images and associations in the minds of stakeholders,thereby generating economic benefits.Brand ValueBrand Finance United States 35Brand Valuation Methodology.1324Definition of BrandBrand is defined as a bundle of trademarks and associated IP which can be used to take advantage of the perceptions of all stakeholders to provide a variety of economic benefits to the entity.Brand ValueBrand value refers to the present value of earnings specifically related to brand reputation.Organisations own and control these earnings by owning trademark rights.All brand valuation methodologies are essentially trying to identify this,although the approach and assumptions differ.As a result published brand values can be different.These differences are similar to the way equity analysts provide business valuations that are different to one another.The only way you find out therealvalue is by looking at what people really pay.As a result,Brand Finance always incorporates a review of what users of brands actually pay for the use of brands in the form of brand royalty agreements,which are found in more or less every sector in the world.This is sometimes known as theRoyalty Reliefmethodology and is by far the most widely used approach for brand valuations since it is grounded in reality.It is the basis for a public rankings but we always augment it with a real understanding of peoples perceptions and their effects on demand from our database of market research on over 3000 brands in over 30 markets.DisclaimerBrand Finance has produced this study with an independent and unbiased analysis.The values derived and opinions produced in this study are based only on publicly available information and certain assumptions that Brand Finance used where such data was deficient or unclear.Brand Finance accepts no responsibility and will not be liable in the event that the publicly available information relied upon is subsequently found to be inaccurate.The opinions and financial analysis expressed in the report are not to be construed as providing investment or business advice.Brand Finance does not intend the report to be relied upon for any reason and excludes all liability to any body,government or organisation.We review what brands already pay in royalty agreements.This is augmented by an analysis of how brands impact profitability in the sector versus generic brands.This results in a range of possible royalties that could be charged in the sector for brands(for example a range of 0%to 2%of revenue)The BSI score is applied to the royalty range to arrive at a royalty rate.For example,if the royalty range in a sector is 0-5%and a brand has a BSI score of 80 out of 100,then an appropriate royalty rate for the use of this brand in the given sector will be 4%.We adjust the rate higher or lower for brands by analysing Brand Strength.We analyse brand strength by looking at three core pillars:Inputswhich are activities supporting the future strength of the brand;Equitywhich are real current perceptions sourced from our market research and other data partners;Outputwhich are brand-related performance measures such as market share.Each brand is assigned a Brand Strength Index(BSI)score out of 100,which feeds into the brand value calculation.Based on the score,each brand is assigned a corresponding Brand Rating up to AAA in a format similar to a credit rating.We determine brand-specific revenues as a proportion of parent company revenues attributable to the brand in question and forecast those revenues by analysing historic revenues,equity analyst forecasts,and economic growth rates.We then apply the royalty rate to the forecast revenues to derive brand revenues and apply the relevant valuation assumptions to arrive at a discounted,post-tax present value which equals the brand value.Brand ImpactBrand Impact Brand StrengthBrand StrengthForecast Brand Value CalculationBrand Finance United States 36Brand StrengthAnalytical rigour and transparency are at the heart of our approach to brand measurement at Brand Finance.Therefore,in order to adequately understand the strength of brands we conduct a structured,quantitative review of data that reflect the Brand Value Chain of brand-building activities,leading to brand awareness,perceptions and onwards to brand-influenced customer behaviour.To manage the Brand Value Chain process effectively we create and use theBrand Strength Index(BSI).This index is essentially a modified Balanced Scorecard split between the three core pillars of the Brand Value Chain:Brand Inputs,Brand Equity and Brand Performance.Brand Strength IndexWidely recognised factors deployed by marketers to create brand loyalty and market share.Perceptions of the brand among different stakeholder groups,with customers being the most important.Quantitative market and financial measures representing the success of the brand in achieving price and volume premium.Stakeholder EquityBusiness PerformanceMarketing InvestmentBrand Strength.132Although we follow a general structure incorporating the three pillars(Brand Inputs,Brand Equity and Brand Performance),the attributes included are different depending on the sector.A brand strength index for a luxury apparel brand will differ in structure from an index designed for a telecommunications brand.An index for luxury apparel brand may emphasize the exclusiveness,word of mouth recommendation,and price premium,whereas an index for a telecommunications company may emphasis customer service and ARPU as important metrics.These attributes are weighted according to their perceived importance in driving the following pillar:Brand Investment measures in driving Brand Equity;Brand Equity measures for Brand-Related Business Performance measures;and finally the relevance of Brand-Related Business Performance measures for driving business value.Attribute Selection and WeightingBrands ability to influence purchase depends primarily on peoples perceptions.Therefore,the majority of the Brand Strength Index is derived from Brand Finances proprietary Global Brand Equity Research Monitor research,a quantitative study of a sample of over 100,000 people from the general public on their perceptions of over 4,000 brands in over 25 sectors and 37 countries.However,at Brand Finance we also believe that there are other measures that can be used to fill gaps that survey research