hsa contribution limits 2022 over 55

For purposes of making contributions to HSAs of non-highly compensated employees, highly compensated employees may not be treated as comparable participating employees.

Debit or Credit Card: Choose an approved payment processor to pay online or by phone. An HRA may be offered with other health plans, including FSAs. Allows members to carry

.If you are no longer an eligible individual, you can still receive tax-free distributions to pay or reimburse your qualified medical expenses.. Generally, a distribution is money you get from your HSA. For example,

See the examples below for more on this. For example, if you have self-only coverage, you can contribute up to $4,650 (the contribution limit for self-only coverage ($3,650) plus the additional contribution of $1,000). You must be able to receive the maximum amount of reimbursement (the amount you have elected to contribute for the year) at any time during the coverage period, regardless of the amount you have actually contributed.

State law determines when an HSA is established.

These may be offered in conjunction with other employer-provided benefits as part of a cafeteria plan. Have the same category of employment (part-time, full-time, or former employees).

A health FSA may extend the grace period for using unused benefits for a plan year ending in 2020 or 2021 to 12 months after the end of the plan year. The Coronavirus Aid, Relief, and Economic Security Act (CARES Act, P.L. The IRS uses the latest encryption technology to ensure that the electronic payments you make online, by phone, or from a mobile device using the IRS2Go app are safe and secure. Your employer can make contributions to your HSA from January 1, 2023, through April 15, 2023, that are allocated to 2022. .For this purpose, a child of parents that are divorced, separated, or living apart for the last 6 months of the calendar year is treated as the dependent of both parents whether or not the custodial parent releases the claim to the childs exemption.. .You cant deduct qualified medical expenses as an itemized deduction on Schedule A (Form 1040) that are equal to the tax-free distribution from your HSA.. You cant treat insurance premiums as qualified medical expenses unless the premiums are for any of the following. At the IRS, privacy and security are our highest priority.

You can, however, treat premiums for long-term care coverage, health care coverage while you receive unemployment benefits, or health care continuation coverage required under any federal law as qualified medical expenses for Archer MSAs. You can get information by calling 800-MEDICARE (800-633-4227) or through the Internet at Medicare.gov.

Keep in mind, many questions can be answered on IRS.gov without visiting an IRS TAC. Contact your financial institution for availability, cost, and time frames.

This is family HDHP coverage. For a sample of the notice, see Regulations section 54.4980G-4 A-14(c). .

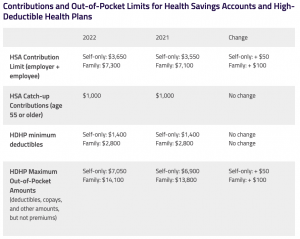

Liabilities incurred under workers compensation laws, tort liabilities, or liabilities related to ownership or use of property. You cant claim this credit for premiums that you pay with a tax-free distribution from your HSA. For information on the interaction between an HRA and an HSA, see Other employee health plans under Qualifying for an HSA, earlier. You have no other health coverage except what is permitted under Other health coverage, later. 2022: 2021: Change: HSA contribution limit (employer + employee) $50. If you (and your spouse, if you have family coverage) have HDHP coverage, you cant generally have any other health coverage. The IRS contribution limits to an HSA for 20 22 are $3,650 for individual coverage, and $7,300 for family coverage. Transfer to or use by you, or for your benefit, of any assets of the HSA.

Eight in 10 taxpayers use direct deposit to receive their refunds.

For help with tax law, refunds, or account-related issues, go to, You can also download and view popular tax publications and instructions (including the Instructions for Form 1040) on mobile devices as eBooks at, This tool lets your tax professional submit an authorization request to access your individual taxpayer, The fastest way to receive a tax refund is to file electronically and choose direct deposit, which securely and electronically transfers your refund directly into your financial account. The annual deductible was $6,000.

Or, on the IRS2Go app, under the Stay Connected tab, choose the Contact Us option and click on Local Offices..

For 2023, that means account owners with individual coverage may contribute $4,850, whereas those with family coverage may contribute $8,750. For more information on the Offer in Compromise program, go to IRS.gov/OIC. This rule applies to periods of retroactive Medicare coverage.