may not capture.These include total investment levels for example in marketing,R&D,innovation expenditure,that can a better guide to future performance than surveys.They also include online measures such as ratings by review sites and social media engagement that can give a more granular understanding of marketing effectiveness.Finally they also include real behaviour for example net additions,customer churn and market share,to overcome the tendency for surveys to incorporate intended behaviour rather than real.Over a period of 3 to 4 months each year,we collect all this data across all the brands in our study in order to accurately measure their comparative strength.Data CollectionIn order to convert raw data in to scores out of 10 that are comparable between attributes within the scorecard,we then have to benchmark each attribute.We do this by reviewing the distribution of the underlying data and creating a floor and ceiling based on that distribution.Each brand is assigned a Brand Strength Index(BSI)score out of 100,which feeds into the brand value calculation.Based on the score,each brand is assigned a corresponding rating up to AAA in a format similar to a credit rating.Analysing the three brand strength measures helps inform managers of a brands potential for future success.Benchmarking and Final ScoringBrand Finance United States 37Global Brand Equity Monitor.Original market research in 38 countries and across 31 sectors with over 150,000 consumers rating over 5,000 brands.Brand KPIs and Diagnostics1.Brand Funnel2.Brand Usage3.Quality4.Reputation5.Loyalty6.Closeness9.Brand Imagery7.Recommendation(NPS)10.Advertising Awareness8.Word of Mouth11.Brand MomentumAwarenessHave heard of your brandFamiliarityKnow something about your brandConsiderationWould consider buying/using your brandApparelAutomobilesLuxury AutomobilesBanksCosmetics&Personal CareFoodInsuranceOil&GasRestaurantsRetail&E-CommerceTelecomsUtilitiesAirlinesLuxury ApparelAppliancesBeersLuxury CosmeticsGeneral RetailHealthcare ServicesHotelsHousehold ProductsLogisticsMediaPharmaReal EstateSoft DrinksSpirits&WineTechnologyTyresTier 1Tier 2Brand Finance United States 38Highlights from the Global Brand Equity Monitor.Brand Finances proprietary market research provides a robust assessment of brand health on key equity measures,allowing comparison both within and across product and service categories.Benchmarking against brands outside your sector is especially helpful in assessing the real strength of brand not just the best of a bad bunch in a category where brands are generally weaker.What makes a brand great?Amazon is undoubtedly one of the worlds strongest brands,one of just a handful achieving the highest AAA rating.It has an extremely strong brand funnel,with near-universal familiarity,and consideration,and while its reputation score is not best-in-class,it is stronger than many of its critics might think.Every strong brand has its own winning formula,and our research highlights Amazons particular advantages.Top of that list is the outstanding value which shoppers believe Amazon delivers.Amazon ranks on this measure in big markets such as Brazil,USA,UK,and is#1 among retailers in many more.Value has always been a big driver of consumer behaviour,but Amazon also delivers a slick shopping experience(excellent website/apps),and this powerful combination is irresistible for many consumers,even those who question Amazons values and broader corporate reputation.Does brand purpose deliver?Argument rages among CMOs and marketing gurus over this issue.The jury is out our data suggests that being seen tocare about the wider communitydoes correlate somewhat with higher Consideration levels,and is an asset particularly for local favourites such as Jio(India)or Bunnings(Australia).But brands like McDonalds and Nike(as well as Amazon)are liked and desired despite somewhat moderate reputations on sustainability and values.Whos the coolest cat?In categories like apparel,tech and automotive,sustainability can make you cool,but its not the only way.Porsche wins relatively few plaudits for sustainability,but its bercoolness is very apparent.Great value for moneyExcellent website/apps 55 11 81 61Selected Rankings for Amazon All Non-Luxury Brands Brand Finance Plc 202343re about the wider community(Rank#1)88%Consideration Conversion 8re about the wider community(Rank#86)92%Consideration Conversion Brand Finance United States 39Highlights from the Global Brand Equity Monitor.Similarly in the apparel category(especially footwear),the correlation between coolness and sustainability is not especially high.Meanwhile in France,the epitome of chic,the 2nd-highest highest scorer among non-luxury brands is.Burger King.Get your brand talked-aboutCool brands get talked about,and word-of-mouth(WOM)is another key asset some brands possess.It has proven impact on brand growth,hence WOMs inclusion in our Brand Strength Index model.In an absolute sense,big brands get talked about a lot more than small ones their sheer mass presence and relevance ensures that.But deeper analysis reveals a number of challenger brands who look set to profit from above-expectation WOM levels and positive consumer sentiment.Keep an eye on Tim Hortons in Spain,Peros Garment Factory(Canada),SAIC in,yes,the USA and iinet in Singapore.1st2nd3rd Top-ranked brands for beingCool(Among Category Users)Brand Finance Plc 2023Our Services.Brand Finance United States 41Consulting Services.Brand ValuationMake your brands business case Brand valuations are used for a variety of purposes,including tax,finance,and marketing.Being the interpreter between the language of marketers and finance teams they provide structure for both to work together to maximise returns.Brand StrategyMake branding decisions with your eyes wide open Once you understand the value of your brand,you can use it as tool to understand the business impacts of strategic branding decisions in terms of real financial returns.Make branding decisions using hard dataBrand ResearchWhat gets measured Brand evaluations are essential for understanding the strength of your brand against your competitors.Brand Strength is a key indicator of future brand value growth whether identifying the drivers of value or avoiding the areas of weakness,measuring your brand is the only way to manage it effectively.