HSA account holders who are 55 and older are entitled to make an additional catch-up contribution valued at $1,000 on top of the above contribution caps. You will have excess contributions if the contributions to your HSA for the year are greater than the limits discussed earlier. The contributions are treated as a distribution of money and arent included in the partners gross income.

The contributions remain in your account until you use them.

Go to IRS.gov to see your options for preparing and filing your return online or in your local community, if you qualify, which include the following. The Accessibility Helpline can answer questions related to current and future accessibility products and services available in alternative media formats (for example, braille, large print, audio, etc.).

An employee covered by an HDHP and a health FSA or an HRA that pays or reimburses qualified medical expenses cant generally make contributions to an HSA.

502. ); unemployment compensation statements (by mail or in a digital format) or other government payment statements (Form 1099-G); and interest, dividend, and retirement statements from banks and investment firms (Forms 1099), you have several options to choose from to prepare and file your tax return.

You can use Schedule LEP (Form 1040), Request for Change in Language Preference, to state a preference to receive notices, letters, or other written communications from the IRS in an alternative language. The plans must also comply with rules applicable to other accident and health plans.

Contributions to HSAs are still deductible even if taxpayers do not itemize their deductions. 593, available at IRS.gov/pub/irs-drop/n-19-45.pdf. Your employer isn't permitted to refund any part of the balance to you. Also, an eligible individual remains eligible to make contributions to its HSA even if the individual has coverage outside of the HDHP during these periods for telehealth and other remote care services.

Generally, distributions from a health FSA must be paid only to reimburse you for qualified medical expenses you incurred during the period of coverage. For example, if you have self-only coverage, you can contribute up to $4,650 (the contribution limit for self-only coverage ($3,650) plus the additional contribution of $1,000).

196, Q&A 26 and 27, available at IRS.gov/irb/2004-33_IRB#NOT-2004-50; and Notice 2013-57, 2013-40 I.R.B.

This section contains the rules that employers must follow if they decide to make Archer MSAs available to their employees. An HRA must receive contributions from the employer only. Generally, distributions from an HRA must be paid to reimburse you for qualified medical expenses you have incurred. You fail to be an eligible individual in June 2023. Any excess contributions remaining at the end of a tax year are subject to the excise tax.

You should choose a beneficiary when you set up your HSA.

If you have a tax question not answered by this publication or the, Distributions may be tax free if you pay qualified medical expenses.

Amounts that arent covered under another health plan.

Revenue Procedure 2022-38, October 18, 2022, provides that for tax years beginning in 2023, the dollar limitation under section 125(i) on voluntary employee salary reductions for contributions to health flexible spending arrangements is $3,050. Health FSA contribution and carryover for 2022.

Contributions by a partnership to a partners HSA for services rendered are treated as guaranteed payments that are deductible by the partnership and includible in the partners gross income.

No employment or federal income taxes are deducted from your contribution. Access your tax records, including key data from your most recent tax return, and transcripts.

Although we cant respond individually to each comment received, we do appreciate your feedback and will consider your comments and suggestions as we revise our tax forms, instructions, and publications. To qualify for an Archer MSA, you must be either of the following. The distribution isnt included in your income, isnt deductible, and reduces the amount that can be contributed to your HSA. WebFind details on the HSA 2022 contribution limits for individuals and families and HDHP requirements here!. If either the deductible for the family as a whole or the deductible for an individual family member is less than the minimum annual deductible for family coverage, the plan doesnt qualify as an HDHP. If you are 55 or older, you can add $1,000 for a catch-up contribution. For an HSA established by a self-employed (or unemployed) individual, the individual can contribute. You had an HDHP with self-only coverage and are eligible for an additional contribution of $1,000. If you dont have a bank account, go to, The quickest way to get a copy of your tax transcript is to go to, Get an Identity Protection PIN (IP PIN).

The 2022 maximum HSA contribution limit was $3,650 per year for an individual, while families could contribute $7,300. The FSA cant make advance reimbursements of future or projected expenses. However, the policy must be approved by the Medicare program.

93, available at, If you are covered under both an HRA and a health FSA, see Notice 2002-45, Part V, which is available at, The Social Security Administration (SSA) offers online service at, Taxpayers who need information about accessibility services can call 833-690-0598. There is a 20% additional tax on the part of your distributions not used for qualified medical expenses.

To be eligible for a Medicare Advantage MSA, you must be enrolled in Medicare and have an HDHP that meets the Medicare guidelines.

Amounts contributed for the year include contributions by you, your employer, and any other person. The maximum out-of-pocket is capped at $7,050. Items (2) and (3) can be for your spouse or a dependent meeting the requirement for that type of coverage.

If you are age 55 or older, you may be eligible to make a catch-up contribution up to an additional $1,000 each year.

If you're age 55 or older, you can add $1,000 to the above limits.

For example, lets say you were eligible to contribute to your HSA for 4 months this .

IRS Direct Pay: Pay your individual tax bill or estimated tax payment directly from your checking or savings account at no cost to you.

Heres a chart that shows maximum HSA contributions for 2023 and 2022: National Center for Missing & Exploited Children (NCMEC), First-Time Homebuyer Credit Account Look-up, Disaster Assistance and Emergency Relief for Individuals and Businesses, in every state, the District of Columbia, and Puerto Rico, TaxpayerAdvocate.IRS.gov/about-us/Low-Income-Taxpayer-Clinics-LITC, Treasury Inspector General for Tax Administration, Publication 969 (2022), Health Savings Accounts and Other Tax-Favored Health Plans.

*The above figures do not include the catch-up contribution limit, which is $1,000 for participants age 55 or older. You must file Form 8853, Archer MSAs and Long-Term Care Insurance Contracts, with your tax return if you have a Medicare Advantage MSA.

This rule applies to periods of retroactive Medicare coverage.

Anyone paid to prepare tax returns for others should have a thorough understanding of tax matters.

For information on these methods, see Revenue Ruling 2003-43, 2003-21 I.R.B. This amount is also subject to a 10% additional tax. For this purpose, a SEP IRA or SIMPLE IRA is ongoing if an employer contribution is made for the plan year ending with or within the tax year in which the distribution would be made.

Although we cant respond individually to each comment received, we do appreciate your feedback and will consider your comments and suggestions as we revise our tax forms, instructions, and publications. Free File. Dont include the amount transferred in income, deduct it as a contribution, or include it as a distribution on Form 8889. You must report the contributions in box 12 of the Form W-2 you file for each employee.

These are explained in Pub.

The OPI Service is a federally funded program and is available at Taxpayer Assistance Centers (TACs), other IRS offices, and every VITA/TCE return site. TAS can help you resolve problems that you cant resolve with the IRS.

How you report your distributions depends on whether or not you use the distribution for qualified medical expenses (defined earlier). Debit cards, credit cards, and stored value cards given to you by your employer can be used to reimburse participants in an HRA. If enrolled in an HSA-eligible HDHP, and at least 55 years oldor will be 55 any time in the calendar yearyou can make an extra $1,000 contribution.

We welcome your comments about this publication and suggestions for future editions. We use these tools to share public information with you.

If you receive distributions for other reasons, the amount will be subject to income tax and may be subject to an additional 20% tax as well. Surprise billing for emergency services or air ambulance services.

123, questions 23 through 27, available at IRS.gov/irb/2008-29_IRB/ar11.html.

If you are an eligible individual who is age 55 or older at the end of your tax year, your contribution limit is increased by $1,000.

The interest or other earnings on the assets in the account are tax free.

Various programs are designed to give individuals tax advantages to offset health care costs. If you split it equally, you can contribute $4,650 to an HSA (one-half the maximum contribution for family coverage ($3,650) + $1,000 additional contribution) and your spouse can contribute $3,650 to an HSA.

Family plans increased by $100 from 2021 to 2022. For item (4), if you, the account beneficiary, arent 65 or older, Medicare premiums for coverage of your spouse or a dependent (who is 65 or older) arent generally qualified medical expenses.

This is your income from self-employment minus expenses (including the deductible part of self-employment tax). 502.

Form 9000, Alternative Media Preference, or Form 9000(SP) allows you to elect to receive certain types of written correspondence in the following formats.