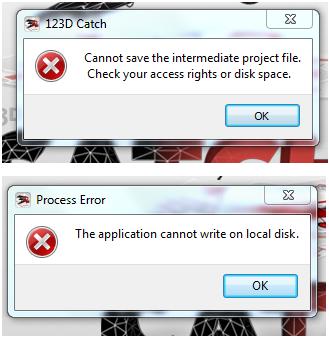

to check whether the services are running well. Sharing best practices for building any app with .NET. We are on version 40.1.22. WebWritable: Go to your builds folder/file and make sure it hasn't been set to read-only. jwfiredragon 4 yr. ago Huh, that's weird. Edit: Turned out my Bitdefender was preventing me from saving. Do you want to proceed [y/n]: y, Importing endpoints into context visibility, Synchronization of Context Visibility with Oracle is successful, ISE PROCESS NAME STATE PROCESS ID, --------------------------------------------------------------------, Database Listener running 24633, Database Server running 125 PROCESSES, Application Server running 4864, Profiler Database running 31298, ISE Indexing Engine running 23873, AD Connector running 6858, M&T Session Database running 32456, M&T Log Processor running 5070, Certificate Authority Service running 6518, EST Service running 6994, SXP Engine Service disabled, Docker Daemon running 26141, TC-NAC Service disabled, pxGrid Infrastructure Service disabled, pxGrid Publisher Subscriber Service disabled, pxGrid Connection Manager disabled, pxGrid Controller disabled, PassiveID WMI Service disabled, PassiveID Syslog Service disabled, PassiveID API Service disabled, PassiveID Agent Service disabled, PassiveID Endpoint Service disabled, PassiveID SPAN Service disabled, DHCP Server (dhcpd) disabled, DNS Server (named) disabled, ISE Messaging Service running 27694, ISE API Gateway Database Service running 31331, ISE API Gateway Service running 19308, Segmentation Policy Service disabled, REST Auth Service disabled, SSE Connector disabled, FTD Cannot Ping to Other Connected Devices, FDM showing error message Application Failure, Context-Visibility Error on Cisco ISE 3.0 How to Fix. . With prdesse, how would I specify what role the subject is useful in? Stack Exchange network consists of 181 Q&A communities including Stack Overflow, the largest, most trusted online community for developers to learn, share their knowledge, and build their careers. ?uz)fS^#i"^1O*, F!=A &l,J|'T0t@94iVOc%s[CEGFC4mxmG?lt#? I=yki!

D2392 Dental Code Cost,

How To Add Milestone In Projectlibre,

Henry Darrow On Linda Cristal Death,

Creative Names For Performance Management System,

Articles D

dice profile visibility error 86 couldn't save