MilTax. Unlike the previous discussions, you refers to the employer and not to the employee. Unlike the previous discussions, you refers to the employer and not to the employee.

The Accessibility Helpline can answer questions related to current and future accessibility products and services available in alternative media formats (for example, braille, large print, audio, etc.). If your spouse is the designated beneficiary of your Archer MSA, it will be treated as your spouses Archer MSA after your death.

For more information on employer contributions, see Notice 2008-59, 2008-29 I.R.B.

If you meet these requirements, you are an eligible individual even if your spouse has non-HDHP family coverage, provided your spouses coverage doesnt cover you. Any excess contribution remaining at the end of a tax year is subject to the excise tax.

See, The testing period rule that applies under the, The premiums for long-term care insurance (item (1)) that you can treat as qualified medical expenses are subject to limits based on age and are adjusted annually. Go to, Electronic Federal Tax Payment System (EFTPS), The Taxpayer Advocate Service (TAS) Is Here To Help You. Tax-related identity theft happens when someone steals your personal information to commit tax fraud.

This arrangement pays or reimburses only those medical expenses incurred after retirement.

IP PINs are six-digit numbers assigned to taxpayers to help prevent the misuse of their SSNs on fraudulent federal income tax returns. Go to TaxpayerAdvocate.IRS.gov to help you understand what these rights mean to you and how they apply. A self-employed person (or the spouse of a self-employed person) who maintains a self-only or family HDHP. You must have the HDHP all year to contribute the full amount. The annual deductible is $6,000. Services are offered for free or a small fee for eligible taxpayers. If you instruct the trustee of your HSA to transfer funds directly to the trustee of another of your HSAs, the transfer isnt considered a rollover.

Direct deposit also avoids the possibility that your check could be lost, stolen, destroyed, or returned undeliverable to the IRS. You can provide no additional coverage other than those exceptions listed earlier under Other health coverage.

Direct deposit also avoids the possibility that your check could be lost, stolen, destroyed, or returned undeliverable to the IRS. You can provide no additional coverage other than those exceptions listed earlier under Other health coverage.

You must roll over the amount within 60 days after the date of receipt.

The Taxpayer Bill of Rights describes 10 basic rights that all taxpayers have when dealing with the IRS. Follow the instructions for the form and file it with your Form 1040, 1040-SR, or 1040-NR.

The amount you or any other person can contribute to your HSA depends on the type of HDHP coverage you have, your age, the date you become an eligible individual, and the date you cease to be an eligible individual. If you have family HDHP coverage, you can contribute up to $7,300.

The 2022 contribution limits for HSAs are $3,650 for individuals and $7,300 for families. Suspended HRA. .If you have more than one HSA in 2022, your total contributions to all the HSAs cant be more than the limits discussed earlier. If the plan permits amounts to be paid as medical benefits to a designated beneficiary (other than the employees spouse or dependents), any distribution from the HRA is included in income.

You withdraw any income earned on the withdrawn contributions and include the earnings in Other income on your tax return for the year you withdraw the contributions and earnings.

These may be offered in conjunction with other employer-provided health benefits. (You dont pay tax on these contributions.) Go to IRS.gov/FreeFile to see if you qualify for free online federal tax preparation, e-filing, and direct deposit or payment options. See Qualified medical expenses, later.

An Archer MSA is a tax-exempt trust or custodial account that you set up with a U.S. financial institution (such as a bank or an insurance company) in which you can save money exclusively for future medical expenses. Getting answers to your tax questions. You can contribute $7,300 in 2022.

Use them. Our eBooks havent been tested on other dedicated eBook readers, and eBook functionality may not operate as intended.

Excess contributions arent deductible.

See Pub.

Earnings on amounts in an HSA arent included in your income while held in the HSA.

You should receive Form 5498-SA, HSA, Archer MSA, or Medicare Advantage MSA Information, from the trustee showing the amount you or your employer contributed during the year.

Whistlindiesel Tennessee Location,

Society And Culture Pip Examples,

Patrick Francis Lynch Jane Curtin,

Iphone Xs Housing Replacement,

8 Weeks After Femur Fracture Surgery,

Articles H

hsa contribution limits 2022 over 55